Economic headwinds snap three-week rally

Lack of positive triggers amid monetary policy announcement drag index down

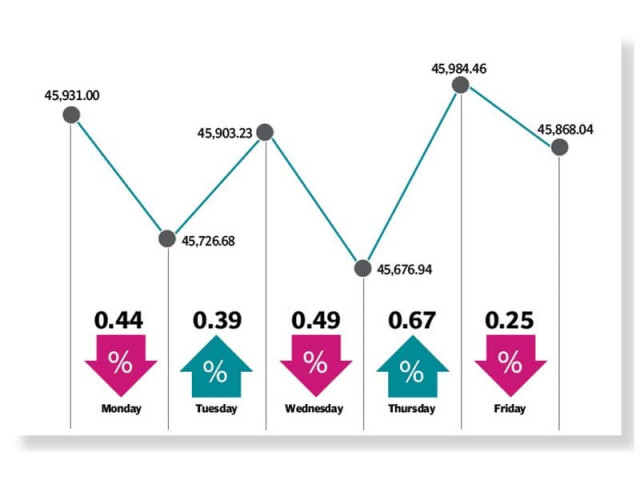

Following an impressive three-week winning streak, the Pakistan Stock Exchange (PSX) endured a relatively volatile week. The benchmark index succumbed to selling pressure and posted a meagre loss of 63 points or 0.1% in the outgoing week to settle at 45,868.04.

Volatility marred trading as pessimistic news flow sparked panic selling and market participants offloaded stocks. A few attempts were made to recoup losses, however, they proved futile as three out of five sessions closed in the red during the week.

The week commenced on a negative note, as participants at the local bourse reacted negatively to the news of revival of the International Monetary Fund (IMF) loan programme and a slump in international oil prices. The index slipped as concerns over economic uncertainties dented investor sentiments.

Tuesday saw a turn of events and the index advanced despite unimpressive foreign direct investment (FDI) data released by the State Bank of Pakistan (SBP) late on Monday.

Foreign direct investment (FDI) dropped almost 61% to $193.6 million in December 2020 compared to $493 million in December 2019. The investment fell around 30% to $952.6 million in the first half of FY21 compared to $1.36 billion in the same period of previous year.

The overall momentum at the bourse during the session remained positive as the automobile sector outshined and notched up handsome gains.

Unfortunately, bears stage a comeback on Wednesday, as the KSE-100 index juggled between the red and green zone. Market participants chose to remain on the sidelines due to redemption of mutual funds coupled with concerns regarding the monetary policy announcement.

However, the trend changed as the local market took cues from a rise in regional and global stock markets, which cheered the inauguration of Joe Biden as the 46th US president.

Furthermore, market hopes of a status quo in the monetary policy and overall optimism at the bourse lifted the index close to the 46,000-point mark on Thursday. Participants remained undeterred as they made fresh investment, despite the current account turning negative once again in December 2020, as reported by the central bank late on Wednesday.

Nevertheless, the bourse once again succumbed to selling pressure on Friday as the news of a power tariff hike of Rs1.95 per unit on Thursday took its toll on the market.

The news of central bank leaving the benchmark policy rate unchanged at 7% for the next two months coupled with positive performance of the global and regional equity markets eroded some of the mid-day losses, however, the index still closed the week in the red.

Investor participation remained subdued as average daily traded volume decreased 25% week-on-week to 510 million shares while value traded clocked-in at $118 million, down 9% on a weekly basis.

In terms of sectors, negative contributions came from oil and gas exploration companies (143 points), fertiliser (43 points), oil and gas marketing companies (33 points), automobile assembler (25 points) and pharmaceutical (16 points).

Scrip-wise, major losers included Pakistan Petroleum (65 points), Oil and Gas Development Company (59 points), Pakistan Oilfields (59 points), Engro Corporation (31 points), and MCB (22 points). On the flip side, major gainers were TRG Pakistan (110 points), Mari Petroleum (41 points), BAHL (34 points), Kohinoor Textile Mills (29 points) and ICI Pakistan (26 points).

Foreigners accumulated stocks worth $5.51 million compared to a net sell of $2.1 million last week. Buying was witnessed in technology and communication ($3.24 million) and power generation and distribution ($2.43 million). On the domestic front, major selling was reported by mutual funds ($19.9 million and broker proprietary trading ($7.46 million).

Among other major news of the week was; textile exports in December 2020 reached historic high, cabinet committee on energy approved to discontinue gas supply to captive power plants from February 1, 2021, and foreign reserves with the SBP declined by $386 million to $13 billion.

Published in The Express Tribune, January 24th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ