Rahat Fateh Ali Khan's income on FBR's radar

The organisation has requested FIA to provide the singer's travel history

Renowned singer Rahat Fateh Ali Khan seems to be once again under the watch of Federal Board of Revenue (FBR). The tax collection authority has launched a probe into the income generated from Khan's concerts abroad.

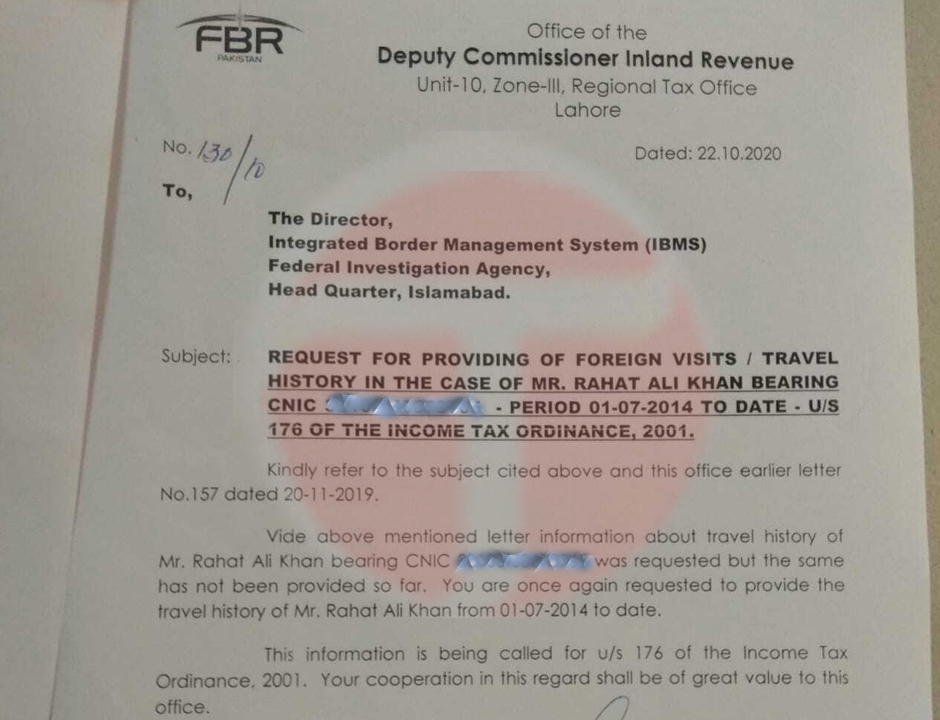

The FBR has requested the aid of the Federal Investigation Agency (FIA) in order to assess Khan's money trail. In a letter sent to FIA by the FBR, the former has been asked to provide Khan's travel history for the last six years. As per the letter, details of Khan's foreign trips from July 1, 2014, to date have been requested.

Meanwhile, Khan's representatives have claimed that so far, the FBR hasn't reached out to the singer. "We haven't received any notice from FBR as of yet. We are currently looking into the matter," Khan's manager Muhammad Amir, told The Express Tribune.

This is not the first time, the singer has come under the radar of FBR in regard to his taxes. Back in 2017, Khan's bank accounts were seized over evasion of tax. At the time, the FBR had maintained that action was taken due to non-payment of income tax worth more than Rs3 million in 2015.

Then back in 2011, Khan was called to the Lahore Regional Tax Office after his return from a foreign tour and informed by members of the FBR that he had not paid his taxes for the past five years despite the board’s repeated notifications. Khan had pleaded ignorance of Pakistani tax laws and procedures and promised to file tax returns on time henceforth.

Have something to add to the story? Share in the comments below.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ