Remittances rise 24% to $2.1b in Aug

Inflows exceed $2b mark for third consecutive month

In line with market expectations, the inflow of foreign currencies sent home by overseas Pakistanis slowed down from the record high registered in June and July but still it remained healthy at over $2 billion for the third month in a row.

“Overseas Pakistanis sent $2,095 million in remittances in August 2020 - 24.4% higher than August last year - in addition to the record $2,768 million in July 2020. For the first two months of this fiscal year (FY21), our remittances are up 31% over the same period of last year,” Prime Minister Imran Khan said on his Twitter handle on Monday.

Remittances in August, however, were 24% lower when compared with the record high of $2.77 billion in July, according to data released by the State Bank of Pakistan (SBP).

“Workers’ remittances remain strong in August,” the central bank said in a statement. “In August, workers’ remittances remained above $2 billion for the third month in a row…in line with SBP projections.” Before June, the workers’ remittances had remained lower than $2 billion for five successive months (January-May 2020).

“Efforts under the Pakistan Remittances Initiative (PRI) and the gradual reopening of businesses in major host countries such as the Middle East, Europe and the United States contributed to this increase,” the SBP said.

“Historically, remittances peak in the months around Eid festivals every year as happened in June and July ahead of Eidul Azha. And they take a dip in forthcoming months (as happened in August),” BMA Capital Executive Director Saad Hashmi said while talking to The Express Tribune.

Remittances remained high as overseas Pakistanis continued to send money through formal banking channels amid the collapse of parallel illegal channels like Hundi/Hawala and temporary suspension of international flights in the wake of Covid-19, he added.

Besides, the government and the central bank also made efforts to attract higher remittances under the PRI of 2009. The government has recently increased incentives for global and domestic banks and remittance-transferring firms to make the inflow of foreign currencies faster, cheaper and more convenient under the PRI.

Last week, they allowed overseas Pakistanis to open and maintain bank accounts in local and foreign currencies in Pakistan through mobile and internet banking under the Roshan Digital Account initiative.

The government expects an increase in the inflow of workers’ remittances and foreign exchange reserves through the digital account as it offers attractive returns on investment by overseas Pakistanis in the stock market and Naya Pakistan housing schemes with no restrictions on inward and outward financial transactions.

Hashmi noted that the growth in remittances came from non-Gulf Cooperation Council (GCC) countries like the US and the UK. “This is an encouraging sign,” he said.

This suggests Pakistan will manage to receive notably higher remittances than the record high of $23.1 billion received in the previous fiscal year ended June 30, 2020. “Pakistan is expected to receive $24-25 billion in FY21,” he said.

Fitch Ratings, one of the top three global credit rating agencies, has however anticipated an average 12% drop in remittances to five Asian nations, including Pakistan, in the second half of 2020.

Earlier, the World Bank and the Asian Development Bank (ADB) foresaw up to 20% decline in remittance inflows to the nations.

The rating agency said the record high workers’ remittances in June and July was received on the back of temporary factors, “including migrant workers transferring their full savings in preparation to return home, the impact of lockdown restrictions on transferring funds and a shift to formal remittance channels.”

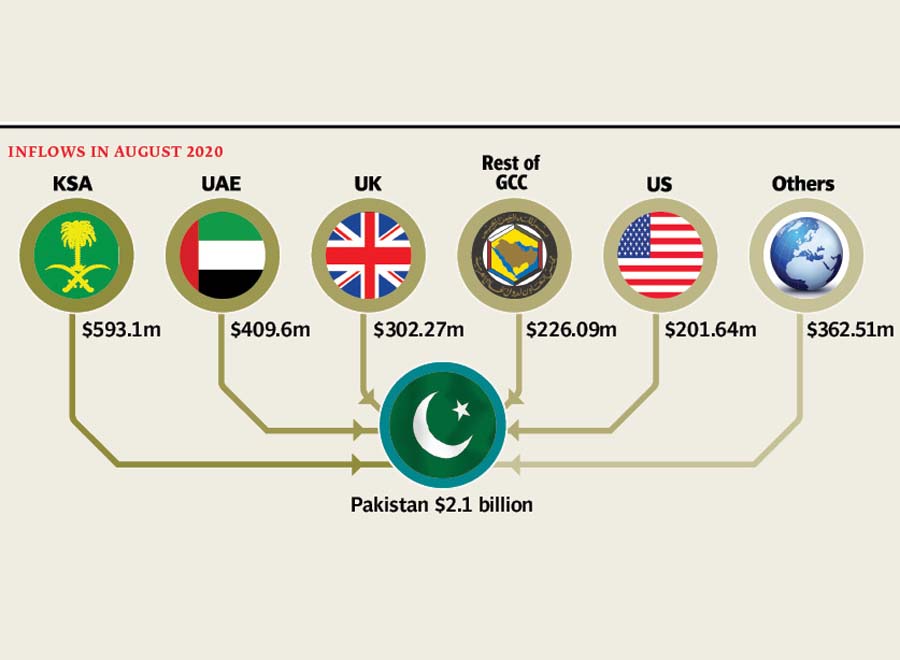

Country-wise remittances

Country-wise data reveals that inflows from the Kingdom of Saudi Arabia (KSA) increased 18% to $593 million in August compared to the same month of last year. They improved 1% to $410 million from the United Arab Emirates (UAE).

Inflows surged 51% to $202 million from the United States of America (USA) while remittances grew 67% to $302 million from the United Kingdom (UK).

Published in The Express Tribune, September 15th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ