Eight-week winning streak ends at PSX

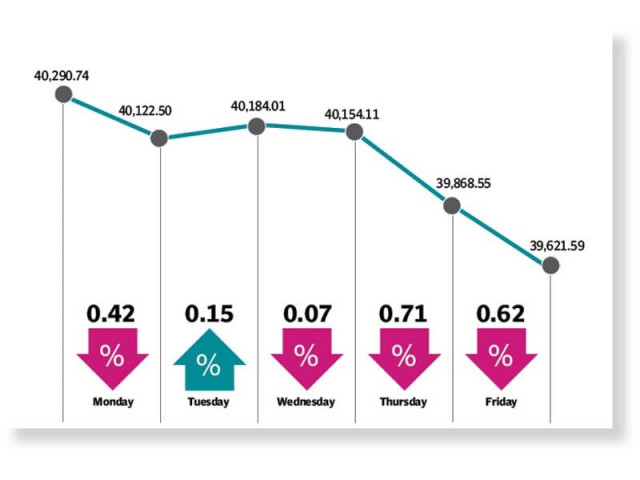

KSE-100 index sheds 669 points to close at 39,621 levels

Following an impressive eight-week rally, the KSE-100 index succumbed to selling pressure in the outgoing week and closed with a loss of 669 points or 1.7% to settle at 39,621 levels.

“This correction was due given the local bourse rallied 46% from its low in five months,” said JS Global analyst Amreen Soorani.

The bourse witnessed a volatile trading week as stocks struggled to sustain gains at the 40,000-level in the wake of domestic economic and regional political ques.

The week kicked off on a bearish note as the government’s agreement with independent power producers (IPPs) on renegotiation of power purchase agreements (PPAs) fuelled profit-taking

Additionally, the Supreme Court of Pakistan’s verdict pertaining to gas infrastructure development cess (GIDC) continued to weigh on investor sentiment. In its decision, the apex body dismissed all petitions against the GIDC levy and ruled in favour of the federal government which would collect Rs420 billion from different companies.

The trend reversed on Tuesday buoyed by encouraging remittances data, which soared to a new monthly high in July 2020. An affirmation of B- rating for Pakistan and a stable outlook by Fitch Ratings also helped revive investor sentiments.

The bourse remained under selling pressure for the rest of the week owing to rising uncertainty and lack of positive news flows to lift the market upward.

Disappointing foreign direct investment (FDI) numbers, which showed a 35% month-on-month decline in July, wreaked havoc on the market and encouraged investors to divest their stockholdings.

Adding fuel to the downtrend, yields of Pakistan Investment Bonds (PIB) rose during the auction last week, which dashed market hopes of further monetary easing and extended the selling spree.

In its report on Pakistan’s economy, Standard & Poor’s (S&P) rating agency anticipated a high fiscal deficit and debt-to-gross domestic product ratio in FY21, which dampened investor sentiment further.

Profit-booking was observed throughout the week, however, oil marketing companies sector staged a modest rally on back of expected clearance of the circular debt position.

“Pakistan continues to fare better amongst regional and world markets on the Covid-19 front while positive economic developments paint an optimistic picture of the country,” stated an Arif Habib Limited report.

During the outgoing week, average daily trading volumes settled at 441 million shares (down 24% week-on-week) while average value traded clocked-in at $107 million (down 15% week-on-week).

Contribution to the upside was led oil and gas marketing companies (39 points), pharmaceuticals (22 points), transport (9 points), paper and board (five points) and vanaspati and allied industries (three points).

On the other hand, negative contributions came from power generation (218 points) and fertiliser (165 points) sectors.

Stock-wise, major gainers were Pakistan Oilfields (33 points), Fauji Fertiliser (32 points), Sui Northern Gas Pipelines (30 points), Allied Bank (15 points) and Sui Southern Gas Company (14 points).

Foreign selling this week clocking-in at $4 million compared to a net buy of $8.7 million last week. Selling was witnessed in banks ($3.2 million) and cement ($2.9 million). On the domestic front, major buying was reported by insurance companies ($7.9 million and Individuals ($7.3 million).

Among major news of the week was; government unveiled its two-year report, Pakistan’s long-term outlook was deemed ‘stable’ by S&P and textile exports jumped 14.4% year-on-year in July 2020.

Published in The Express Tribune, August 23rd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ