Market suffers worst slide in two years

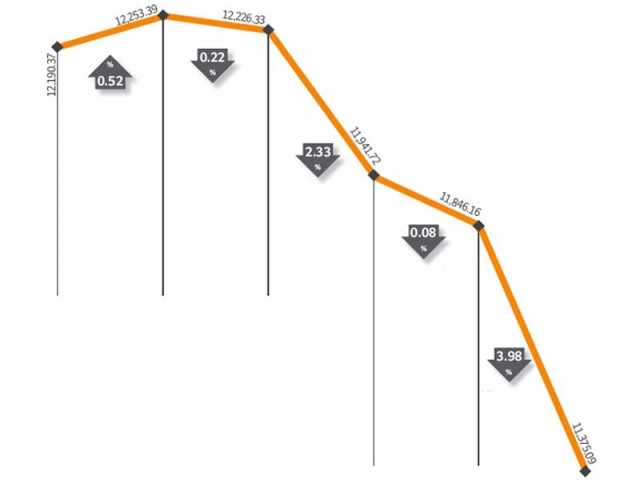

KSE-100 index shed 6.7%, amid massive global sell-off.

The country’s stock markets received a hammering and were subjected to the worst decline in almost two years during the week ended August 5.

The benchmark KSE-100 index fell 6.7 per cent (815 points) amid a massive global equity sell-off.

With the US markets still reeling from the near-default of the US government, Europe took centre stage as the precarious economic conditions in Italy came to the fore during the week. What followed was a massive sell-off in global equity markets, which took its toll on the Pakistani market as well.

The market, as expected, opened the week on a positive note following the surprise decision of the State Bank of Pakistan to reduce the discount rate by 50 basis points in the prior week, citing stable inflation numbers and reduced government borrowings in recent months.

However, the excitement was short-lived as after a gain of 0.5 per cent on the opening day, the market took a severe beating in the next four days as selling pressure built up exponentially and volumes dwindled as investors pulled out.

The tumultuous week culminated with the crash on Friday, when the KSE-100 index shed four per cent, following the 512-point decline in the Dow Jones Industrial on Thursday. The decline was the worst since October 19, 2009.

The selling was broad-based and almost all sectors were victims of the market’s wrath, despite the continuing corporate results season. Prime examples were Allied Bank Limited and Lucky Cement, which announced decent results, but fell 4.9 per cent and 2.8 per cent respectively.

The oil and gas sector was the hardest hit, with the Oil and Gas Development Company shedding 9.65 per cent, Pakistan Oilfields falling 5.8 per cent and Pakistan Petroleum dropping 2.84 per cent. The sector has the heaviest weight in the bourse and effects of its decline consequently took their toll on the market.

Oil marketing companies were also hard hit, with Pakistan State Oil falling 13 per cent despite an increase in furnace oil prices. Similarly, Attock Petroleum Limited dipped 8.8 per cent. The fertiliser sector’s woes continued despite the government’s announcement of an end to excessive gas outages for the sector. Fauji Fertiliser fell 3.7 per cent, Fauji Fertiliser Bin Qasim fell 3.6 per cent while Engro Corporation suffered the most, falling 9.5 per cent by the end of the week.

Average volumes stood at 52 million shares traded per day, up one per cent over the previous week. However, the Friday session accounted for 113 million shares which increased the overall number, which would otherwise have been lower. Around Rs212 billion worth of value was wiped out from the market as capitalisation dropped 6.6 per cent to Rs3.01 trillion by the end of the week.

What to expect?

With global markets in turmoil, the Pakistani market can be expected to follow suit and react to changes in international markets in the coming week. It should, however, be noted that due to the crash, several blue-chip stocks are now trading at attractive valuations and could trigger a much-needed buying spree in the weeks ahead.

Monday, August 1

The stock market rose by 63 points following the State Bank of Pakistan’s unexpected decision to lower the discount rate by 50 basis points. The gains in equities failed to stimulate interest from sideliners as volatile law and order situation and political uncertainty kept the trade volume at dismal 38.9 million shares.

Tuesday, August 2

Volumes at the Karachi Stock Exchange touched a 13-month low as investors remained passive on the first day of Ramazan. Trade volumes plummeted to dismal level of 15 million shares compared with Monday’s tally of 39 million shares.

Wednesday, August 3

Panic settled in as the stock market took a drastic 285-point drop to close at 11,941.72 points. Due to an ever-worsening law and order situation and weak international markets, investors refused to take advantage of the valuations.

Thursday, August 4

The recent slump in the stock market continued as the bourse fell another 95 points to end the day at 11846.16 points. The sustained fall seemed to reflect the lack of improvement in both, the law and order situation and weak international markets.

Friday, August 5

As global markets witnessed the worst day in trading since 2009, the KSE also followed its lead and witnessed panic selling. Friday’s decline is the highest single-day fall in the past two years.

Published in The Express Tribune, August 7th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ