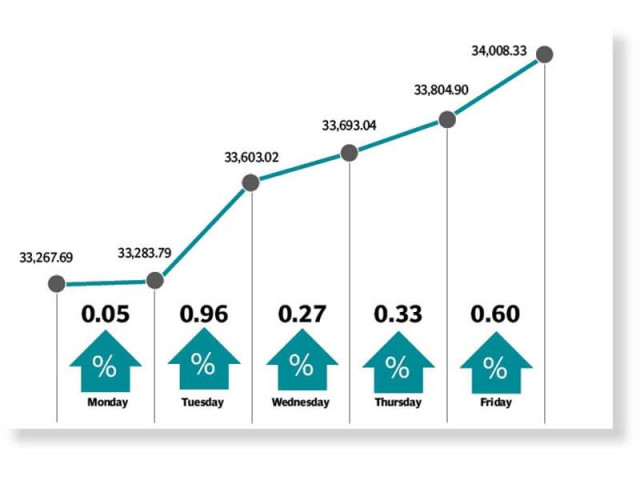

Weekly review: PSX posts gains in all five sessions

Investors cheer lockdown ease, interest rate cut as activity increases

Investors were euphoric over the easing lockdown as businesses were allowed to once again resume activities. Anticipation of a hefty cut in interest rates also helped fuel bullish sentiments and improved activity in highly levered stocks. However, commercial banks felt the heat on account of expectation of further rate cut, which may stress profitability of the banking sector.

On the development front, Prime Minister Imran Khan directed the government to expedite construction work on the Diamer-Bhasha dam, which drove investors’ interest in cement and steel sectors.

Meanwhile, the MSCI review of Pakistan, announced this week, had also weighed on market sentiments with some expecting Pakistan to retain its place while others expected the country to be downgraded to frontier markets.

In the review announced on May 12, Pakistan successfully kept its May 2017 upgraded status in the MSCI Emerging Markets (EM) Index and staved off the possibility of being downgraded to the Frontier Markets (FM) Index. Despite the positive news, the development did not spur any drastic reaction from the market as trading during the session on Wednesday remained mixed. Additionally, news flows on the upcoming budget also begun to surface this week.

Although investors continued to await the monetary policy announcement, the KSE-100 rallied following the approval of a Rs50-billion agriculture package, which sparked interest in investment in agriculture-related stocks.

Market players began accumulating fertiliser and tractor companies’ stocks, however, the uptrend could not be sustained because the investors’ joy over the relief package subsided soon afterwards.

The last trading day of the week pushed the index past 34,000 points amid increased expectations of cut in interest rates by the central bank. The index trimmed some gains as a surge in global crude oil prices coupled with concern over growing fiscal deficit and negative economic growth dented investors’ sentiment. Later in the day, the State Bank of Pakistan (SBP) slashed the benchmark interest rate by 100 basis points to 8%. On the other hand, Moody’s report was also released this week where the rating agency put Pakistan under review for downgrade, which had little impact on the local bourse in the outgoing week.

Participation picked up as volumes were up 15% week-on-week to 219 million shares, while value traded dipped 21% week-on-week to $40.3 million.

Contribution to the upside was led by oil and gas exploration companies (192 points), cements (177 points), fertiliser (148 points), food and personal care products (61 points), and technology and communication (57 points).

Scrip-wise, major gainers were FFC (74 points), MARI (73 points), LUCK (66 points), NESTLE (59 points), and OGDC (56 points). Meanwhile, BAHL (40 points), SNGP (35 points) ABL (20 points), INDU (17 points) and PAKT (14 points) were the major losers of the week.

Foreigners offloaded stocks worth of $10.91 million compared to a net sell of $17.82 million last week. Major selling was witnessed in commercial banks ($2.89 million) and power generation and distribution ($2.4 million). On the local front, buying was reported by individuals ($5.56 million) followed by mutual funds ($4.97 million).

Among major highlights of the week were; Moody’s placed Pakistan’s credit rating under review, Rs442 billion agreement for construction of Diamer-Bhasha dam was signed, fiscal deficit to hit at least 9.4%, govt likely to unveil tax-free budget for 2020-21, and car sales nosedived by 52% in July-April.

Published in The Express Tribune, May 17th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ