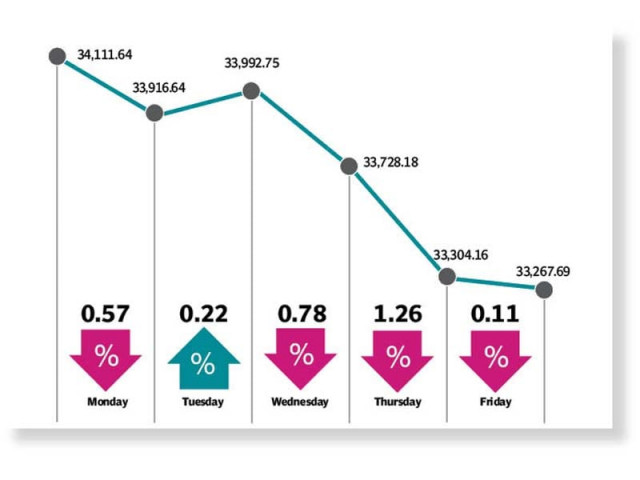

Weekly review: Profit-taking drags KSE-100 index in red

KSE-100 sheds 884 points to settle at 33,268 points

Trading commenced on a negative note on Monday as the index lost ground due to instability in international crude oil prices. Investors remained cautious regarding the impact of Covid-19 pandemic on the national economy and domestic markets. Moreover, anticipation of rate cut in the upcoming monetary policy announcement weighed on sentiment that prevented investors from taking fresh positions.

The tables turned in the following session as the index returned to the green territory on back of jump in international oil prices and hopes of easing of a nationwide lockdown. Investors continued to book profits during the session, while a massive fall in exports by 54% year-on-year in last month followed by a fall in cement dispatches by 24% year-on-year in April 2020 amid lockdown also weakened sentiment.

Furthermore, prediction of the International Monetary Fund (IMF) regarding total foreign reserves depletion by $1.9 billion in the coming 15 months added fuel to this decline. Moreover, 12-month T-Bill cut off yield climbed up by 28 basis points.

Meanwhile on Wednesday, the stock market once again plunged into negative territory due to poor trade data published by the Pakistan Bureau of Statistics, according to which the country’s exports slipped below $1 billion in April. Moreover, concern over Morgan Stanley Capital International (MSCI)’s review, due on May 12, further dented investor confidence and sparked selling, which dragged the market deep into the red zone.

Bears held their ground in the following session due to looming economic uncertainty. The market also remained preoccupied with the fear of Pakistan slipping into the frontier market index from the emerging market category in the MSCI review. The pessimism triggered selling pressure, which persisted throughout the day, and market participants resorted to profit-booking.

The downward trend persisted on the last trading day of the week, which saw the index finish in red. Despite the federal government’s decision to ease lockdown from Saturday onwards, trading remained lacklustre as the number of Covid-19 case rose steeply. The downturn was also fuelled by concerns over IMF’s projection of surging government debt coupled with poor data of oil and cement sales for April 2020.

Participation crawled up as average volumes rose 7% week-on-week to 190 million, while average value traded fell 5% to clock-in at $46 million.

In terms of sectors, negative contributions came from commercial banks (231 points), cement (211 points), power generation and distribution (156 points), fertiliser (148 points) and oil and gas exploration companies (99 points). Meanwhile, positive contribution came from oil and gas marketing companies (76 points), food and personal care products (34 points) and technology and communication (21 points).

Scrip-wise, negative contributions were led by HUBC (126 points), LUCK (102 points), HBL (82 points), FFC (76 points) and MCB (74 points).

Foreign selling continued this week clocking-in at $17.8 million compared to a net sell of $11.6 million last week. Selling was witnessed in exploration & production ($7.1 million) and commercial banks ($5.1 million). On the domestic front, major buying was reported by individuals ($20.3 million) and companies ($5.7 million).

Other major news of the week was: government moved to take over Rs800 billion power sector circular debt, Pakistan formally applied for $1.87 billion debt relief from G20 countries, foreign reserves held by the SBP increased $259 million to $12.3 billion and trade deficit widened by 42% month-on-month in April 2020.

Published in The Express Tribune, May 10th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ