Weekly review: Bourse plummets on foreign selling

Corporate results fail to save the day.

The market suffered as local investors remained cautious and foreigners offloaded $12 million during the week, in line with regional peers.

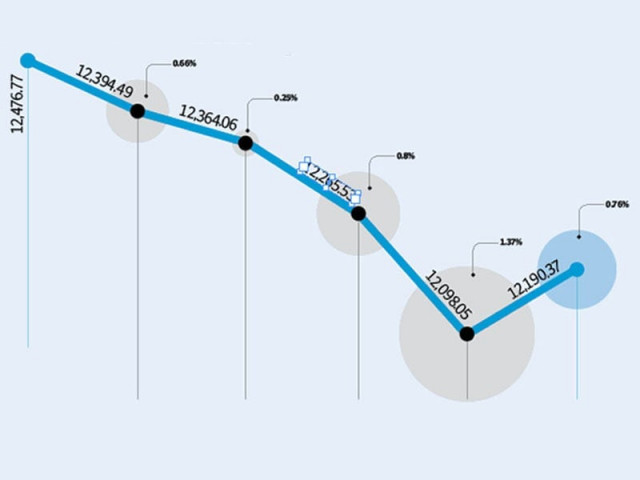

The Karachi Stock Exchange’s (KSE) benchmark 100-share index lost 2.3 per cent or 286 points to end at 12,190 point level.

Corporate results season gathered steam with big names in the fertiliser and banking sectors announcing healthy numbers, however, the impact was limited as the results could not save the index or volumes from falling.

The selling trend was also witnessed in regional markets as latest data shows foreign sell off of $600 million and $460 million in Taiwan and South Korean markets, respectively. US stocks posted the biggest weekly decline in a year as a blur of debt-ceiling developments left the market uncertain over the course of Washington’s deadlocked negotiations.

In addition, investors exercised caution as they awaited the monetary policy announcement due over the weekend.

Volumes fell 39 per cent during the week to dismal level of 51.8 million shares. Volumes have fallen to an alarming level as the average volumes in the same period two years ago was 161 million shares. The Securities and Exchange Commission (SECP) held a discussion on Thursday to come up with ideas to boost activity at the capital markets.

Corporate earnings come in strong

Key companies MCB Bank, United Bank Limited, Fauji Fertilizer Bin Qasim and Fauji Fertilizer Company announced healthy results failed to trigger any meaningful rally.

The same overall fertiliser sector capped off a disappointing week with Engro falling 5.7 per cent, FFC declining 2.5% and FFBL descending 1.5% on a weekly basis.

Pakistan Oilfields, a share that has outperformed the broader market recently, also bore the brunt of selling as the stock ended 6.3 per cent lower on a weekly basis hit by aggressive selling based on unfounded rumours of a dry well at Domail field.

Outlook

With the corporate result season in full swing, results and payout expectations are likely to continue driving investor interest, according to a KASB Securities research note. However, another key variable to note is that the start of Ramadan will witness a dip in the activity, a regular trend seen over the years.

Furthermore, the recent selling spree of foreign investors is likely to remain fresh in the minds of local participants who will continue to track the foreign institutional investor numbers to gauge future direction, adds the note.

The central bank’s decision to slash the discount rate in the monetary policy is expected to rumble the market slightly as the market forecast the rate to remain unchanged.

Monday, July 25

The stock market declined due to worsening law and order situation while trading activity remained sluggish.

Oil and banking, the two major sectors that supported the stock market last week, bore the brunt of the decline.

Tuesday, July 26

Stock market fell in a lacklustre session as investors kept their distance from the trade session. Although MCB Bank performed well after its better than expected result announcement but other heavyweights pulled the index down.

Wednesday, July 27

The stock market declined as investors opted to book profits at a higher level.

Pakistan Oilfields, whose stock declined 4.88 per cent during the day, witnessed massive selling and almost hit its 5% lower limit of as rumours spread of a dry well at Domail II.

Thursday, July 28

The stock market declined to its lowest point in two months as fears over US default gripped an already weak local market.

Friday, July 29

The stock market rose before the weekend break as the oil and gas sector led the buying charts amid weak activity.

Published in The Express Tribune, July 31st, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ