FDI surges 75% to $1.85 billion in July-February period

Jump comes on back of inflows into telecom sector due to licence renewal fee

PHOTO: FILE

FDI surged 75% to $1.85 billion in Jul-Feb of the fiscal year 2019-20, from $1.06 billion in the same period of the previous year, according to data released by the State Bank of Pakistan (SBP) on Monday.

The growth in investment, however, remained low compared to the existing potential as investors anxiously waited for clarity on economic policies before initiating new projects in the country.

In February alone, the investment went up a massive 151% from $115.3 million in 2019 to $289 million in the current year.

FDI soars to 26-month high at $385.3m in Sept

Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary-General M Abdul Aleem told The Express Tribune that the bulk of inflows came from the telecom licence renewal fee as China Mobile and Telenor received money from their parent companies for deposit in Pakistan. Apart from that, he said, investment also went into ongoing projects in the power sector.

“These are healthy inflows but more growth is needed,” he remarked, adding that it was a good sign and the FDI was expected to rise further.

Talking about the potential impact of coronavirus on the FDI, Aleem said, “The virus will not have a lot of impact on foreign investment because the inflows are long-term commitments.”

He pointed out that ongoing projects and those in the pipeline would continue to attract investment. “New projects may not immediately start but the ongoing projects will continue to receive investment,” he added.

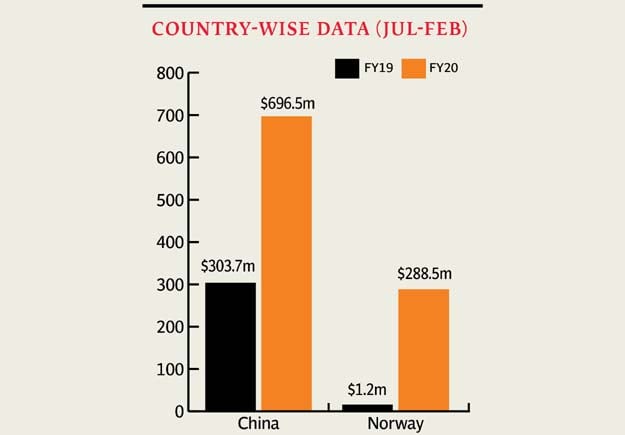

Country-wise FDI

China continued to lead with FDI of $696.5 million in Jul-Feb FY20, compared to $303.7 million in the same period of previous year.

The OICCI official said inflows from China were mostly on account of telecom and power projects in addition to investments under the China-Pakistan Economic Corridor (CPEC).

Meanwhile, inflows from Malta were recorded at $148.2 million in the eight-month period of FY20 compared to outflow of $93.3 million in the previous year.

Pakistan's FDI jumps by massive 78% in Jul-Nov

FDI from Norway increased to $288.5 million in the Jul-Feb period of FY20 from $1.2 million in the previous year, while Hong Kong invested $105.8 million in the ongoing year compared to $91.3 million in the previous year.

Sector-wise inflows

In terms of sectors, the power industry received the most investment of $575.6 million in the period under review compared to outflow of $294.5 million in the same period of previous year.

On the other hand, inflows into the communication sector were recorded at $471.8 million compared to outflow of $138.6 million in the previous year. The oil and gas exploration sector saw inflow of $177 million compared to $222.5 million in the previous year.

Published in The Express Tribune, March 17th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ