Pakistan's FDI jumps by massive 78% in Jul-Nov

Surge comes due to inflows from telecom companies, online payment firm

PHOTO: REUTERS

The foreign investment in local projects stood at $477.3 million in the same five months (Jul-Nov) in the preceding year, the State Bank of Pakistan (SBP) reported on Tuesday.

“Pakistan has witnessed a notable improvement in foreign investment. It came following Zong (China Mobile) and Telenor paid (partial) fees for spectrums and Ant Financial Services Group (AliPay of China) invested in online payment infrastructure in Pakistan,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem told The Express Tribune.

“China Mobile paid $230 million as (licence) fee,” Alpha Beta Core CEO Khurram Schehzad said in a commentary on the five-month FDI inflows. The Pakistan Telecommunication Authority (PTA) reported the receipt of the payment from the China-based mobile phone operator in the first week of December.

Similarly, Ant Financial Service paid the second tranche of $70 million in late November. Earlier, it announced to acquire 45% stake in Telenor Microfinance Bank with a total investment of $184.5 million in March 2018.

Earlier, Norway-based Telenor Pakistan paid around $224.6 million as partial renewal fee for the spectrum in September, it was learned.

Schehzad said, “FDI may total around $1.5-2 billion in the full fiscal year 2020. The return of stability in macroeconomic indicators and particularly in rupee-dollar parity should encourage foreign investors to pour capital in Pakistan,” he said.

He said minus the payment from telcos, the FDI was recorded better in the first five months compared to the same period of last year. “FDI has started picking up. The outlook remains positive,” he said.

He noted that foreign investors have also started returning to the Pakistan Stock Exchange (PSX) after they invested a notable amount of around $1.2 billion in sovereign debt instruments like treasury-bills since July to date.

“The hot money in debt market may total around $2-3 billion in full FY20,” he said.

The SBP reported that foreigners invested a net $19.5 million in shares through PSX in the five months under review compared to divestment of $330.6 million in the same period of last year.

However, FDI in the single month of November dropped 30% to $200.1 million compared to $285.4 million in the same month of last year, according to the central bank.

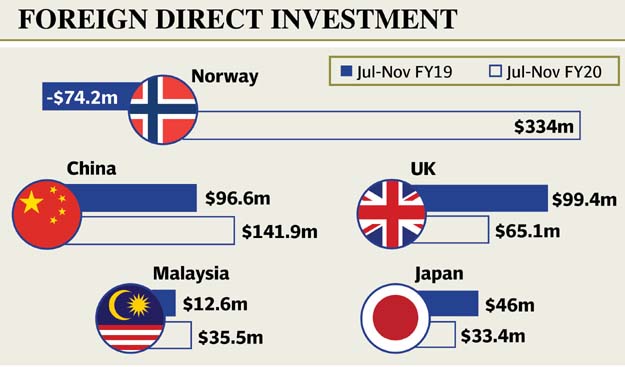

Country-wise FDI

Norway made the single highest investment of $334 million in the first five months compared to the divestment of $74.2 million in the same period of last year.

China became the second largest foreign investor with net investment totalling $141.9 million compared to $96.6 million last year.

The United Kingdom invested $65.1 million compared to $99.4 million. Malaysia poured net $35.5 million compared to $12.6 million last year.

Sector-wise FDI

The communication sector attracted the highest FDI at $291 million in the five months compared to an outflow of $113 million in the corresponding period of last year.

The financial business received FDI worth $131.1 million in the period under review compared to $64.9 million in the same period of last year. The electricity machinery sector saw FDI at $83.4 million compared to $124.4 million. The oil and gas exploration sector attracted investment of $61.9 million compared to $133.8 million.

Published in The Express Tribune, December 18th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ