FDI soars to 26-month high at $385.3m in Sept

Investment in first quarter of FY20 improves to $542.1 million

PHOTO: REUTERS

With that inflow, the FDI in first quarter (July-September) of the current fiscal year improved to $542.1 million, just 3% less than the $559.4 million received in the same quarter of previous year, the State Bank of Pakistan (SBP) reported on Thursday.

If the $224.6 million paid by Telenor Pakistan as licence renewal fee from its head office in Norway is removed, the FDI inflow will remain sluggish due to economic slowdown in Pakistan.

“Foreign investors are still waiting for improvement in macroeconomic indicators, including economic (gross domestic product or GDP) growth rate of at least 3-3.5%, to initiate new long-term investment projects in Pakistan,” Arif Habib Limited Head of Research Samiullah Tariq said while talking to The Express Tribune.

He was quite hopeful that Pakistan would achieve the State Bank’s projected GDP growth of 3.5% compared to the 2.4% growth anticipated by the International Monetary Fund (IMF) in the current fiscal year 2019-20.

An official in the private sector, who closely observed foreign investment flows into the country, blamed the failure of economic managers as they did not market the potential projects which would attract a significant amount of FDI.

“Otherwise, economic indicators like the current account deficit and rupee-dollar parity have become stable,” he said but requested not to be named.

The cellular firm paid $224.6 million in partial fee to the government as it is fighting a court case to determine what should be the actual licence renewal fee. It believes the fee should be $291 million as opposed to the $450 million demanded by the government.

Tariq noted that Pakistan had started receiving short-term portfolio investment in debt instruments (treasury bills) from foreigners since the beginning of the current fiscal year in July and voiced hope that Islamabad would receive long-term FDI soon.

The country has received a total of $321.8 million worth of foreign investment in T-bills in the Jul-Sept 2019 quarter compared to $0.1 million in the same quarter of previous year.

“Pakistan may attract foreign investment in debt instruments in the range of $2-3 billion in the current fiscal year. This should help in improving the foreign currency reserves,” he said.

In September 2018, the FDI stood at $182.1 million, which was almost half when compared with $385.3 million which Pakistan received in September 2019.

Country-wise FDI

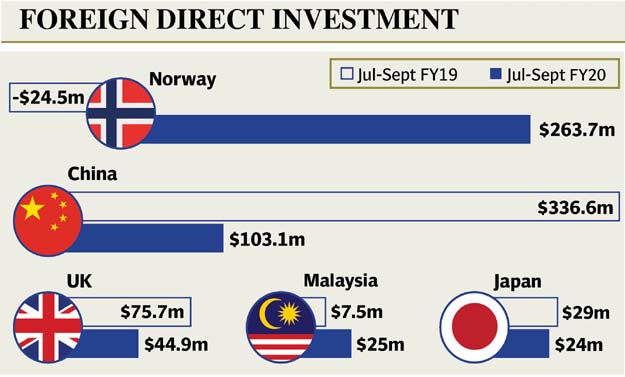

Norway emerged as the largest foreign direct investor in Pakistan. The Scandinavian country invested a total of $263.7 million in the Jul-Sept quarter compared to outflow of $24.5 million in the same quarter of last year.

China, which had been the largest investor for several quarters due to multibillion-dollar projects under the China-Pakistan Economic Corridor (CPEC), ranked number two with net FDI inflow of $103.1 million in the quarter under review compared to investment of $336.6 million in the corresponding quarter of last year.

The United Kingdom invested $44.9 million compared to $75.7 million last year. Malaysia invested $25 million compared to $7.5 million last year.

Published in The Express Tribune, October 18th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ