Worst slump in oil - a boon for Pakistan

Lower oil prices can help decelerate inflation, curtail import bill and cut interest rates

PHOTO: REUTERS

The plunge in crude oil can help Pakistan - which is heavily dependent on imported energy - save around $4-5 billion alone in oil and gas imports, decelerate the currently high level of inflation and prepare a strong case for a cut in the benchmark interest rate this month (March 17) to allow businesses to acquire cheaper financing for new and expansion of running production lines.

Top three research houses of the country developed consensus the central bank is likely to decrease the rate by one percentage point to 12.25% next week.

"Pakistan is a net importer of oil with petroleum group imports contributing 25% to the total imports...[It] would be able to save $5 billion per annum on its imports," Arif Habib Limited Head of Research Samiullah Tariq said in a comprehensive report on 'Oil Price Mayhem - A Boon for Pakistan's Economy' on Monday.

Pakistan meets over 70% of its energy requirements through imports.

The energy imports are one-fourth ($7.13 billion) of the total imports at $27.34 billion in the first seven-month (Jul-Jan) of the current fiscal year, according to Pakistan Bureau of Statistics (PBS).

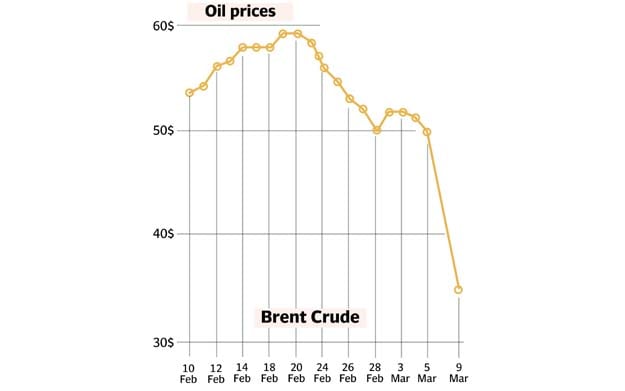

In intra-day trade on Monday, the US crude (WTI) and the Brent dropped around 30% to $32.55 per barrel and $35.50 per barrel, respectively, since Friday opening.

The prices crashed after the cartel of oil producing and exporting countries (OPEC) and Russia failed to reach an agreement to cut production to keep the prices stable in the backdrop of an extended slowdown in the global economy due to outbreak and spread of the coronavirus infections. Besides, Saudi Arabia, later on Monday, decided to increase output.

"We believe both Russia and Saudi Arabia have the capacity to absorb low oil prices for a while due to lower production costs. This fact, in addition to the coronavirus epidemic, has the potential to keep oil prices under pressure in the near term," BMA Capital Executive Research Saad Hashmi said in a report.

"As the global economic activity resumes to original levels (expectedly sometime in summer), we believe the demand for oil to rise in tandem," he added.

The Organization of Economic Cooperation and Development (OECD) said last week the global economy may sharply slow down this year as governments around the world try to contain the virus and anticipated a rebound in the growth from 2021.

In a brief commentary on the oil prices crash, Alpha Beta Core CEO Khurram Schehzad said, "It was a good development for Pakistan macros, as massive decline in oil prices may lead to decline in energy imports, thereby helping reduce trade deficit; pass-on should lead to decline in inflation, as well as reduced energy costs to businesses/industrial sector, besides potential to improve indirect taxes for the government and decrease in subsidies from the government."

To recall, containing inflation and collecting targeted revenue in taxes are the two leading challenges to Pakistan, which entered into the latest International Monetary Fund's (IMF) 39-month long loan programme worth $6 billion on tough economic conditions in May 2019.

To contain the inflation and increase its revenue, the government partially passed-on the drop in international oil prices to domestic consumers and partially absorbed the drop to increase its revenue, earlier this month.

DESIGN: IBRAHIM YAHYA

DESIGN: IBRAHIM YAHYA"The drop in oil prices bodes well for the CPI (consumer price index/inflation) outlook as every $10 per barrel is expected to shave off 0.3% from...inflation on annualised basis," Hashmi said.

The drop in the oil prices has created a big room to further cut the oil prices for local people, businesses and industries with the aim of taming the inflation in the domestic economy and supporting them to grow.

Inflation reading came at 12.4% for the previous month of February. Research houses have anticipated inflation in the range of 10-10.5% for the current month of March and a further notable cut in April.

The reduced inflation would allow the State Bank of Pakistan (SBP) to make the first cut in the benchmark interest rate next week. This would help the domestic economy and businesses to turnaround sooner than later.

The availability of comparatively cheaper financing would enable domestic businesses and industries to borrow more to meet working capital and go on expansions.

"On the other hand, we can potentially see a cumulative reduction in exports and remittances by around $1-2 billion," Topline Securities CEO Muhammad Sohail said.

"On a net basis, Pakistan's external account could potentially improve by $2.2-2.8 billion (50% of Pakistan's current account deficit) due to $20 per barrel lower oil prices. We expect, rupee/dollar to remain stable in the near term," he said.

On the fiscal side, he said, lower oil prices will give the government enough fiscal space to sail through at least the next couple of IMF quarterly reviews. The government is unlikely to completely pass on the impact of lower oil prices to the consumers, through increase in Petroleum Development Levy (as seen in March).

The government is also likely to pocket part of lower oil prices in electricity tariffs (under monthly fuel adjustments), resulting in lower accumulation of circular debt. "The pressure (from IMF) to increase gas prices will also subside," he said.

Such developments are expected to help further building up the country's foreign currency reserves and strengthen rupee against the dollar. In the short-run, however, an increased foreign selling may be seen at local debt (T-bills/PIBs) and stock markets.

What it means for the common man?

The drop in oil prices would also positively impact the common man in Pakistan. An expected deceleration in inflation reading should reduce kitchen budget. Partial pass-on of the massive drop in international oil prices to domestic consumers and its wide positive impact on business and economy, should all help people to reap the fruits.

The likely early revival in the economy at macro and micro levels may not benefit businesses alone, but revival in businesses should create new job opportunities as well.

Published in The Express Tribune, March 10th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ