Cement sector paving the way for industrial recovery

Demand for cement will pick up once Naya Pakistan Housing Programme kicks off

PHOTO: REUTERS

The gloomy profit and loss statements filed by cement manufacturers at the bourse gave a harsh reality check to both promoters and stock market investors hoping to unlock the growth potential of fast-paced urbanisation at one end of the spectrum and China-Pakistan Economic Corridor (CPEC)-related growth on the other end.

It has really never rained for the cement sector since 2017 as demand slowdown coupled with the rising cost of borrowing, rupee depreciation and last but not the least the introduction of axle load regime badly squeezed the juicy margins that were once the hallmark of the cement sector.

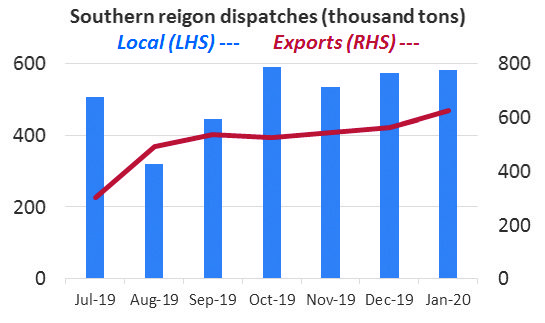

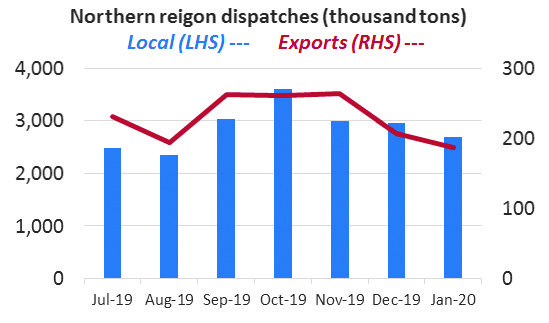

The wider underperformance of stocks of cement giants Lucky Cement (-49%), Fauji Cement (-66.71%) and DG Khan Cement (-72.56%) since their peak in 2017 could easily be explained by the dispatch figures for both southern and northern regions.

Both the zones have some common and specific issues that sound more similar to the past when the price war started due to plant expansions. However, this time, as the scenario unfolded, the situation appeared graver than before as the economic horizon was continuously covered by dark clouds appearing from all fronts.

Despite all the negativity, reading of the latest sales figures in conjunction with the large-scale manufacturing (LSM) data indicates that the storm has just passed although we are not completely out of the woods.

From the numbers, it is very clear that cement players, especially in the south, have so far resorted to clinker export to compensate for the slowdown in local construction activities. This gave some respite to the topline but the bottom line remained depressed due to lower margins in clinker sales as compared to the finished product.

Cement players in the landlocked northern region are facing additional headwinds due to tensions along the border and eventually exports to India have completely stopped.

However, going forward, the announcement of two major dam projects will drive growth in the northern region, as highlighted by Faisal Shaji, Head of Research at Standard Capital Securities.

He is optimistic about the pickup in demand once the Naya Pakistan Housing Programme kicks off.

Other positive signs on the horizon are government willingness to make expenditures under the Public Sector Development Programme (PSDP), as highlighted by Haris Aslam, Head of AKD Trade.

So far, the government has released 61% of funds allocated for development projects as the International Monetary Fund (IMF) also wants to see the government commits to fully utilise PSDP allocations to drive economic growth.

On the supply side, there will be a lot of pressure on the capacity utilisation in the cement sector once all the expansions come on line this year. This may be a bad omen for the already leveraged cement companies if they have to further borrow to meet their working capital requirement to maintain the idle capacity. All eyes are now focused on the recovery in local cement demand, which will pave the way for recovery in many industries, fed directly or indirectly by the construction sector.

The writer is a financial market enthusiast and attached to Pakistan’s stocks, commodities and emerging technology

Published in The Express Tribune, March 2nd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ