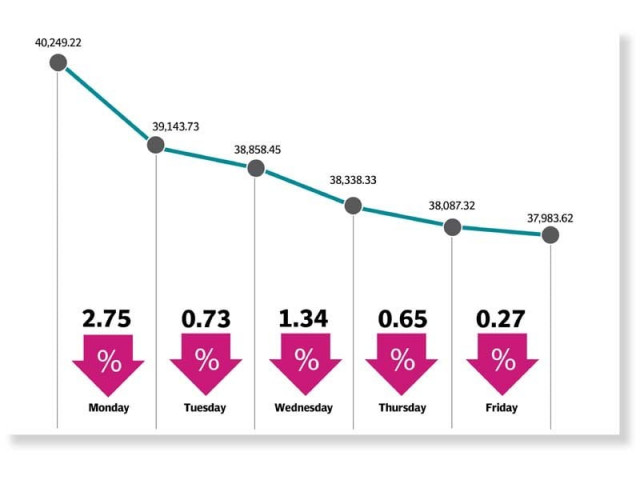

In Pakistan, stocks battered as index plummets 5.6%

Sell-off in global equity and commodity markets due to virus outbreak triggered bearish trade

“The local equity bourse depicted the biggest weekly decline since June 16, 2017 in points,” stated an AHL Research report.

The outbreak, which has now spread in 40 countries with no signs of containment, wreaked havoc on global equity and commodity markets as it sent investors in a panic. Apprehensions over the coronavirus sent world stock markets skidding, with an index of global stocks setting its largest weekly fall since the 2008 global financial crisis, and over $5 trillion wiped from global market value this week.

With an impact of such epic proportions, it was no surprise that the domestic stock market would bear the brunt of the global sell-off. Moreover, a decrease in international crude oil prices also sparked worries and pushed oil stocks down.

Hopes the epidemic, first detected in China in December, would be over swiftly and economic activity quickly return to normal have been shattered. “The uncertainty hovering over the markets will only be alleviated when there is a sense that the worst is almost over,” said Quincy Krosby, chief market strategist at Prudential Financial Inc.

The Financial Action Task Force (FATF)’s announcement of keeping Pakistan in the grey list also played the role of a catalyst in the market’s bearish close. Reeling from the global impact and developments on the local front, the PSX witnessed all five sessions finish deep in red.

Matters failed to improve as sentiments were dampened by political uncertainty after a provincial cabinet decided not to further extend the bail granted on medical grounds to former prime minister Nawaz Sharif. Although, there was no positive trigger for the stock market during the week, by Wednesday persistent selling pressure in world markets following a spike in the number of virus cases in Middle Eastern countries sent a fresh wave of fear through the investors who opted to offload their stockholdings.

That said, uncertainty over the International Monetary Fund’s (IMF) next loan tranche also fuelled bearish trade at the PSX.

The situation worsened on Thursday after the government confirmed late on Wednesday two confirmed cases of the virus in Karachi. Investors restored to panic selling, and pushed the index 1,400 points down as economists anticipated serious implications for Pakistan’s economy if the virus spread to the country. Moreover, Moody’s report signalling an adverse impact on local banks after Pakistan’s inclusion in the FATF’s grey list, further eroded sentiments However, buying in the later hours helped erase most of the day’s losses.

News of Pakistan and IMF reaching a staff-level agreement on the second review and release of third tranche worth $450 million in early April 2020under the $6 billion Extended Fund Facility (EFF) provided some respite to the market but negative factors prevented a positive finish.

Participation picked up as volumes jumped 63% week-on-week to 174 million, while value traded increased 54% week-on-week to $48 million.

In terms of sectors, negative contributions came from E&P (down 575 points) led by weakness in International oil prices, commercial banks (531 points), fertiliser (278 points), power generation and distribution (233 points), and oil and gas marketing companies (191 points). Scrip-wise, negative contributions were led by PPL (down 256 points), OGDC (194 points), HUBC (170 points), HBL (152 points), and ENGRO (103 points).

Foreign selling continued this week clocking-in at $22.5 million compared to a net sell of $8.6 million last week. Selling was witnessed in commercial banks ($7.6 million) and E&P ($4.8 million). On the domestic front, major buying was reported by insurance companies ($25.3 million) and banks/DFIs ($7.8 million).

(with additional input from reuters)

Published in The Express Tribune, March 1st, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ