Weekly review: Stock rally continues for seventh successive week

Investor confidence improves following developments on macroeconomic front

Weekly review: Stock rally continues for seventh successive week

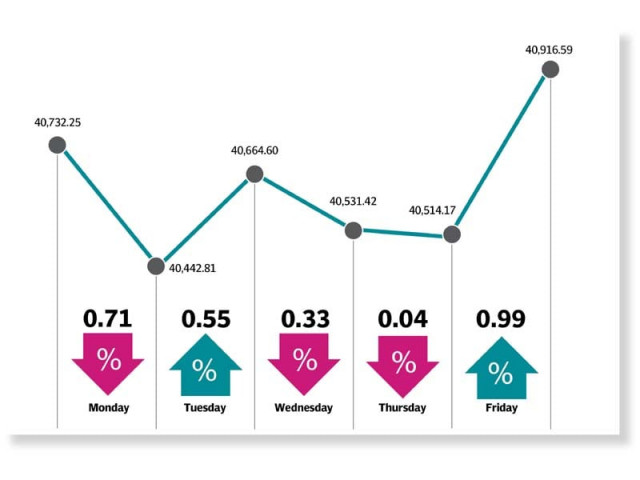

The KSE-100 powered past the 41,000-point mark this week, levels last seen in February 2019, albeit, settling at 40,917 points, up 184 points or 0.45%.

“This marks the highest index return in terms of percentage generated in seven consecutive weeks (+21.6%) in the past 10 years, last observed in September 2009,” stated a report of AHL securities.

Data on economic indicators released during the week highly influenced the direction of the market.

The week began on a negative note with the KSE-100 index declining as investors resorted to profit-taking on expectations of correction in the market.

However, the bearish trend reversed in the following session as market participants cherry picked stocks, which helped pare losses and uplift the market. Unfortunately, the positive momentum could not be sustained and the index retreated on Wednesday and Thursday due to dull sentiments. The upbeat inflows from remittances, encouraging trade figures and a further decline in PIB yield also failed to spur any activity in the market, which remained sombre.

Workers’ remittances increased 9.35% to $1.81 billion in November 2019 while trade deficit recorded a 14% contraction on a monthly basis. Moreover, the Pakistan Investment Bond (PIB) yields once again fell during the auction in the outgoing week.

However, during the two days in question, automobile sales exhibited a dismal outlook, which prompted investors to offload auto stocks. The Pakistan Automotive Manufacturers Association (Pama) reported a 44% fall in sales of motor vehicles in November 2019 on a year-on-year basis.

During the final trading session, the benchmark KSE-100 depicted some characteristic resurgence as it breached the 41,000 point mark during intra-day trading following drastic rise in global crude oil prices and news regarding Pakistan inviting Russia to acquire OGDC and PPL shares.

Pakistan offered Moscow to participate in the divestment of government’s shareholding in the country’s largest state-run oil and gas explorers - Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) - and become a strategic partner by acquiring shares. This development particularly strengthened investor sentiments at the end of the week and attracted renewed buying in the exploration and production as well as oil marketing companies sectors. Average volumes declined 41% week-on-week to an average of 276 million shares per day. Meanwhile, average value traded fell 36% week-on-week to clock-in at $67 million.

In terms of sectors, positive contributions came from oil and gas exploration (273 points) as Pakistan invited Russia to acquire governments share in OGDC and PPL, chemical (54 points), food and personal care (47 points), fertiliser (42 points) and tobacco (38 points).

Scrip-wise, positive contributions were led by OGDC (101 points), PPL (84 points), Mari Petroleum (52 points), Nestle (43 points) and Pakistan Oilfields (36 points).

Foreigners turned sellers this week as they offloaded $9.1 million worth of shares compared to a net buying of $1.1 million last week. Selling was witnessed in exploration and production sector ($5.4 million) and commercial banks ($3.5 million). On the domestic front, major buying was reported by individuals ($7.4 million) and mutual funds ($7.6 million).

Among major news of the week was; remittances jumped 9.35% in November 2019, State Bank of Pakistan sold Rs137.6 billion worth of PIBs, and reserves held by the central bank jumped $121 million to $9.23 billion.

Published in The Express Tribune, December 15th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ