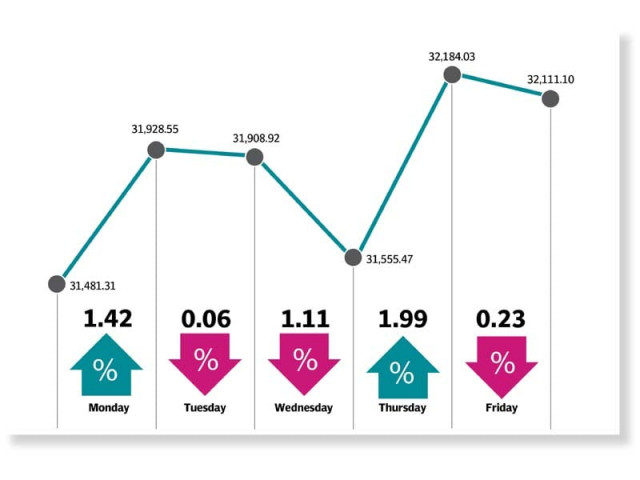

KSE-100 index gains for third successive week

Uptrend in market comes on back of surge in global oil prices

KSE-100 index gains for third successive week

The KSE-100 posted a cumulative return of 8% in the past three weeks, according to a report of Topline Securities.

The bullish momentum continued on the back of improved macroeconomic data and spike in global crude oil prices, which sparked a buying spree in the exploration and production (E&P) sector. Additionally, more developments on political and economic fronts also helped the index rise past the 32,000 mark.

Global crude oil prices jumped a massive 20% on Monday following last weekend’s attack on two Saudi oil facilities. The impact of that development was also felt at the stock market as the index gained in the wake of increased investor interest in oil and gas exploration stocks. Support also came from expectation of monetary policy easing during the week.

Unfortunately, the positive momentum could not be sustained and the index retreated in the following session. Largely in line with market expectations, the State Bank of Pakistan kept the interest rate unchanged. However, there was no major impact of the announcement on the market as it had mostly been factored in. The downtrend was mostly led by profit-taking in the cement sector.

Bears maintained their grip at the bourse on Wednesday and the index slipped further due to dismal foreign direct investment (FDI) data. FDI dropped 58% to $156.7 million in first two months (Jul-Aug) of the current fiscal year 2019-20. Moreover, fluctuations in international crude oil prices in the wake of escalating tensions in the Middle East roiled global markets and aggravated investor sentiment at the PSX.

Tables turned dramatically as the index once again returned to its winning ways following the auction of Pakistan Investment Bonds (PIBs), which helped investors take a positive view on the interest rate and it reflected positively on the stocks.

A reduction in PIB yields triggered positive activity as a decline in the yields stirred expectation of a rate cut, which was further cemented by positive statements from the visiting IMF Middle East and Central Asia director.

Despite an improvement in the current account deficit, volatility returned on the last trading day of the week. The index experienced range bound trading and finished the day on a negative note amid healthy volumes.

Trading activity registered a dip as average daily turnover went down 5% to 123 million shares while average daily traded value dropped 12% to $33 million.

In terms of sectors, the benchmark index was mostly driven by oil and gas exploration companies (up 204 points), commercial banks (147 points), fertiliser firms (98 points), oil and gas marketing companies (89 points) and pharmaceutical firms (56 points).

Stock-wise, the positive contribution was led by Pakistan Petroleum (up 99 points), HBL (77 points), UBL (72 points), Oil and Gas Development Company (63 points) and Engro (57 points).

Foreigners were the net buyers of stocks worth $7.75 million compared to net buying of $1.01 million last week. Buying was witnessed in commercial banks ($3.6 million) and cement companies ($2 million).

On the domestic front, major selling was reported by insurance companies ($9 million) and mutual funds ($6.8 million).

Other major news of the week included current account deficit declining 55% in first two months of FY20, IMF chief saying Pakistan’s loan programme was off to a good start and it could not be revised after only three months, central bank holding the benchmark interest rate steady at 13.25% and SBP’s foreign exchange reserves jumping $138 million to $8.6 billion.

Published in The Express Tribune, September 22nd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ