Powell says Fed will act as appropriate but offers little guidance

Emphasises US economy has continued to perform well overall

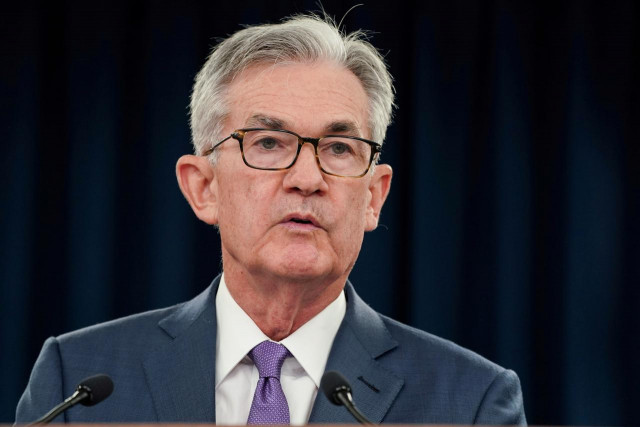

Emphasises US economy has continued to perform well overall. PHOTO: REUTERS

The chair, under pressure from President Donald Trump to cut rates soon and deeply, listed a series of economic and geopolitical risks that the Fed is monitoring - many of them, Powell noted, linked to the administration's trade war with China and other countries.

But "the US economy has continued to perform well overall," Powell said in keynote remarks at an annual Fed economic symposium at this mountain retreat. "Business investment and manufacturing have weakened, but solid job growth and rising wages have been driving robust consumption and supporting moderate overall growth."

If the trade wars have disrupted business investment and confidence and contributed to a "deteriorating" global growth, Powell said the Fed could not set all that right through monetary policy.

There are "no recent precedents to guide any policy response to the current situation," Powell said, adding that monetary policy "cannot provide a settled rulebook for international trade."

Between that, the possibility of a hard Brexit, tension in Hong Kong, an economic slowdown in places like Germany and other overseas troubles, Powell said the Fed needed to "look through" short-term turbulence and focus on how the United States is performing.

But the overall tone of his statement may disappoint investors expecting the Fed to cut rates at its September meeting and possibly several more times this year. The central bank reduced its benchmark rate by a quarter percentage point in July in what Powell referred to as a mid-cycle adjustment.

The initial response in markets was muted, with bond yields edging lower and US stocks briefly paring some of the drop triggered earlier by China's announcement of retaliatory tariffs on US goods.

It is also likely to disappoint Trump, both in focusing on the impact that trade uncertainty is having on the global economy, and in not giving a clear signal that more cuts are coming.

The Fed must "look through what may be passing events, focus on how trade developments are affecting the outlook, and adjust policy to promote our objectives" of 2% inflation and strong employment.

No matter what course Powell chooses, it is clear from the minutes of the Fed's most recent meeting released on Wednesday and from the range of comments from policymakers also in attendance here that he lacks a broad consensus among his colleagues about the appropriate course of action.

Earlier on Friday, St Louis Federal Reserve Bank President James Bullard said the policy-setting Federal Open Market Committee would have a "robust debate" about cutting US interest rates by a half percentage point at their next policy meeting in September.

"I think there will be a robust debate about 50," he said in an interview with Bloomberg TV. "I think it's creeping onto the table."

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ