Govt faces difficulties in containing fiscal deficit

SBP's third quarterly report reveals the widening gap between revenue and expenditure.

Govt faces difficulties in containing fiscal deficit

The government is facing difficulties in containing the growing fiscal deficit – the gap between revenue and expenditures – which is clearly visible in the sharply rising domestic debt, the State Bank of Pakistan (SBP) said in its third quarterly (January-March) report on the state of economy on Monday.

Outstanding government domestic debt reached Rs5,594 billion or 31.8 per cent of the estimated Gross Domestic Product (GDP), which is more than double the stock at end-June 2007.

This sharp growth in debt stock is fuelling concerns about macro stability and monetary management, the report said.

The government has little option but to rely on domestic sources to finance a growing fiscal gap as most external sources have become reluctant.

In addition, the maturity profile of domestic debt reveals that the government has to rollover the entire stock of Rs2,854 billion of short-term debt at least once a year. “Any surge in credit demand from other sectors of the economy could elevate rollover risk and could also expose the government to interest rate risk,” the report added.

Government borrowing from SBP was largely contained in fiscal 2011 till April 2011, but the government borrowed over Rs350 billion from the central bank from March 31 – May 3, 2011) largely meant to incorporate the growing quasi-fiscal expense into the budget.

Quasi-fiscal deficits are financial transactions of units that are not included in a government’s budget but that have some of the same effects as fiscal policy.

The government released Rs120 billion to ease the circular debt – cash backlog in the energy sector – to improve the financial condition of power companies, one of the quasi-fiscal expenses. The circular debt stood at Rs168 billion even after Rs120 billion payments as of May 2011.

In other words, this borrowing is actually financing the quasi-fiscal deficits from previous years, according to the report.

The report also stressed that implementation of fiscal reforms still pose political challenges. “Structural problems like expanding the base of GST through withdrawal of exemptions, tax on agricultural income and restructuring of public sector enterprises are pending resolutions and awaiting consensus,” the report added.

Trade deficit improves for third straight year

Trade deficit continued to narrow for the third consecutive year, declining by 2.1 per cent during July to April 2011 on a yearly basis. Unlike the previous two years, this decline was not due to contraction in the import bill, but due to the stellar performance of exports, says the report.

Despite a challenging economic environment, a growth of 27.9 per cent in exports is indeed commendable, adds the report.

Imports also posted a significant rise of 14.7 per cent during July 2010 to April 2011 after declining during the previous two years. The surge in exports was driven by rising demand owing to global economic recovery and rising trend in international commodity prices.

Deficit flips to surplus after six years

After remaining in deficit for six consecutive years, Pakistan’s current account posted a surplus of $0.7 billion in July to April 2011. This improvement overshadowed the deterioration in the financial account during this period, resulting in an overall surplus of $1.2 billion during July 2010 to April 2011, compared with $0.7 billion in corresponding period of the previous year.

The current account surplus is primarily a result of strong export growth and an increase in worker remittances, says the report.

Remittances crossed the $10 billion mark for the first time in the country’s history as the figure reached $10.1 billion in the first eleven months of the current financial year.

Not washed away with the floods

The agriculture sector posted a strong recovery after the devastating impact of the floods in early period of the financial year 2011, led by the livestock sub-sector, minor crops and some major crops including sugarcane and wheat.

Notwithstanding the significant losses caused by the floods, growth in the livestock sub-sector was sufficient to provide much needed impetus to agriculture growth. In the case of minor crops, some recovery was expected after the flood as farmers focused more on minor crops like vegetable and pulses instead of established major crops.

The floods and the favourable weather conditions helped enhance sugarcane production both in Punjab and Sindh. Therefore, production estimates were revised upward to 53.7 million tons from the earlier estimates of 49.4 million released in November 2010.

Flood impact on prices finally wares off

Recent trends in the consumer price index – key indicator of inflation –suggest that the impact of floods on prices has clearly worn-off, but in overall terms, inflationary pressures remain quite strong.

Inflation came down to 13.23 per cent in May 2011 from a peak of around 15.5 per cent in December 2010.

As the effects of the floods wore off, shortages of perishable food items were contained, says the report. The consequent decline in prices of perishable food items was the main reason behind deceleration in food inflation, adds the report.

Inflation is expected to remain close to 14 per cent in fiscal 2011, an improvement over SBP’s earlier projections.

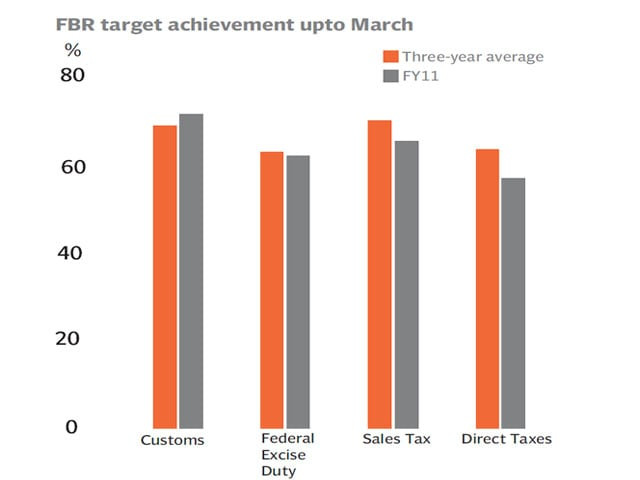

Revenue collection remains weak

Revenue collection remained weak throughout the year as Federal Board of Revenue was only able to collect Rs1,020 billion during July 2010 to March 2011, which represent 64 per cent of the annual tax collection target.

More importantly, tax collection did not show any growth in real terms, as it remained lower than the current inflation of 14 per cent. Furthermore, the sectors experiencing growth, agriculture and services, still remain outside the tax net or are lightly taxed.

The tax to GDP ratio has fallen below 10 per cent, which is considerably lower than comparable countries like India, Indonesia and Sri Lanka.

Growth takes a step back

The country is expected to post a growth of 2.4 per cent against the target of 4.5 per cent for financial year 2011, which is even weaker than the 3.9 per cent achieved in fiscal 2010.

A slowdown in growth was anticipated since the country had suffered severe losses due to the devastation caused by the unprecedented floods in August 2010. Also the allied industries, trading services, and export sectors were adversely affected. Furthermore, power infrastructure and many industrial units were also damaged.

Growth was also hampered as the government had to reallocate development funds to disaster management and rehabilitation. A reduction in several key expenditure heads was therefore required and many public construction projects were shelved.

Published in The Express Tribune, July 5th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ