LNG use helps reduce oil-based power production

Overall power generation rises 1.6% to 122,706GWh in FY19

LNG use helps reduce oil-based power production

On the other hand, hydel generation - the cheapest source - remained on top of the list.

Hydel power production was recorded at 32,356 gigawatt-hour (GWh) in the fiscal year ended June 30, 2019, higher by 14.6% from 28,241GWh in the preceding year. Increased water flow in dams helped raise hydel production.

Private sector may be allowed LNG distribution

“Increased rains helped in ramping up hydel power generation in FY19,” JS Research analyst Ali H Zaidi told The Express Tribune.

Total power production improved 1.6% to 122,706GWh in FY19 compared to 120,728GWh in FY18, according to data compiled by the research house.

“Gas and RLNG (re-gasified liquefied natural gas) are other cheaper sources. RLNG’s tremendous growth in energy mix has helped meet demand of various power plants (Bhikki, Haveli Bahadur Shah, Balloki, Halmore, Orient, Rousch, Kapco, Saif and Sapphire),” stated the Economic Survey of Pakistan 2018-19.

RLNG-fired power production surged almost 35% to 28,146GWh in the year under review compared to 20,895GWh in the previous year. Similarly, the imported coal-based production increased over 37% to 16,310GWh compared to 11,887GWh in FY18.

On the other hand, furnace oil-based generation dropped 60% to 9,092GWh and high-speed diesel-based generation declined 96% to a mere 31GWh in the year. The major shift in the energy mix became possible due to increased availability of installed capacity based on imported gas and coal in the absence of required infrastructure to utilise the additional capacity.

The overall electricity generation capacity has increased by over 45.7% to 34,282 megawatts since June 2014, according to the Economic Survey and the central bank.

However, “available system can transfer only 25,339MW (at the end of fiscal year 2018),” the central bank said in its third quarterly report on the state of Pakistan’s economy, released recently.

Lowest price offers made for LNG supply

“The energy sold required to be increased by at least 30% between FY18 and FY19 in order to keep the capacity cost component at the FY17 level and by at least 57% to keep the capacity cost component at the FY16 level,” said the State Bank of Pakistan (SBP).

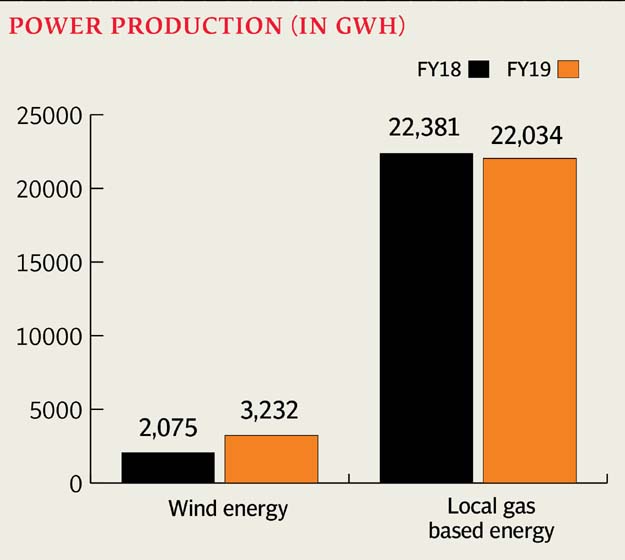

Renewable energy - especially wind power production - soared almost 56% to 3,232GWh in FY19 compared to 2,075GWh in FY18, JS Research reported.

“Five wind power projects of 246.6MW capacity were completed and they started supplying electricity to the national grid (during fiscal year 2019),” the Economic Survey said. Power generation from locally produced gas edged down 1.6% to 22,034GWh in FY19 compared to 22,381GWh in the previous year, likely due to depletion of local gas production.

Despite the addition of cheaper sources of energy production, “the average cost of generation increased by 4.8% year-on-year in FY19 owing to higher costs of major fuel sources,” Zaidi said.

The central bank has, however, attributed the higher power tariff to a sharp increase in capacity payments to the power houses which were not utilised (like oil-based plants) in the system.

“In absolute terms, capacity payments are estimated to be around Rs664 billion for FY19, representing an increase of around 60% over the preceding year,” the SBP said in its third quarterly report.

Published in The Express Tribune, July 31st, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ