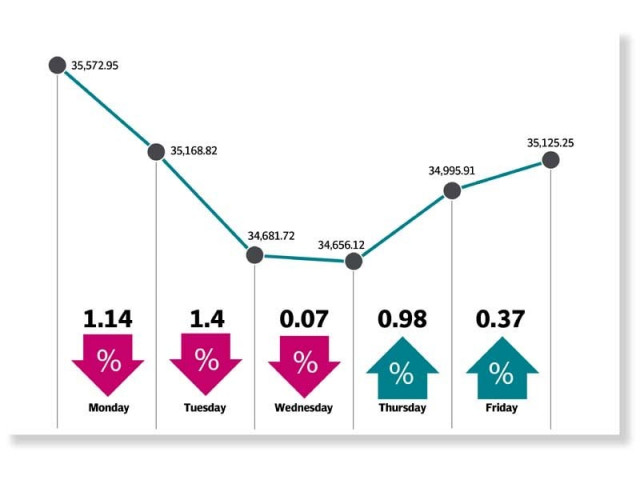

Weekly review: Lack of triggers, profit-taking drive market down

KSE-100 index closes lower by 448 points to settle at 35,125

The rupee lost further ground against the US dollar, which impacted investor sentiments in the stock market. Other developments that kept the index in check included Fitch Rating’s assessment of Pakistan’s economy and ongoing debate over the federal budget for next fiscal year.

The benchmark KSE-100 index kicked off trading on a negative note and plunged on account of post-budget uncertainty and lack of institutional support. Moreover, Fitch Ratings kept Pakistan’s credit rating unchanged despite a staff-level agreement between Islamabad and the International Monetary Fund (IMF) as it saw significant risks to implementation of the $6-billion loan programme.

However, the last two trading sessions of the week saw the change in trend and the index posted a decent recovery on the back of some positive news, which included the contraction in the country’s trade deficit, positive development on the FATF front and likely release of third Sukuk payment for resolving the circular debt problem.

Investor participation remained moderate as average daily trading volumes went down 8.5% to 125 million shares, reflecting a slim market interest, while the average daily traded value dipped 21% to $27 million.

In terms of sectors, negative contribution came from commercial banks (down 181 points), fertiliser producers (88 points), cement manufacturers (49 points), oil and gas marketing companies (42 points) and pharmaceutical firms (29 points).

Sectors that contributed positively included power generation and distribution companies (up 38 points) and exploration and production companies (31 points) on the back of rising international crude oil prices.

Stock-wise negative contribution came from Fauji Fertiliser Company (down 62 points), Bank AL Habib (43 points), Pakistan Petroleum Limited (38 points), Lucky Cement (31 points) and Kapco (31 points).

Hubco (up 83 points), Oil and Gas Development Company (54 points) and Pakistan Oilfields (37 points) supported the KSE-100 index.

Foreign selling continued during the week, which came in at $5.7 million compared to net selling of $4.9 million last week. Selling was witnessed in exploration and production ($4.5 million) and cement companies ($1.4 million).

On the domestic front, major buying was reported by individuals ($7.9 million) and banks/DFIs ($3.7 million).

Major news of the week included Fitch keeping Pakistan’s rating stable at ‘B negative’, the SBP governor saying prior actions taken to secure IMF loan, foreign direct investment plunging 49% in July-May FY19, current account deficit shrinking 29% in 11 months, PM telling textile barons that revival of the zero-rating status was not feasible and the government expected to float Rs200 billion worth of Sukuk next week for slashing the circular debt.

Published in The Express Tribune, June 23rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ