Asad Umar discloses IMF demands for loan package

Says final agreement reflects concessions that Pakistan won in negotiations

Former Finance Minister Asad Umar. PHOTO: FILE

The staff-level agreement reached between Pakistan and the IMF last month was largely in line with the concessions that he secured during four months of negotiations, said Umar in the National Assembly while revealing details of closed-door talks for the first time.

But Umar criticised at least five tax measures that he said would discourage future investments and increase burden on the poor and middle-income group.

Pakistan fulfills all IMF commitments: SBP chief

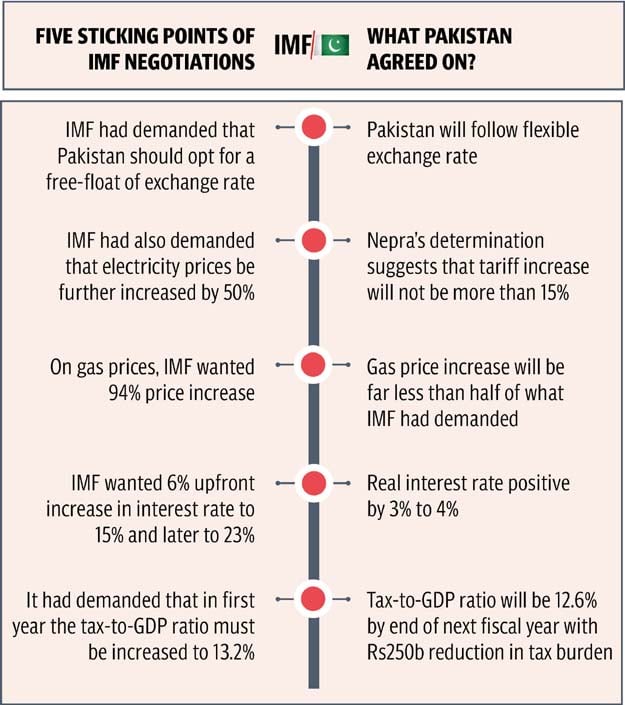

The fund’s conditions also included a 6% upfront increase in the key interest rate, free float of exchange rate and increase in the tax-to-GDP ratio to 13.2% in the next fiscal year, said Umar. The former finance minister’s speech would help end speculations that the deal struck by Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh after Umar’s ouster was different from what Pakistan had negotiated.

Pakistan and the IMF reached a staff-level agreement on May 11 and the IMF Executive Board is scheduled to approve the $6-billion package on July 3. Those who had billions of rupees in assets abroad were not affected by the IMF programme and he had to think about 210 million people, said former finance minister while explaining the delay in finalising the deal with the IMF.

Umar said there were five main conditions of the IMF deal. These were electricity prices, gas prices, tax rates, policy rate of the State Bank and rupee valuation.

The IMF had demanded that Pakistan should opt for free float of the exchange rate but Umar’s position was that the country could not afford the free float.

Umar said he was “very happy” that the SBP governor said there should not be a “free float currency regime in a country like Pakistan”. The free float would allow speculators to play with the currency’s value. He pointed out that the SBP governor had said that Pakistan would follow a flexible exchange rate.

However, the local currency was constantly losing its value and was traded at Rs156.96 in the inter-bank market on Thursday. Umar said the IMF also demanded that electricity prices should be further increased by 50%, but the National Electric Power Regulatory Authority’s (Nepra) determination suggested that the increase would not be more than 15%.

On gas prices, the IMF wanted a 94% price increase but the hike would be far less than half of what the IMF had demanded, said the former finance minister.

Umar said when the interest rate in Pakistan was 9%, the IMF wanted a 6% upfront increase to 15%. From there, the interest rate was to be increased to 23% due to increase in inflation, said the ex-finance minister.

On the increase in taxes, Umar said the IMF had demanded that in the first year the tax-to-GDP ratio must be increased to 13.2%. But the final agreement showed that the tax-to-GDP ratio would be 12.6% by the end of next fiscal year and that meant a Rs250-billion reduction in tax burden, said Umar.

These conditions were relaxed due to four-month-long negotiations with the IMF, he said. “The IMF programme is tough today but is not even closer to what the IMF had initially demanded,” he reiterated.

Speaking on the proposed budget, Umar said there was no doubt that Pakistan was facing tough economic conditions. But even in these difficult circumstances, there was a need to protect the middle-income class along with the poor, he said.

He echoed concerns expressed by textile exporters over delay in release of their genuine tax refunds due to imposition of 17% general sales tax at the manufacturing stage.

“We cannot lose taxes on local sales of the five export-oriented sectors but the government should be mindful that withdrawal of the zero-rating regime may create liquidity crunch for the sectors,” he added.

The former finance czar said if the liquidity crisis was created due to withdrawal of the facility, the investors’ confidence may get hurt. The government expects Rs100 billion in additional revenues from withdrawal of the zero-rating facility.

Opposition brands finance bill ‘IMF budget’

Umar said the government had increased the minimum tax, which might hurt new investment. At least, the new investment should be excluded from the minimum tax in the first five years, he added. The government aims to earn an extra Rs65 billion from the increase in minimum tax. The government has also withdrawn the tax credit facility on balancing, modernisation, rehabilitation and expansion (BMRE) by the industrialists to earn an additional Rs95 billion. Umar was of the view that this facility should continue for attracting new investment.

He criticised his government’s decision to increase the sales tax on sugar and cooking oil, saying it was not suitable to increase taxes on sugar whose prices were already rising.

Published in The Express Tribune, June 21st, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ