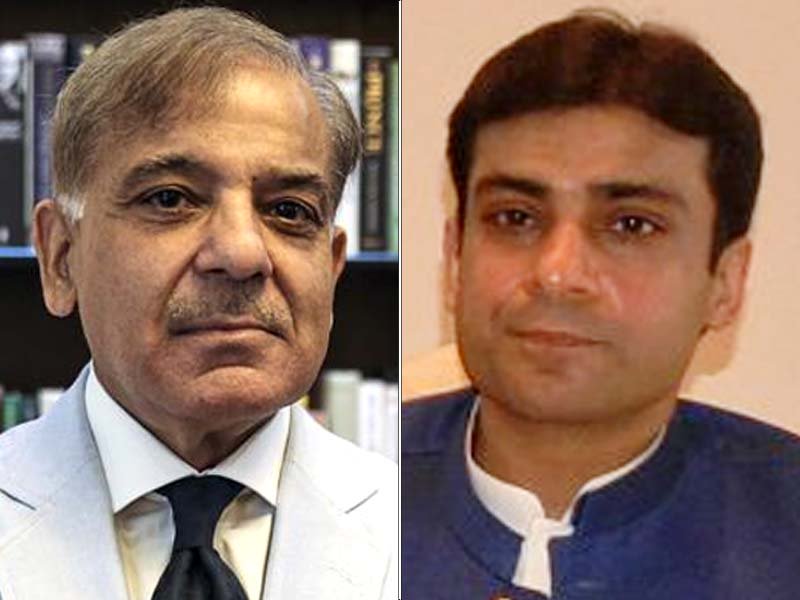

The investigation report submitted by NAB in an accountability court revealed that 10 international money exchange companies – six from Dubai and four based in the UK – were used to carry out huge monetary transactions to the bank accounts of Shehbaz Sharif, his sons Hamza Shehbaz and Suleman Shehbaz, as well as other party members.

The six Dubai-based companies were identified as Al-Hussain Exchange, Al-Zaruni Exchange, Multi-net Trust Exchange, RMU Global Exchange, Reems Exchange and Karim Money Exchange. The four UK-based companies included Main International, Usman International, FX Currency and Crossbar FX.

According to the report, Rs370 million were transferred to Suleman Shehbaz and others’ accounts. The report further said the Sharif family also created various companies in the name of unknown servants.

Following NAB’s probe, Qasim Qayyum and Fazal Dad Abbasi – the two individuals allegedly involved in money laundering on behalf of Shehbaz’s family – failed to recognise the exchange companies.

Qasim Qayyum could only recognise one company, Usman International, while Fazal Dad could not identify any of the ten companies or the senders.

Investigation earlier found that Qayyum was running an illegal foreign exchange business at Sadiq Plaza on Mall Road and Ali Tower MM Alam Road between 2005 and 2018.

Fazal Dad, on the other hand, had been an old employee of the Sharif Group, working with Suleman since 2005. He was arrested for his alleged involvement in collecting cash from different sources before handing them over to Qayyum.

The accused would later arrange fictitious foreign remittances to the bank accounts of Shehbaz and family members. He used the identity cards of his employees or others, showing them as the source of the remittances. Both the accused were arrested on April 3, 2019.

The investigation started when NAB discovered “the huge volume of suspicious cash transactions” in the bank accounts of Shehbaz, Hamza, Suleman and other family members.

Consequently, the Financial Monitoring Unit of NAB forwarded an application to the bureau’s chairman on January 12, 2018 to investigate the transactions. An inquiry was allowed in October 2018 and later its status was turned into an investigation.

1732498967-0/Outer-Banks--(1)1732498967-0-405x300.webp)

1732086766-0/BeFunky-collage-(74)1732086766-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ