Market watch: Bearish trading continues, index drops below 36,800

Benchmark index loses 241.83 points to settle at 36,784.44

Benchmark index loses 241.83 points to settle at 36,784.44. PHOTO: EXPRESS

The KSE-100 index fell sharply from the moment trading began as investors were cautious in the wake of an International Monetary Fund (IMF) report, which predicted a slowdown in Pakistan’s growth.

Pre-budget uncertainty also resulted in persistent selling pressure, which dragged the index down. With the final round of talks between the IMF and Pakistan under way on a possible bailout package, market participants watched developments closely and stood on the sidelines.

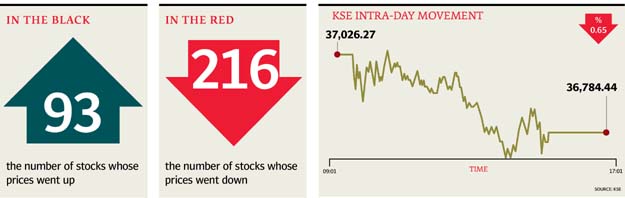

At the end of trading, the benchmark KSE 100-share Index recorded a decrease of 241.83 points, or 0.65%, to settle at 36,784.44.

Topline Securities, in its report, stated that the index extended losses for the second consecutive day as investors were wary of upcoming events like the federal budget and tax amnesty scheme.

“Furthermore, an IMF technical team is in the town till May 7, which is likely to dictate key revenue measures for the upcoming federal budget,” it said. During April, the KSE-100 index lost 4.8% - the worst April in the past 14 years. Exploration and production, cement and banking sectors were the top laggards, eating away 887 points from the index.

“Investor sentiments in the exploration and production sector were hurt after offshore drilling hit a snag, while the cement sector remained under pressure due to decrease in cement prices as differences of opinion persisted among cement manufacturers over uniform pricing,” Topline said.

JS Global analyst Danish Ladhani said equities closed on a bearish note with benchmark KSE-100 Index shedding 242 points.

“Market remained volatile as the final round of talks between the IMF and Pakistan over a potential bailout package, which is expected to be signed next month, is underway.”

KEL (+1.0%) disclosed its material information where there company is planning to set up a 700MW power project with the assistance of a Chinese engineering firm, calling it a milestone project in the economic cooperation between China and Pakistan.

Moreover HASCOL (+1.0%), in its material information has denied allegations of tax fraud after it was reported that the company was involved in tax evasion of Rs3.9 billion.

Cements were the major laggards in Tuesday’s trading session where LUCK (-0.7%), FCCL (-2.7%) and DGKC (-2.0%) closed in the red as the reports aired that the manufacturers in the latest meeting failed to reach to a consensus on pricing and quota allocation.

Mixed sentiments were seen in the financials where HBL closed in the red, while MCB (+0.3%) and UBL (+1.2%) closed in the green zone.

“We expect market to remain volatile ahead and recommend investors to stay cautious in the short run,” he added.

Overall, trading volumes decreased to 110.6 million shares compared with Monday’s tally of 177.5 million. The value of shares traded during the day was Rs4.6 billion.

Shares of 326 companies were traded. At the end of the day, 93 stocks closed higher, 216 declined and 17 remained unchanged.

Unity Foods was the volume leader with 12.4 million shares, losing Rs0.14 to close at Rs13.36. It was followed by Pak Elektron with 9.3 million shares, losing Rs0.43 to close at Rs22.76 and The Bank of Punjab XD with 6.3 million shares, losing Rs0.18 to close at Rs12.43.

Foreign institutional investors were net buyers of Rs330.8 million worth of shares during the trading session, according to data compiled by the NCCPL.

Published in The Express Tribune, May 1st, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ