Market watch: KSE-100 turns bullish as investors cherish Chinese loan

Benchmark index increases 147.15 points to settle at 38,531.87

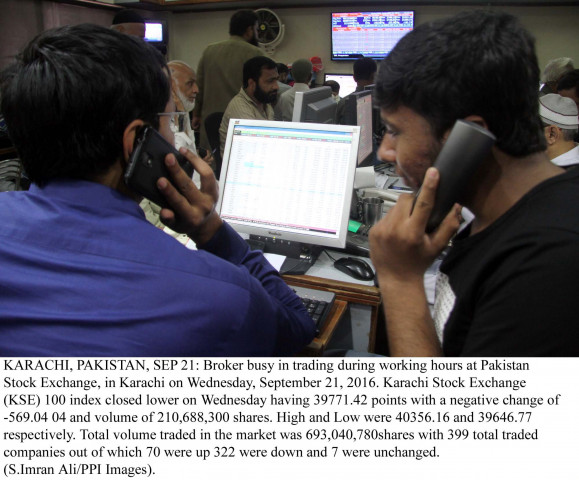

Benchmark index increases 147.15 points to settle at 38,531.87. PHOTO: PPI / FILE

Sentiments of market participants were also buoyed by news that Pakistan and Malaysia were going to sign millions of dollars of investment agreements on the sidelines of Prime Minister Mahathir Mohamad's visit to Pakistan.

The KSE-100 spiked as soon as trading began and climbed over 300 points in early hours, but investors started offloading their holdings later, wiping off some of the gains by the end of first session. Nevertheless, the session closed above the 38,600-point mark.

Market watch: KSE-100 continues to lose ground amid lack of triggers

The second session opened downwards as the bourse came under selling pressure, however, cherry-picking in final minutes helped the index regain lost ground and closed the day in the black after three consecutive days of losses.

The cement sector bore the brunt of dented sentiments where major stocks lost ground. On the other hand, the financial sector stood strong despite some uncertainty in the market.

At the end of trading, the benchmark KSE 100-share Index recorded an increase of 147.15 points, or 0.38%, to settle at 38,531.87.

Arif Habib Limited, in its report, stated that the market had a relatively better session on Friday as compared to the previous entire week.

"Prime Minister Imran Khan's promise of sharing good news in three weeks did the trick for investors, helping exploration and production stocks, especially those of Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited, to take off and grow both in price and volumes," the report said.

"First session of the day saw the market rise 228 points with trading volume of 35.2 million, which grew further in the second session with the addition of another 108 points, reaching a total of +336 points."

However, selling pressure also emerged in the second session, which erased almost all the gains made during the day. Later, in the last half hour of trading, the market saw buying activity, which pushed the index up by 207 points (unadjusted).

Stocks that contributed positively included Pakistan Petroleum (+84 points), OGDC (+58 points) and Pakistan Oilfields (+23 points).

Stocks that contributed negatively included Hubco (-37 points), Nestle (-20 points) and Pakistan Services Limited (-11 points), the report added.

Market watch: Bulls dominate as KSE-100 surges 545 points

Overall, trading volumes increased to 84.6 million shares compared with Thursday's tally of 81.4 million. The value of shares traded during the day was Rs4.4 billion.

Shares of 330 companies were traded. At the end of the day, 139 stocks closed higher, 159 declined and 32 remained unchanged.

Pakgen Power was the volume leader with 12.37 million shares, gaining Rs0.76 to close at Rs15.01. It was followed by The Bank of Punjab (XD) with 12.17 million shares, gaining Rs0.08 to close at Rs13.08 and OGDC with 5.32 million shares, gaining Rs4.23 to close at Rs145.94.

Foreign institutional investors were net sellers of Rs0.21 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ