Govt to hunt tax evading Pakistanis in Russia, Turkey

PM gives two weeks to FBR to take steps showing it is serious to curb corruption

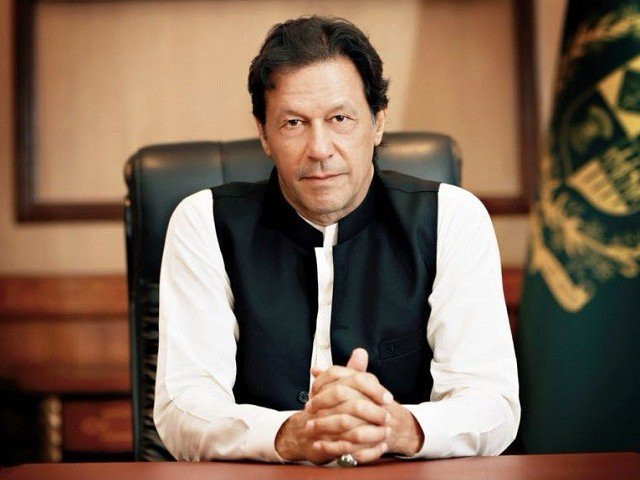

Prime Minister Imran Khan. PHOTO: PID

The decision to approach the tax authorities of these two countries was taken by Prime Minister Imran Khan during a meeting that he chaired last week, senior officials of the Federal Board of Revenue (FBR) told The Express Tribune.

On January 30, the PM took a number of decisions to curb corruption in the FBR, discourage under-invoicing of imports from China and trace with the help of intelligence agencies people who had been named in the Panama leaks. Imran Khan also gave two-week time to FBR Chairman Jehanzeb Khan to take steps that must signal that the organisation is serious to curb corruption.

Govt sends notices to big landlords for tax evasion

One of the important decisions was to immediately establish contacts with Russian and Turkish tax authorities to get information about Pakistanis who have assets in these two foreign jurisdictions.

The Panama leaks that changed the political landscape of Pakistan had revealed the hidden offshore assets of over 300 Pakistanis in April 2016. Due to delay in taking action against these people, the money was moved from known tax havens to other foreign jurisdictions.

Pakistan already has an agreement on tax matters with Turkey. But it does not have such an arrangement with Russia, although the federal cabinet in 1998 had allowed negotiating a taxation treaty.

The FBR has been unable to recover any significant amount from those named in the Panama leaks. The officials said that despite the window available under the Organisation for Economic Cooperation and Development (OECD), Pakistan did not write to foreign jurisdictions to get the critical information.

Cigarette industry: NAB to extend probe into Rs60-billion tax evasion

But the Pakistan Tehreek-e-Insaf (PTI) government has claimed that it has written to foreign jurisdictions – including the Republic of Panama, a small Latin American state – to get information.

The officials said it is a time consuming exercise to get such information, although Panama is bound to share it under the OECD arrangement. The officials said the PM also asked the FBR to seek help of other authorities, mainly the Federal Investigation Agency (FIA), to trace people who remained off the FBR’s limits even almost three years after the Panama leaks episode.

The FBR claims that the information provided in the leaks was largely general in nature. The details like the exact identity of the person and nature of investment was not available with the tax machinery.

The PM also directed the Ministry of Foreign Affairs to request China to further broaden the scope of exchange of information on trade matters. Last year, Pakistan and China started exchange of data information (EDI) on imports and exports. But the scope of such information is limited to only trade under the Free Trade Agreement, which constitutes nearly 60% of the total bilateral trade.

This left nearly $6 billion bilateral trade outside the exchange of information domain, which Pakistan now wants to capture to control massive under-invoicing in the range of $4 billion to $6 billion per annum.

The FBR remains under pressure due to its inability to broaden the tax base and achieve its revenue collection targets. The tax machinery faced a revenue shortfall of Rs191 billion for the July-January period. The government wants the FBR to increase its tax collection through enforcement measures.

But the FBR spokesperson said on Monday that the machinery cannot add Rs500 billion annually through enforcement measures and provisional assessments. During the meeting, the PM had also directed the FBR to immediately start provisional tax assessment of high net-worth individuals.

In order to strengthen the FBR’s capacity, the PM also directed the Establishment Division to repatriate within a week all FBR officers serving on deputation in other departments. This order will not be applicable to the FBR officers serving in the PM’s Office. The FBR chairman has also been given two-week deadline to improve the image of his tainted department.

It was also decided that the FBR would separate tax audit function from the assessments, aimed at focusing more on those people who remain outside the net and enjoy lavish lifestyles. The FBR chief has been asked to include the tax recovery through notices as part of assessment of officers.

The premier also issued directives to hire a new chairperson of the Pakistan Revenue Automation Limited, a subsidiary of the FBR, from the private sector. The PM ordered reconstitution of the board of the National Database and Registration Authority (NADRA) to bring into it top professionals from the private sector. NADRA’s role is critical in the government’s drive to broaden the tax base through the use of information technology.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ