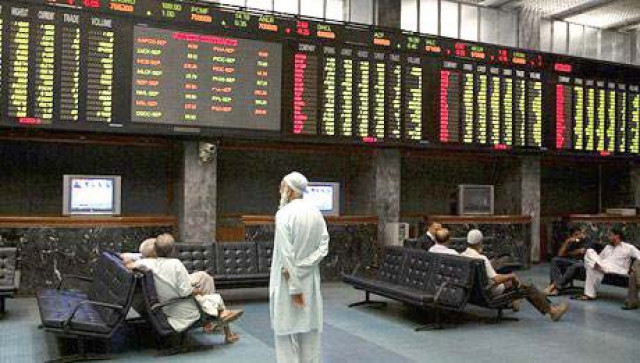

Equities flat before budget announcement

The Karachi Stock Exchange (KSE) benchmark 100-share index ended 0.16 per cent, or 15.58 points, higher at 9,636.88.

Turnover was 97.9 million shares, down from 140.1 million shares traded on Thursday.

Investors were nervous as was obvious from the index ups and downs, according to dealers. The KSE-100 touched a high of 9,665.29 and low of 9,543.47 on Friday.

The government will unveil its federal budget on Saturday for the period from July 2010 to June 2011.

The Pakistani economy grew by a provisional 4.1 percent in the financial year ending on June 30, compared with 1.2 percent growth in the previous year, according to the 2009/10 Pakistan Economic Survey.

The index posted some gains towards the close as institutions started buying stocks at lower levels, according to analysts. According to them the market they witnessed some profitable selling at the lower levels which pulled the index down again.

“Investors preferred to remain cautious on the last trading day before the budget announcement and the market moved in a range of 121 point with a low and high of 9,543 and 9,665,” said JS Global Capital’s analyst, Muzzamil Mussani. He added investors’ major concern was implementation and modalities of capital gain tax. He said that during the last hours of trading there were rumours in the market that capital gain tax will be levied only on trading of less than 6 months.

It had been agreed between KSE members and the Ministry of Finance that the 10 percent capital gains tax will be levied on trading of less than six months whereas the 7.5 per cent tax would be levied on trading between six months to 1 year.

“Rumors regarding deferment of VAT and CGT created some interest in the market. However, investors preferred to adopt wait and see strategy on the last day before budget,” said Topline Securities analyst, Furqan Punjani.

“Understandably volumes remained soft as the budget is likely to announce an imposition of CGT possibly hampering volumes in the near term,” said Elixir securities analyst, Faisal Bilwany. He added that stocks witnessed a mild recovery in late trading on rumours that Mutual funds would were likely to be exempted from Capital Gains Tax.

Out of the 373 stocks which were traded during the day, 189 were up, 162 were down. The price of 22 stocks remained unchanged.

Major banking stocks like National Bank of Pakistan (down 1.5 per cent) and United Bank Limited (down 0.2 per cent) and other banks, with the exception of MCB bank, closed in the negative. This was despite positive news for the sector as the State Bank of Pakistan has announced that Forced Sales Value benefits to banks, on land, have increased to four years from the earlier three years.

The wider market remained cautious with Pakistan Petroleum ltd under pressure amid concerns of decline in Sui field’s reserves, according to Bilwany. He said that this was despite reports of foreign buying in ENGRO and Pakistan State Oil.

Published in the Express Tribune, June 5th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ