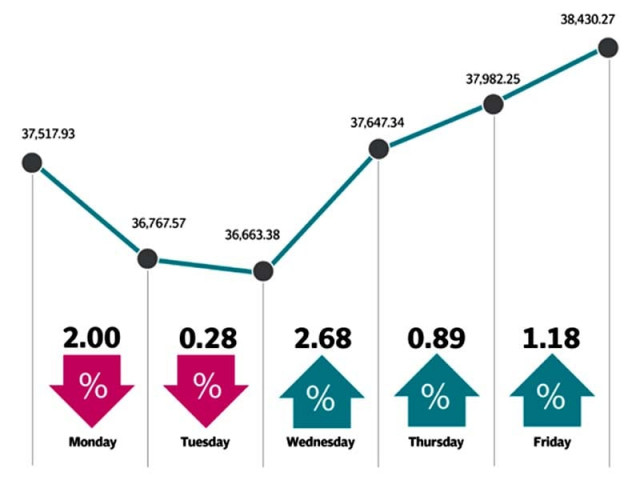

KSE-100 recovers 2.4% after losing ground for three weeks

Clarity on economic front, attractive valuations help instill investor confidence

KSE-100 recovers 2.4% after losing ground for three weeks

The positive run came after a three-week bearish run, underpinned by attractive valuations. Investors rushed to build positions in blue-chip stocks, supporting the market bounce back from its previous week’s low.

QESCO kicks off operation against electricity thieves

The week started on a negative note, but soon the market recovered the lost ground as some clarity emerged on the external front. Finance Minister Asad Umar announced that Pakistan was approaching the International Monetary Fund (IMF) for a bailout package as well as expectation of funding from other multilateral agencies fuelled investor confidence in the national economy.

The previous three weeks’ cumulative decline of 9% had also indicated that the market was poised for a recovery through cherry-picking of stocks.

Given the precarious external account situation, the decision to impose regulatory duty on approximately 570 imported goods showed the intent of the government to bring down the external deficit.

On the other hand, foreign direct investment (FDI) inflows into the country dropped 42.6% to $440 million in first quarter of the current fiscal year, which eroded investor trust and increased macroeconomic concerns.

The State Bank of Pakistan (SBP) said measures included in the supplementary budget by the government meant the country would miss its growth target of 6.2% in the current fiscal year by a wider margin than originally stated.

On the political front, the announcement of prime minister’s second visit to Saudi Arabia before scheduled trip to China and developments in relation to meeting requirements of the Financial Action Task Force (FATF) to curb terror financing aided the investors’ positive sentiments.

Market participation witnessed an uptick with average daily traded volumes up 13% week-on-week to 199 million shares. However, the average daily traded value was down 5.2% week-on-week to $49 million.

Sector-wise, positive contribution came from cement companies (170 points), oil and gas marketing companies (117 points), fertiliser (98 points), automobile assemblers (89 points), and oil and gas exploration companies (81 points). On the other hand, negative contribution came from commercial banks (34 points) and tobacco companies (26 points).

Scrip-wise positive contribution was led by DG Khan Cement (52 points), Pakistan Oilfields (52 points), Pakistan State Oil (52 points), Indus Motor (50 points) and Pakistan International Bulk Terminal (50 points).

Foreign selling continued in the outgoing week as well which came in at $19.1 million compared to net selling of $32.6 million last week. Selling was witnessed in commercial banks ($8.3 million) and exploration and production companies ($2.9 million).

Karachi hit by power breakdown as national grid line trips

On the domestic front, major buying was reported by companies ($5.8 million) and individuals ($5.1 million).

Among major highlights of the week were Shell seeking to secure profit margins in dollar, government coming up with steps to overcome urea shortage, forex reserves going down to $14.6 billion, Chinese auto giant Changan International entering Pakistan, ECC approving uninterrupted gas supply to export-oriented industries, Indus Motor raising vehicle prices by Rs100,000-350,000 following recent rupee depreciation and five export sectors getting priority in gas supply during winter.

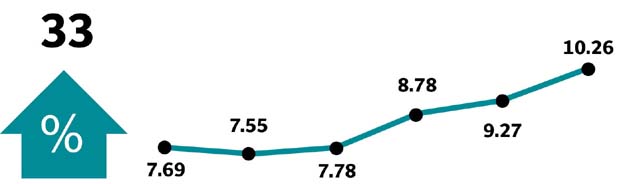

Winners of the week

Byco Petroleum

Byco Petroleum Pakistan operates a crude oil refinery for the manufacture and sale of petroleum products.

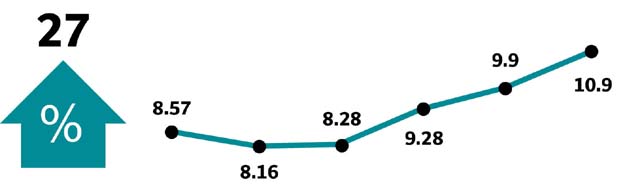

Pakistan International Bulk Terminal

Pakistan International Bulk Terminal is a terminal operating company. The company focuses on setting up a terminal for handling coal, clinker and cement on build, operate and transfer (BOT) basis at Port Qasim Authority.

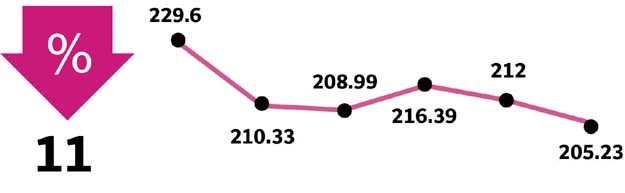

Losers of the week

Agriautos Industries

Agriauto Industries manufactures auto, tractor and motorcycle parts. The group’s products, which are sold to the OEM and replacement parts market, include gaskets, valves and sleeves, shock absorbers, camshafts, brake bands, hydraulic lift covers, steering boxes and transmission components. The group operates in Pakistan.

Jubilee Life Insurance

Jubilee Life Insurance Company is a general insurance company, which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness and investment insurance.

Published in The Express Tribune, October 21st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ