Market watch: Stocks bleed as index plunges another 750 points

Benchmark index decreases 2% to settle at 36,767.57

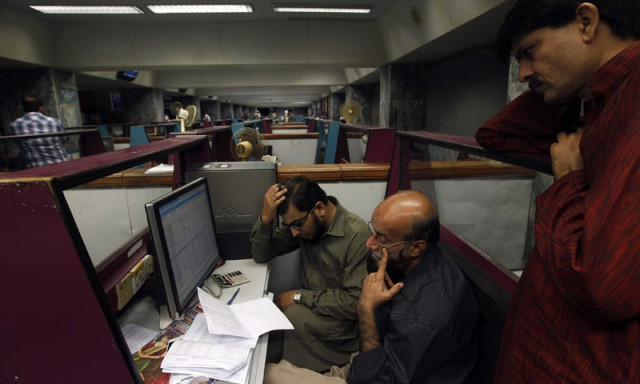

Benchmark index decreases 2% to settle at 36,767.57. PHOTO: REUTERS

Despite the government's announcement of returning to the International Monetary Fund (IMF) for a bailout, investor confidence could not be restored as the selling spree continued. As a result, the index dropped below the psychological barrier of 37,000 points.

The IMF's projection that average inflation in Pakistan might hit 14% by June next year further fuelled the bearish sentiment.

Declining foreign exchange reserves also worried investors, which also contributed to the index's plunge to an intra-day low of 36,274.25 points - a level last seen in June 2016.

Commenting on the situation, Topline Securities' analyst Nabeel Khursheed said the IMF's latest forecast had painted a bleak picture of Pakistan's economy.

KSE-100 plunges 4.4% in turbulent week

"The forecast is driving the market down. Higher inflation means an exorbitant increase in the benchmark interest rate," he added.

The higher inflation along with interest rate hike would put the economy under severe pressure, Khursheed pointed out.

Other analysts said foreign selling and redemption calls forced mutual fund managers to sell part of their holdings at current low prices, which also contributed negatively to the index.

The unfolding political drama and deteriorating macroeconomic indicators hit the stock market hard.

At close, the benchmark KSE 100-share Index recorded a decrease of 750.36 points or 2% to settle at 36,767.57.

Elixir Securities' analyst Murtaza Jafar said the benchmark KSE-100 index continued its downward journey and closed 2% lower on economic concerns and dearth of liquidity.

The PSX Stock Brokers Association held a meeting with Finance Minister Asad Umar and SECP officials to consider what confidence-building measures were needed as the market had plunged 10.3% so far this month.

Uncertainty wipes $41b off PSX capitalisation

"We expect the recent sell-off to taper off around 35,000-35,500 points while we prefer financial and energy stocks on weakness," Jafar said.

JS Global analyst Danish Ladhani said investor enthusiasm was low as selling pressure prevailed despite the government's announcement that it was going to the IMF for a bailout package.

"Moreover, the rupee declined Rs1.40 against the dollar, trading between Rs133.20 and Rs133.40. Furthermore, there were whispers that the market expected the removal of Lucky Cement and United Bank from the MSCI large-cap index and their inclusion in the small-cap index in the next MSCI reclassification due on November 13, which further hampered the market," Ladhani added.

Top heavyweights Pakistan Petroleum (-2.70%), Oil and Gas Development Company (-0.30%), Habib Bank (-0.89%), Engro (-2.52%), MCB Bank (-3.86%), United Bank (-0.04%), Fauji Fertiliser (-1.68%) and Hubco (-1.50%) cumulatively erased 232 points from the index.

Cement heavyweight Lucky Cement (-3.85%) was a major laggard that closed near its lower price limit.

Market watch: Stocks hammered as KSE-100 loses 880 points

"Moving forward, we expect investor sentiment to remain choppy amid absence of any macroeconomic triggers. Therefore, the KSE-100 will remain under pressure along with selling pressure from foreign investors," the analyst said.

Overall, trading volumes increased to 165.5 million shares compared with Friday's tally of 135.4 million. The value of shares traded during the day was Rs6.1 billion.

Shares of 371 companies were traded. At the end of the day, 83 stocks closed higher, 269 declined and 19 remained unchanged.

TRG Pakistan was the volume leader with 16.8 million shares, losing Rs0.54 to close at Rs22. It was followed by Unity Foods with 8.8 million shares, gaining Rs0.30 to close at Rs25.22 and K-Electric Limited with 7.5 million shares, losing Rs0.07 to close at Rs5.14.

Foreign institutional investors were net sellers of Rs424.6 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ