KSE-100 plunges 4.4% in turbulent week

Economic concerns, rupee depreciation take toll on investor sentiments

Economic concerns, rupee depreciation take toll on investor sentiments.

PHOTO: FILE

“Market fell 4% during the week, taking cumulative two-week losses to 9% - the worst two-week performance in 3.6 years,” stated a Topline Securities’ report.

It was a turbulent week at the Pakistan Stock Exchange as news continued to unfold on the economic and political fronts keeping investors cautious.

With lack of clarity on economic policies, stocks took a beating on Monday and the index plunged over 1,300 points. The six-day bearish run prompted the government to clear the air regarding its stance on returning to the International Monetary Fund (IMF) for a bailout.

Following Finance Minister Asad Umar’s announcement that the government would approach the IMF to bridge a huge gap in its external financing needs, bulls took charge as they led the KSE-100 index higher on Tuesday and Wednesday.

Unfortunately, the optimism was short-lived as the possibility of tough measures the government would have to take as part of the IMF programme took a toll on market sentiments.

Just a day after the government said it was seeking IMF bailout, the rupee tumbled 7.54% to Rs133.64 to the US dollar in the inter-bank market. This was the fifth round of massive depreciation of the currency since December 2017 to tame aggressive demand for dollars in a faltering economy and had a mixed impact on the market.

Additionally, the continued decline in foreign exchange reserves of the country and rising circular debt also dampened the overall mood.

Bears once again took control as the bourse also tracked losses in regional markets. Furthermore, Moody’s warning about a potential rise in the country’s debt burden in the future set alarm bells ringing for investors.

Uncertainty wipes $41b off PSX capitalisation

The dismal market performance can also be attributed to reports that certain stocks were facing the risk of exclusion from the MSCI Emerging Market index.

This also dented investor confidence, in addition to the already gloomy economic outlook.

Market participation picked up with average daily traded volume up 55% week-on-week to 176 million shares while average daily traded value was up 48% week-on-week to $52 million.

Sector-wise, negative contribution came from commercial banks (304 points), cements (290 points), fertiliser (212 points), oil and gas marketing companies (179 points), and automobile assemblers (119 points). On the other hand, positive contributions came from miscellaneous (25 points) and textile weaving (2 points).

Scrip-wise negative contributions were led by HBL (166 points), LUCK (149 points), UBL (84 points), PSO (72 points), and FFC (70 points). The refinery sector felt the brunt from rupee devaluation, with National Refinery Ltd emerging as the worst performer from the sector.

Market watch: Stocks hammered as KSE-100 loses 880 points

Foreign selling continued this week clocking-in at $32.6 million compared to a net sell of $8.4 million last week. Selling was witnessed in commercial banks ($21.4 million) and exploration and production ($3.2 million). On the domestic front, major buying was reported by companies ($22.7 million) and insurance companies ($6.5 million).

Among major highlights of the week were; five million homes project launched by the government, World Bank clipped growth forecast to 4.8%, while IMF declined GDP estimates to 4% for FY19, cement sales posted 4% year-on-year growth in 1QFY19 to 10.81 million tons, Attock Cement increased cement prices by Rs20/bag in the south region, cars and LCVs sales down 4% year-on-year to 58,351 units in 1QFY19 and fertiliser manufacturers announced Rs130/bag increase in urea prices.

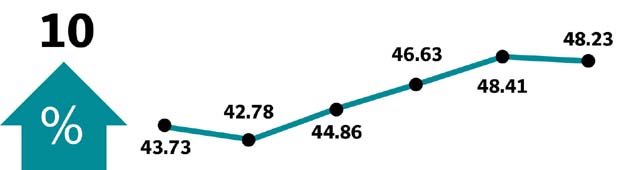

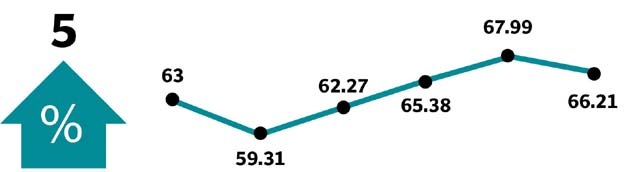

Winners of the week

Habib Metro Bank

Habib Metropolitan Bank Limited is a fully accredited commercial bank. The bank provides banking services to individual and corporate customers including personal loans, education loans, mobile banking, cash management services, short and long-term financing, international trade, and savings accounts.

Feroze 1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

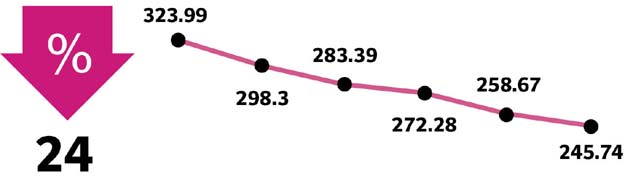

Losers of the week

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The Company markets its products to customers throughout Pakistan.

Pak Suzuki Motor Company

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Published in The Express Tribune, October 14th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ