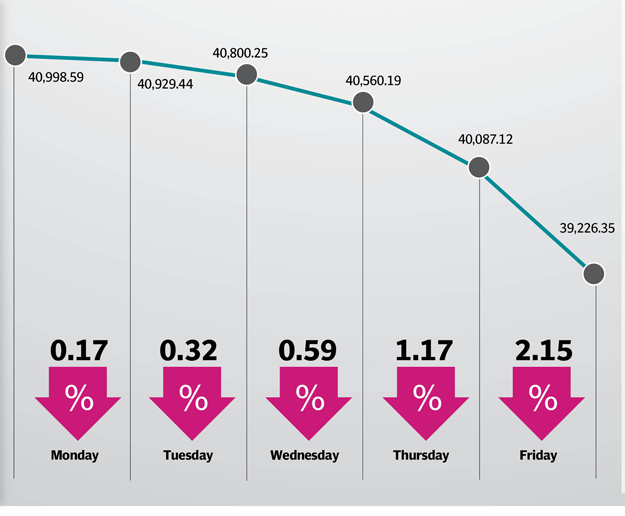

Stocks battered as KSE-100 loses 1,772 points

Market plunge caused by mounting macroeconomic concerns and political developments

Market plunge caused by mounting macroeconomic concerns and political developments.

PHOTO: FILE

According to an Elixir Securities’ report, this was the lowest level since December 21, 2017.

The bearish wave continued for the entire week, as developments on the political and economic front kept investors jittery. Monday witnessed the index decline on the back of slight rupee devaluation in the open market and a hike of 100bps in the key interest rate announced by the central bank.

Following backlash from the public and the opposition on the removal of ban on non-filers for purchase of car and property, the National Assembly approved the mini-budget with continuity of the ban. Auto stocks reacted negatively to the development, which also added to the sombre mood.

A team from the International Monetary Fund was visiting Islamabad during the week and was engaged in discussions with the government over a possible bailout to salvage the crumbling economy. The team recommended a harsh economic plan for the economy, which included further increase in interest rates and devaluation of rupee.

The market reacted strongly to this and plunged another 473 points on Thursday.

Market watch: Stocks hammered as KSE-100 dives 861 points

Although talks of investment agreements with Saudi Arabia remained in the limelight, they failed to garner any positive interest from the participants. The last trading day of the week underwent a massacre as the index plummeted below the significant 40,000-level.

The foreign exchange reserves held by the State Bank of Pakistan (SBP) fell to a four-year low of $8.4 billion, which sent the market into a frenzy of panic.

Immense selling pressure was witnessed, which was aggravated further as news of Opposition leader Shehbaz Sharif’s arrest broke. The National Accountability Bureau (NAB) took the PML-N president in custody over the Rs14 billion Ashiana-e-Iqbal Housing Scheme case.

Additionally, the Oil and Gas Regulatory Authority’s (Ogra) notification of a significant hike in gas prices also dented sentiments.

Market failed to attract participants during the week with average daily volumes decreasing 15% to 113 million shares while the average daily traded value was down 9% to $35 million.

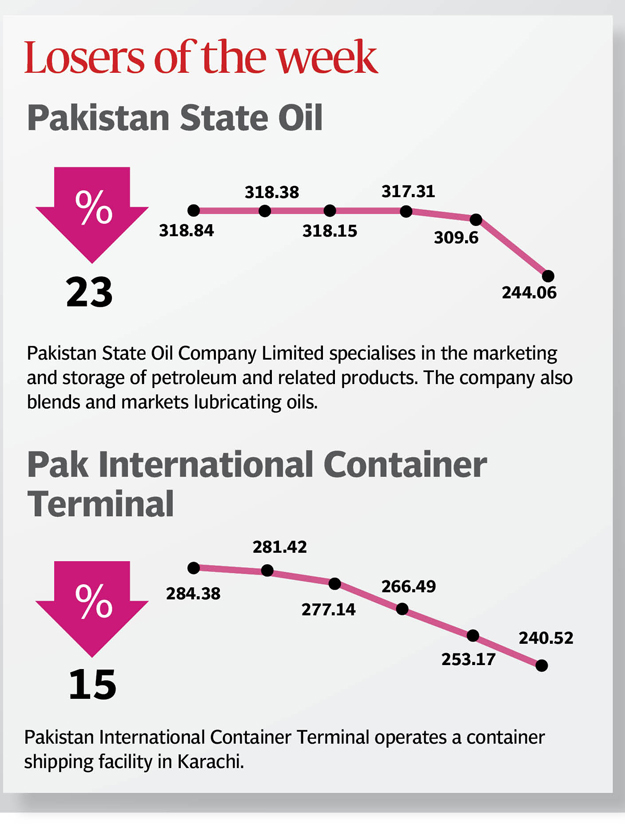

Sector-wise activity was led by commercial banks (down 525 points), cements (217 points), oil and gas exploration companies (151 points), oil and gas marketing companies (146 points) and fertilisers (116 points). Scrip-wise, downside was led by Habib Bank Limited (down 145 points), MCB (105 points), United Bank Limited (94 points), LUCK (89 points), and the Oil and Gas Development Company (77 points).

Foreign selling continued this week clocking-in at $8.4 million compared to net selling of $9.4 million last week. Selling was majorly witnessed in food and personal care products ($3.6 million) and commercial banks ($3.2 million).

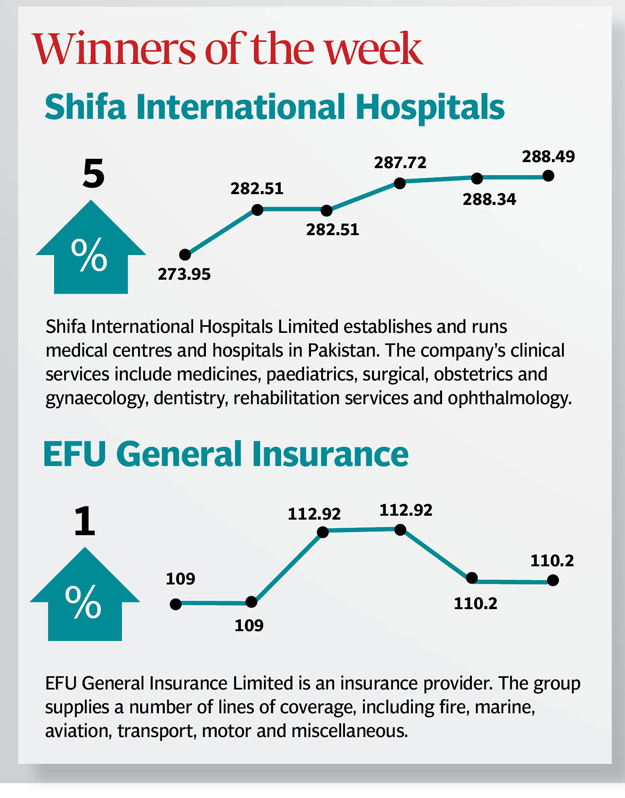

On the domestic front, major buying was reported by companies ($5.2 million), insurance companies ($4.6 million) and banks ($2.44 million), while, mutual funds remained net sellers of $4.6 million.

Market watch: KSE-100 drops 473 points on tough measures suggested by IMF

Among major highlights of the week were; Saudi Arabia oil seeking deferred payment, ECC approved one million tons of sugar exports, restrictions on purchase of property, vehicles reintroduced for tax non-filers, talks with Saudi Arabia on $8 billion Gwadar refinery in final stages and Ogra notified 10-143% gas tariff hike.

Published in The Express Tribune, October 7th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ