Tax break: Court suspends collection of tax from PATA oil industries

Directs customs to release the consignment of ghee mills without charging the tax

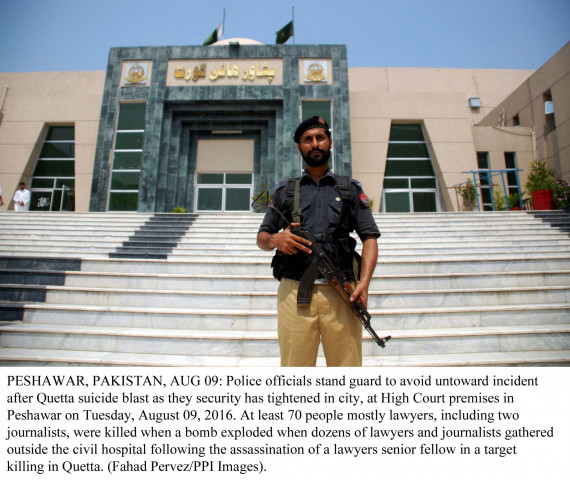

Peshawar High Court. PHOTO: PPI/FILE

As a result, customs were directed to release consignments of raw material for edible oil, which had been held pending payment of the advance tax on the grounds that the special status for Pata had been abolished under the 31st Constitutional amendment.

On Friday, a division bench of the Peshawar High Court (PHC), headed by Justice Ikramullah, suspended the recovery of the tax at the import stage for mills located in Pata.

The order came after Lal Oil and Ghee Industries in Dargai had filed a writ petition before the PHC via their counsel Shumail Ahmad Butt.

Butt argued before the division bench that while the federal government had merged Khyber-Pakhtunkhwa and the erstwhile federally administered tribal areas (Fata), they had committed to keeping the tax exemption for Pata intact for five years.

Hence, the mills were not liable to pay income tax for industrial units located in the defunct Pata areas.

“The demand for income taxes from the petitioner is illegal, unlawful, without lawful authority and thus of no legal effect,” lawyer for the petitioner argued in the court.

Butt went on to explain the oil manufacturing process for the court. He detailed factories have to import raw material including raw palm and other oil along with a host of inputs such as tin plates for the packaging, which it will then process into the final product and sell within territorial limits of the erstwhile Pata.

“All our business activities are strictly [located] within the territorial boundaries of the erstwhile Pata,” he argued.

The Pata areas were given tax concessions by the government as a compensatory measure after decades of war-against-terrorism had caused a mass exodus of people and businesses from the area.

To combat that situation, the federal government in 2010 put forward the “Prime Minister’s Scheme for Rehabilitation of Economic Life in the Province of K-P and Tribal Areas” under which industries were exempted from income taxes.

When Fata was being merged with K-P and Pata’s status was being abolished, businesses had successfully argued that eliminating the tax exemption forthwith would be detrimental to industries in the area and thus sought a phased withdrawal with a grace period of five years. The government had agreed to this proposal.

Published in The Express Tribune, October 6th, 2018.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ