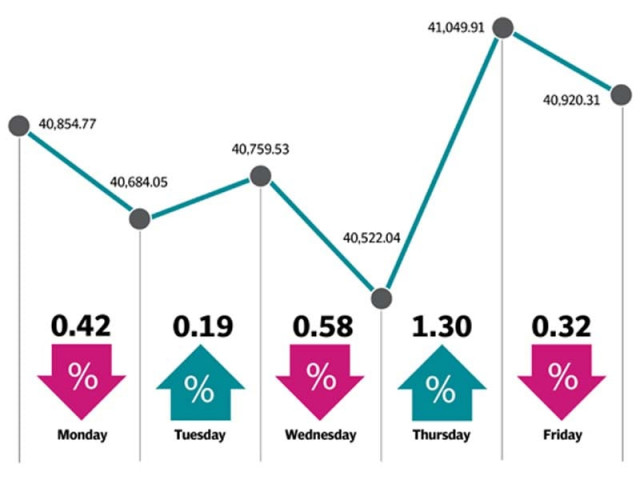

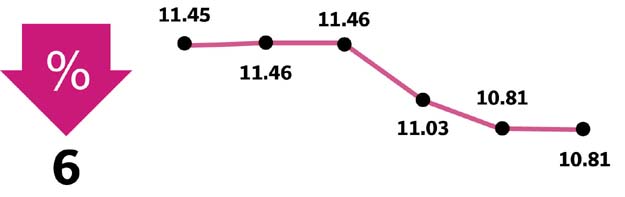

KSE-100 closes flat, gains just 65 points

Investors wait for clarity on economic measures expected to be taken by the government

The week began on a negative note due to a buzz among investors on the possibility of gas and electricity tariff hike. However, the market recovered the next day as investors viewed favourably a news story that said the government was planning to announce a textile incentive package.

Later, the market witnessed mixed news on the economic measures to be taken by the new government.

With expectations of higher taxes and reduction in the Public Sector Development Programme (PSDP), investors awaited the new finance bill, which was due to be presented next week. It would be followed by the arrival of a staff-level team of the International Monetary Fund (IMF) in the last week of current month.

Investor participation improved as average daily volumes slightly increased by 0.2% in the outgoing week to 139 million shares while average daily traded value got better by 19% to $47 million.

In terms of sectors, positive contribution came from oil and gas exploration companies (159 points) due to increase in crude prices during the week, fertiliser companies (55 points) due to no change in gas prices, textile composite (37 points), technology and communications (31 points) and power generation and distribution (25 points).

Sector-wise, negative contribution came from commercial banks (207 points) as a result of foreign selling worth $12.1 million and automobile assemblers (35 points).

Scrip-wise positive contribution was led by Pakistan Oilfields (54 points), Dawood Hercules (52 points), Pakistan Petroleum (50 points), Oil and Gas Development Company (45 points) and Nishat Mills (30 points).

Foreign selling continued to hurt the market. Foreign investors sold a net $26.1 million worth of stocks during the week compared to selling of $9.9 million in the previous week.

Major sectors that borne the brunt of selling were commercial banks ($12.1 million) and cement companies ($8.9 million). On the domestic front, major buying was reported by insurance companies ($11.8 million) and mutual funds ($10.6 million).

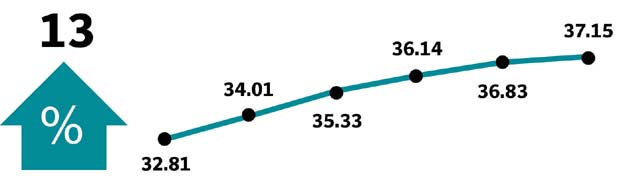

Among major highlights of the week were foreign currency reserves falling $300 million, auto sales dropping 6% in two months, Economic Coordination Committee putting off a decision on gas price hike, remittances jumping 13.5% in July-August, Federal Board of Revenue collecting Rs547 billion in taxes on oil sales in fiscal year 2018, announcement of planned amendments to the finance bill, proposed imposition of ban on the import of cheese, vehicles and smartphones and making idle fertiliser plants operational.

Winners of the week

Fatima Fertilizer

Fatima Fertilizer produces fertilisers. The company is developing a fully integrated fertiliser complex, capable of producing ammonia, nitric acid, nitro phosphate, nitrogen phosphorous potassium and calcium ammonium nitrate.

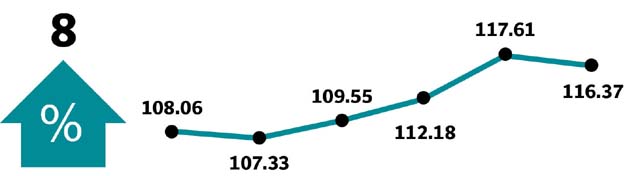

Systems Limited

Systems Limited is Pakistan’s leading IT company that specialises in providing next-generation BPO solutions, ERP solutions and BI services worldwide.

Losers of the week

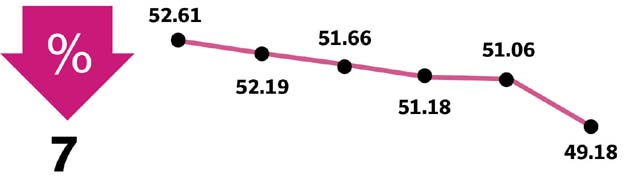

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

First Habib Modaraba

First Habib Modaraba is a multipurpose financing and investment company. The company offers lease financing for plants, machinery, vehicles, property, computers and information technology.

Published in The Express Tribune, September 16th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ