Pakistan can generate resources by expanding branch network of banks

This will allow the country reduce reliance on global lenders and external loans

This will allow the country reduce reliance on global lenders and external loans. PHOTO:FILE

In this scenario, Pakistan’s return to the International Monetary Fund (IMF) is likely to help avoid default and meet financial commitments.

Whether we should go to the IMF or not is a topic of hot discussion among financial experts and economic pundits. I am not against going to the IMF for financial bailouts, however, it would help matters only in the short term. In the long run, financial problems of Pakistan will increase further.

A strong reliance on the IMF or external loans will never allow Pakistan to stand on its own feet. However, approaching the IMF or seeking external loans at the moment seems inevitable because of our current account and balance of payments problems.

Along with reliance on external sources for finances, we also need to assess the internal strength of our financial institutions in mobilising internal resources.

Approaching IMF the only option

For internal generation of funds, commercial banks in an economy serve as a backbone of the financial system as they are an intermediary between savers and businessman. The stronger the network of banks is in a society, the better is the health of the economy as it means resources are optimally utilised.

By improving the branch network of banks, Pakistan can reduce its reliance on external loans and can design its monetary and fiscal policies in the better interest of its public. Despite the emergence of e-banking and phone banking, which has made access to services easier, the commercial banks in developed nations are continuously expanding their branch networks.

For a country like Pakistan, where the literacy rate is low and cybercrime is a potential threat, sole reliance on e-banking for resource mobilisation is not possible. In such circumstances, Pakistan will have to improve the number of bank branches.

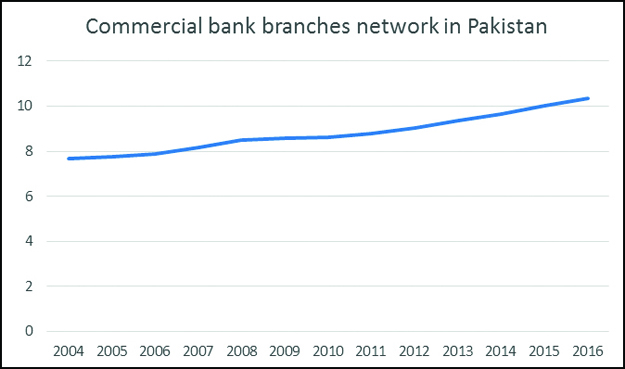

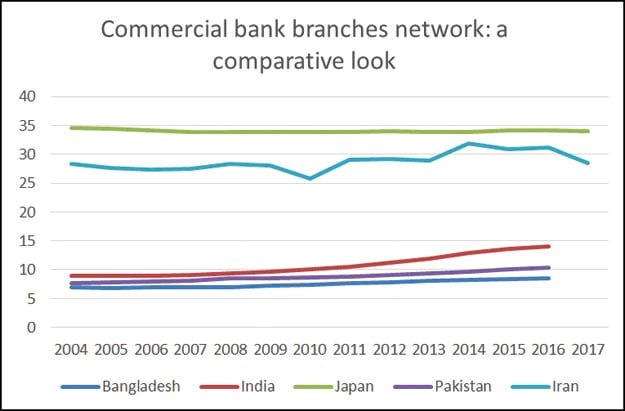

To demonstrate the network of commercial bank branches, data has been collected on commercial bank branches (100,000 adults) for the period ranging from 2004 to 2017.

Branch-less banking accounts soared to 10m in 2017

A descriptive analysis for this period shows that on average in Pakistan, there are only 8.79 branches of commercial banks to meet the need of 100,000 adults.

However, there has been an upward trend over these years, which is a positive sign for the economy. The credit goes to the State Bank of Pakistan, but we are still way behind other economies in the region.

Our descriptive statistics for the same period reflects that on average in India, Iran and Japan there are 10.67, 28.76 and 34.02 commercial bank branches respectively for 100,000 adults to meet their financial needs.

Japan is at the top in this comparison, followed by Iran, India, Pakistan and Bangladesh. After 2009, the gap in terms of commercial bank branches network between Pakistan and India has drastically widened. The reason may be overall poor performance of the economy that resulted in shrinkage of branch network of the banking sector in Pakistan.

Interestingly, Iran is at the second position in comparison as due to the sanctions they are facing, it has almost been a closed economy for the last many years.

It is primarily relying on internal resources and knows that they could be only mobilised optimally by having more commercial bank branches in the country.

We should also learn from Iran and Japan, that in difficult times, mobilisation of internal funds can give a boost to economic growth and can also provide jobs to thousands of unemployed people.

Another fact is that Pakistan is in the list of those countries where the bank spread is very high, but despite a high bank spread, the commercial banks could not expand their branch network as much.

Most of the bankers blame security threats in the country for this and do not want to open branches where they do not see any profit. Here is the question of stakeholder wellbeing as well.

Banking through digital channels gaining momentum

Under the stakeholder model of business, it is not only the profitability of the bank that matters, but its sustainability and presence in society also matters.

In this scenario, the central bank will also have to play its role of custodian of national resources and should force commercial banks to open more branches.

The writer is an assistant professor at the Department of Finance and Investment, NUST School of Business

Published in The Express Tribune, August 13th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ