FBR’s reliance on WHT highlights need for policy revamp

Share of withholding taxes in total direct tax collection increases to 72% from 56% over five years

Of the 1.45 million people, about 640,000 did not pay any tax and just filed annual returns.

PHOTO:FILE

The FBR’s reliance grew to nearly 72% of total direct tax collection from 56%.

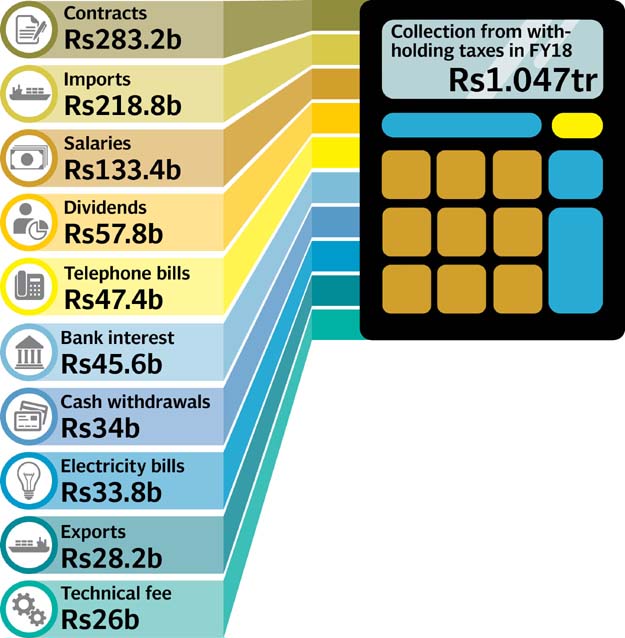

At the end of fiscal year 2017-18, the collection of withholding taxes stood at Rs1.047 trillion, which was equal to 71.8% of total direct tax collection last year, showed official documents.

SC clarifies news item on lowering tax rates on locally-assembled vehicles

In fiscal year 2016-17, the share of withholding taxes in direct tax collection was slightly above 70%. In the last fiscal year, total tax collection stood at Rs3.841 trillion, of which direct taxes were only Rs1.458 trillion or 38%. The annual collection was lower than the target of Rs4.013 trillion.

The share of withholding taxes in total direct tax collection was 56% in June 2013 when the Pakistan Muslim League-Nawaz (PML-N) government came to power. But in its five-year tenure, the government drastically changed the tax structure.

A key reason for the growing reliance on withholding taxes was the PML-N’s policy to impose two separate tax rates on filers and non-filers of income tax returns. In line with the policy, it increased the number of withholding taxes in the past five budgets to around 74 in addition to multiplying the tax rates.

However, people preferred to pay relatively higher taxes and tried to dodge the tax net.

However, the tax collection supported by withholding taxes and other indirect taxes made tax authorities and the political leadership complacent, diverting attention away from core problems.

Of the Rs3.841-trillion annual collection, the withholding taxes, sales tax, customs duty and federal excise duty accounted for Rs3.44 trillion or nearly 90% of the total.

The FBR’s data showed that the tax machinery collected only Rs104.1 billion through its own efforts in the last fiscal year. The share of direct taxes collected by the FBR on its own was a mere 7.1%, slightly better than the preceding year’s 6.9%. This speaks volumes about the efficiency of tax machinery that comprises over 20,000 people.

Another Rs377.4 billion or 26% of direct taxes were contributed by taxpayers as voluntary payments on account of advance income tax and minimum tax.

The Pakistan Tehreek-e-Insaf (PTI), which will form the incoming government, has announced that it will reduce reliance on indirect taxes and increase the contribution of direct taxes. It has also vowed to separate tax policy from FBR’s operations.

Although the FBR collects about 12 dozen withholding taxes, the main contributors were withholding taxes on contracts, imports, salaries, telephone bills, exports, bank interests, cash withdrawal, dividends, technical fee and electricity bills.

AGP, FBR at odds over explaining revenue from tobacco sector

The top contributor to withholding taxes was contracts that contributed Rs283.2 billion or 27% of the total withholding tax collection in the last fiscal year. At the import stage, the FBR collected Rs218.8 billion in withholding tax, 21% of the total withholding tax collection.

Salaried class contributed Rs133.4 billion or 12.7% of total withholding taxes. Tax on dividends contributed Rs57.8 billion, telephone bills Rs47.4 billion, bank interests and securities Rs45.6 billion, electricity bills Rs33.8 billion, cash withdrawals Rs34 billion, banking transactions Rs17.2 billion, exports Rs28.2 billion and technical fee Rs26 billion.

In the last tax year 2017, about 1.45 million individuals and companies, forming 0.7% of total population, filed income tax returns. A breakdown shows that the FBR’s effective tax base comprises less than 250,000 people whose annual income is above the threshold of Rs1.2 million.

Senate body to probe Rs33b fall in revenue receipts

Of the 1.45 million people, about 640,000 did not pay any tax and just filed annual returns.

Then there were about 425,000 individuals whose annual income was between Rs400,001 and Rs800,000, who will be liable to pay only a nominal Rs1,000 in income tax in the new fiscal year.

Another 150,000 individuals showed their annual income between Rs800,001 and Rs1.2 million and thus they will pay only Rs2,000 in tax in the tax year 2018.

Published in The Express Tribune, August 11th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ