Weekly review: A rough start but a better ending

Benchmark KSE-100 Index finishes with just a 13-point decrease in outgoing week

Among major highlights of the week were; State Bank of Pakistan released its 3QFY18 report, urea sales inched up 22% in June, FIA sought Summit Bank’s equity details from SBP and SECP, fiscal deficit increased to 4.3% of GDP in July-Marc period and trade deficit hit an all-time high of $37.67 billion.

PHOTO:EXPRESS

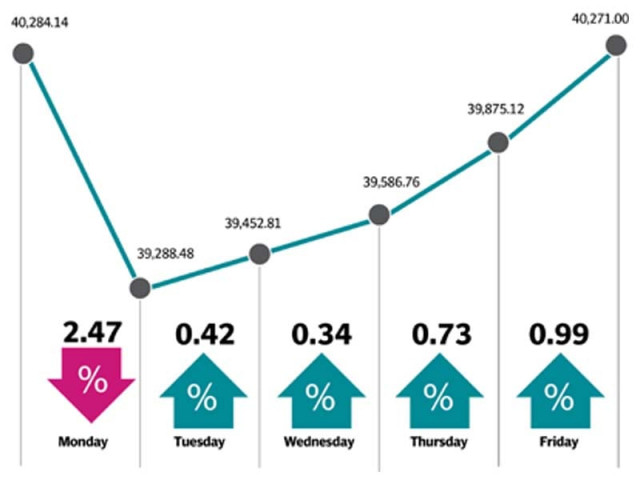

Monday kicked off on a bearish note, as the market remained gloomy due to the Supreme Court’s verdict in the Avenfield apartment case against former prime minister Nawaz Sharif and Maryam Nawaz. Sentiments were further dented as the apex court summoned the heads of three private banks in a money-laundering case. This caused immense panic among investors, who resorted to dump-and-run, leading the market to plunge 1,200 points.

Market watch: KSE-100 ends negative for fourth successive session

Fortunately, the despondency did not last as the KSE-100 turned green for the remainder of the week. Investors regained confidence as attractive valuations caught interest. Further optimism came from expectations of a hike in the interest rate, which led banking stocks to rally. Additionally, Pakistan Army’s press conference regarding holding the elections on time also contributed to stability at the stock market.

Despite the positive run, market analysts predicted uncertainty to persist until general elections on July 25. Although attractive valuations kept market participants interested, political noise and economic woes continue to keep participation thin. However, in comparison to the previous week, average daily volume increased 18% to 131 million, while average daily traded value grew by 41% to $49.3 million.

In terms of sectors, positive contribution came from banks (up 417 points), fertilisers (40 points) and chemicals (20 points). On the other hand, sectors that remained under pressure were led by cements (down 137 points) as coal prices touched $109/ton, food and personal care products (76 points), and oil and gas marketing companies (55 points).

Market watch: KSE-100 gains 396 points as bank stocks rally

Scrip-wise, HBL (up 108 points), MCB (72 points), BAHL (68 points), BAFL (47 points) and ENGRO (41 points) contributed positively to the index. Scrips that traded in the green were HBL (+108pts), MCB (+72pts), BAHL (+68pts), BAFL (+47pts) and ENGRO (+41pts). Scrips that depicted a negative return during the week included NESTLE (down 73 points), DGKC (56 points), DAWH (39 points) and FCCL (35 points).

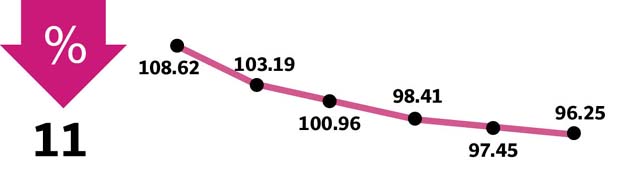

Foreigners continued to remain net sellers for the 10th successive week, offloading stocks worth $26.6 million due to the uncertain political and economic climate. On the local front, mutual funds also remained net sellers of $9.5 million. This was absorbed by insurance companies and individuals with net buying of $13.8 million and $10.7 million, respectively.

Market watch: Continuing its advance, KSE-100 gains for third session in a row

Among major highlights of the week were; State Bank of Pakistan released its 3QFY18 report, urea sales inched up 22% in June, FIA sought Summit Bank’s equity details from SBP and SECP, fiscal deficit increased to 4.3% of GDP in July-Marc period and trade deficit hit an all-time high of $37.67 billion.

Winners of the week

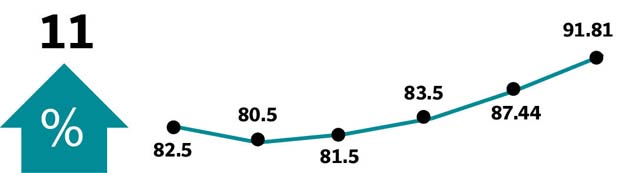

Meezan Bank

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans, and other products through offices located throughout Pakistan.

Bank Alfalah

Bank Alfalah Ltd provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Losers of the week

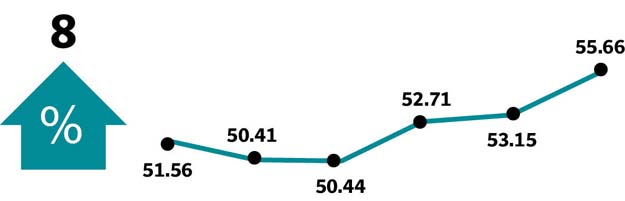

DG Khan Cement

DG Khan Cement Company Limited manufactures and sells portland cement.

Thal Limited

Thal Limited manufactures jute goods. The company also undertakes engineering projects.

Published in The Express Tribune, July 15th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ