Pakistan’s current account deficit widens to record high

Amounts to $14.03b in 10 months of ongoing fiscal year

PHOTO: EXPRESS

The deficit stood at $9.35 billion in the same period of the previous fiscal year, according to the State Bank of Pakistan (SBP).

The deficit increases woes of the country's economic managers as a widening current account takes toll on foreign exchange reserves that have already fallen below $11 billion last week.

Govt expects current account deficit to slow down to $12.5 billion

The situation may even force the government to go back to the International Monetary Fund (IMF) for a bailout package, analysts say.

The deficit is also expected to surpass the estimated figure of $16 billion for fiscal year 2018 after the price of crude oil (the benchmark Brent crude) surged sharply in the international market to three-and-a-half-year high of $80 per barrel on Thursday from around $50 per barrel at the outset of the current fiscal year on July 1, 2017.

Pakistan's economy depends heavily on imported oil and Liquefied Natural Gas (LNG) to fuel its industries as well as fulfil demands of domestic consumers. The country meets almost three-fourths of its energy needs through imports, which contributes close to one-third in the overall import bill of the country.

The government has also devalued the rupee by around 9.5% in two rounds (5% in December 2017 and 4.5% in March 2018) in a bid to narrow down the deficit. The measure has resulted in increasing exports, but largely failed to slow down imports.

The 10-month cumulative deficit of $14.03 billion is much higher than the complete fiscal year 2017's deficit of $12.62 billion, according to the central bank.

Current account deficit widens 50% in July-February

April's figure

The current account deficit in April 2018 alone stood at $1.95 billion, which is 61% higher than $1.21 billion recorded in the prior month of March 2018, it added.

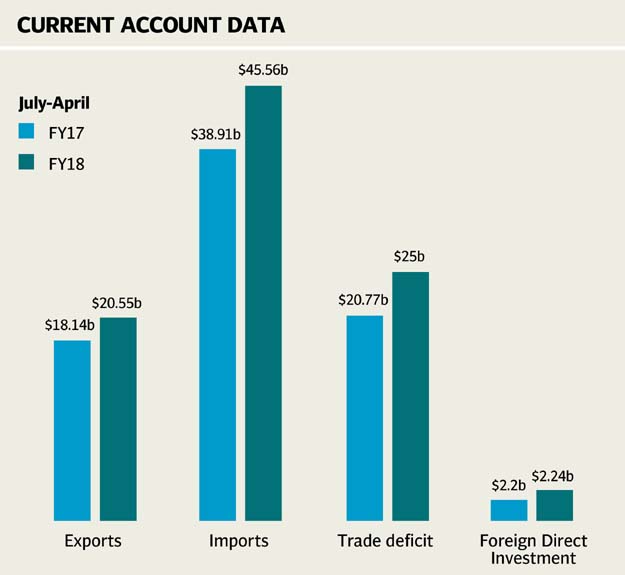

The trade deficit increased 20% to $25 billion in 10 months compared to $20.77 billion in the same period last year. Accordingly, imports increased 17% to $45.56 billion from $38.91 billion and exports enhanced 13% to $20.55 billion from $18.14 billion.

The trade deficit (including of services) rose to $29.21 billion from $24.09 billion.

On the other hand, uptick in workers' remittances sent home by overseas Pakistanis slightly controlled the widening deficit. Remittances rose 4% to $16.25 billion in the 10-month period compared to $15.64 billion in the corresponding period of the previous year.

Current account deficit increases and so do Pakistan’s worries

FDI increased 2.4% in July-April, amounting to $2.24 billion from $2.18 billion in the same 10-month period of the previous year.

Published in The Express Tribune, May 19th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ