Federal budget gets NA nod, passed on third day of presentation

Govt doesn’t fulfill promise to table FATA reforms bill

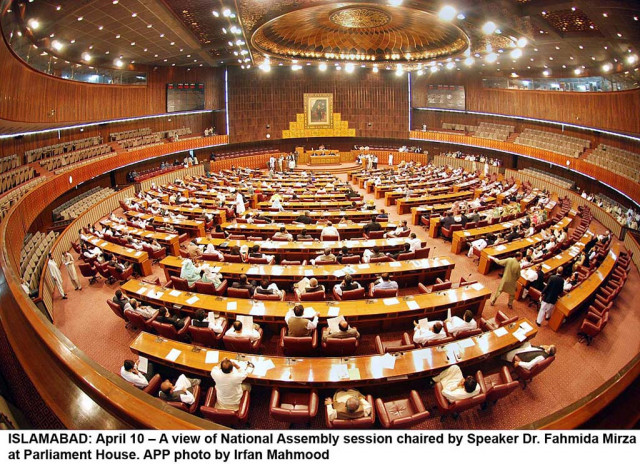

National Assembly of Pakistan. PHOTO: FILE

The opposition benches severely criticised the government for the tax amnesty scheme during the debate on budget, in which the scheme has been incorporated with certain amendments.

The federal excise duty, sales tax and customs duty related budgetary measures will take effect from the day the President of Pakistan would give his approval to the finance bill 2018-19. This will be like enforcing a mini budget for one and a half month before the end of the current fiscal budget.

Non-filers of tax returns will not be able to purchase property but the limit for this purpose has been enhanced from Rs4 million to Rs5 million, Finance Minister Miftah Ismail told the house.

Ismail said according to the bill people who have dollar accounts must be tax filers. "Non-tax filers cannot keep dollar accounts," he said.

A candy-coated budget by Miftah

A number of proposals given by members during debate and recommendations of the Senate were incorporated either fully or partially but the basic structure of the budget remained the same as announced by the finance minister on April 27.

The house held discussion on the supplementary demands for grants and appropriations for the current fiscal year. Responding to the points of the opposition members, Miftah Ismail admitted that the foreign exchange reserves have gone down and that the current account deficit is a serious issue.

He, however, said they have turned the tide as exports have witnessed an upsurge over the last few months. In the month of March, the exports grew by 24 per cent while in April these increased by 18 per cent, he said.

During the marathon proceedings which included clause by clause reading to approve budget, the finance minister at times got confused about the rules and procedure. On one occasion the National Assembly speaker remarked that by the next election ‘he (Ismail) will be okay’.

PPP’s Shazia Marri remarked that the finance minister was not listening to their proposals and he needed to be seated. To it the chair observed that Ismail’s thinking process works better when he is standing.

When opposition placed amendments regarding levying taxes on tobacco, the chair inquired from the finance minister: “Do you smoke cigarette,” and the finance minister said, “I do not smoke but enjoy electric cigarettes.”

The government has been claiming since presenting the full-year budget that it envisages incentives and relief for industry, agriculture and different segments of society while the opposition has been of the view that the government had no right to present the budget for the complete year.

Responding to the proposals and queries of the opposition MPs, the finance minister said specific welfare organisations have been given tax exemption. However, the PPP’s Dr Azra Pechuho asked why all welfare organisations have not been given tax exemption.

Ismail said the Federal Board of Revenue (FBR) has the right to decide which welfare organisation should be exempted. “According to the bill people who have dollar accounts must be tax filers. Non-tax filers cannot keep dollar accounts," he added.

There is no restriction on overseas Pakistanis sending remittance to the country. However, sources of income of those overseas Pakistanis who send more than $0.1 million will be questioned.

"People who are sending money must declare their source of income. If the FBR receives more than Rs10 million remittances then it will be probed,” Miftah Ismail added.

As per some tax relieves announced in the budget people with annual income of between four hundred thousand and eight hundred thousand rupees will pay a token amount of Rs1,000 for the entire year and those with income of eight hundred thousand and 1.2 million would pay just Rs2,000.

There is a ten per cent ad hoc relief allowance to the civil and armed forces employees and ten per cent increase in pensions across the board. House rent ceiling and house rent allowance have also been increased by fifty per cent each.

Minimum pension is being increased from the existing Rs6,000 to Rs10,000 considering the difficulties of low paid pensioners. Similarly, family pension would also get increased from Rs4,500 to Rs7500. Minimum pension of pensioners above 75 years of age will be Rs15,000.

The government has also proposed an allocation of Rs12billion for provision of advances to government servants for house building and purchase of transport facility. It has also set aside Rs5 billion for senior officers’ performance allowance, details of which would be announced separately.

Pakistan posts 5.8% growth rate

Overtime allowance of staff car drivers and dispatch riders is being increased from Rs40 per hour to Rs80 per hour. The finance minister also announced five bonus salaries for all employees working for the Senate and the National Assembly.

At the end of the sitting the finance minister paid his gratitude to NA speaker, the opposition parties and others for extending help to get the budget passed.

Human trafficking

A bill in the National Assembly was tabled seeking the prevention of human trafficking and aiming for taking effective measures to combat and prevent human trafficking. The bill was moved by State Minister for Interior Talal Chaudhry.

The bill aims to provide effective measures to prevent and combat trafficking of especially women and children; to promote and facilitate national and international cooperation in this regard; to protect the trafficking victims and to provide for matters connected therewith or ancillary thereto.

The proceedings of the house were adjourned to meet again on Monday at 3pm.

FATA reforms bills

The ruling party, however, fell short on its promise to table reforms bill for the Federally Administered Tribal Areas (Fata) in parliament on Friday.

On Thursday, the federal cabinet approved moving the Thirtieth Amendment Bill, reiterating the promise by Prime Minister Shahid Khaqan Abbasi that the government intended to “take reforms to its logical conclusion during the current tenure of assemblies”.

The much-hyped bill includes the merger of the tribal areas with Khyber-Pakhtunkhwa within two years despite staunch opposition from two of Pakistan Muslim League-Nawaz’s (PML-N) strongest allies.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ