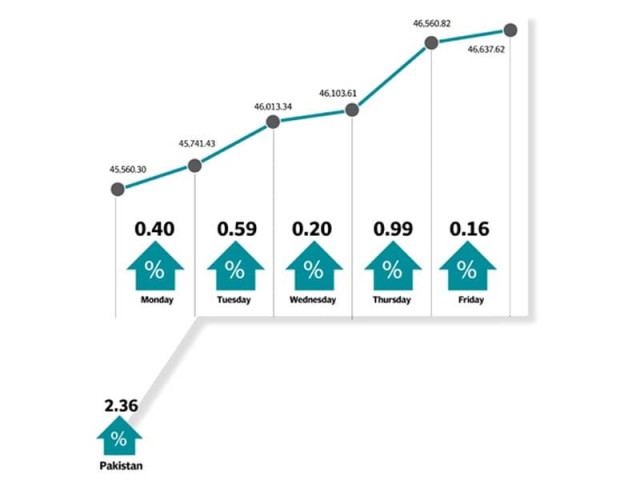

Weekly review: KSE-100 outperforms peers, gains 2.4% in outgoing week

News of amnesty scheme, sector-specific developments help index rise 1,077 points

Weekly review: KSE-100 outperforms peers, gains 2.4% in outgoing week

Following the central bank’s announcement of keeping the interest rate at the same level, banks took a hit on Monday but the positive rally from the preceding session continued as other index-heavy sectors led the way forward. Cement and engineering sectors also garnered interest during the first half of the week and contributed to the upward trajectory. Most importantly, as news regarding the highly anticipated amnesty scheme flowed in, investors quickly turned to banking stocks anticipating material inflows through official channels post announcement.

Reacting to the prime minister’s unveiling of the scheme, the KSE-100 opened in the green on Friday, shooting up 580 points in intra-day trading. Later, profit-taking kicked in as investors adopted a wait-and-see approach till the amnesty’s approval from upper and lower house, as many politicians and business leaders expressed reservations over the announcement.

During the entire week, the market witnessed a positive trend in anticipation of announcement of amnesty scheme and government steps for resolution of external account woes. On the other hand, global markets around the world witnessed a volatile week as US President Donald Trump ordered his administration to put together a plan for additional $100 billion in tariffs on imports of China, escalating a trade fight with Beijing.

Pakistan, on the other hand, attracted foreign flows, helping the KSE-100 recover its losses from the previous calendar year.

“The outgoing week’s surge has taken 2018TD gains to 15.2% and completely wiped out the entire losses for FY18TD,” according to an Elixir Securities report.

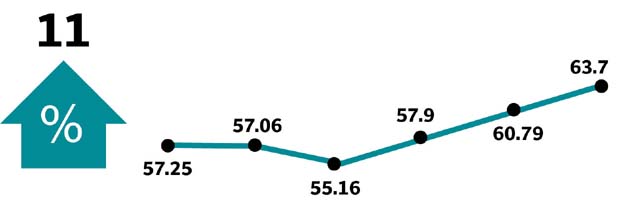

In terms of participation, overall volumes jumped 8% to 259 million shares, while value traded increased 34% to $114 million. Banks and cement sectors were the largest contributors to the \ rise during the week, contributing 203 and 193 points, respectively. Banks returned 1.2% week-on-week in anticipation of amnesty scheme leading to expectations of; prospective higher fee income owing to one-off increase in foreign repatriations, gradual increase in the pie of documented economy and increase in banking deposits.

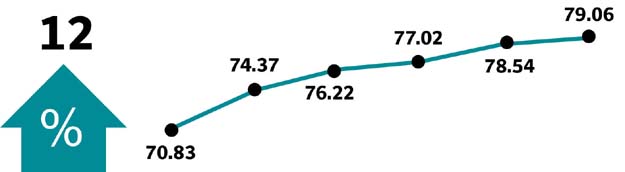

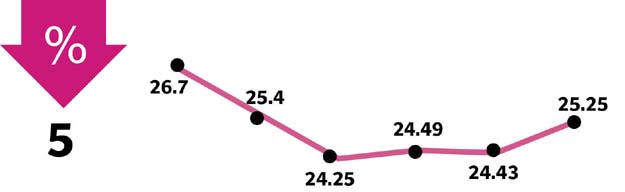

The cement sector returned 3.8% week-on-week and contributed 18% to the KSE-100’s rise. The sector’s performance was attributed to the rise in cement bag prices by another Rs10/bag during the week. Cement prices have so far risen by Rs45-55/bag in north, due to pick up in seasonal demand and to pass on a higher landed price of coal.

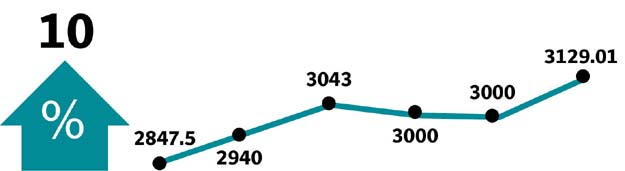

Among other sectors that contributed positively to the index were; oil and gas exploration companies (169 points) given the downward sticky oil prices and advent of new discoveries keeping interest in the sector intact, fertilisers (100 points) and OMCs (96 points).

Scrip-wise, bullish sentiment was led by POL (128 points) driven by rumours of a significant hydrocarbon, HBL (104 points), LUCK (71 points), ENGRO (54 points) and HUBC (53 points).

Foreigners were net buyers of $3.6 million during the week compared to a net buy of $1.9 million in the previous week. Buying was witnessed in exploration and production ($7.1 million) and banks ($2.68 million). On the domestic front, major selling was reported by banks and DFIs ($15.9 million) and insurance companies ($8.6 million), whereas, buying was largely executed by mutual funds ($45.3 million) and NBFCs ($1.7 million).

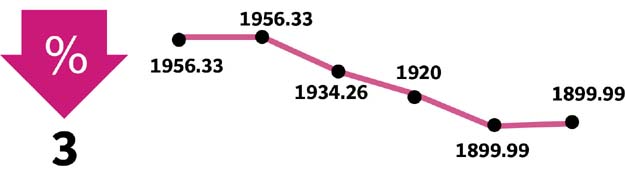

Among major highlights of the week were; overall foreign exchange reserves slipped to $17.8 billion, IFTC agreed to lend $3 billion to Pakistan, inflation eased to 3.2% in March and FTA with China was delayed due to industry concerns.

Winners of the week

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

Losers of the week

Standard Chartered Bank

Standard Chartered Bank Pakistan Limited is an international bank that provides consumer and wholesale banking.

Pak Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

The Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial banking services.

Published in The Express Tribune, April 8th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ