APTMA puts forward proposals for textile industry

Recommendations include availability of electricity and gas, tariff rationalisation

Recommendations include availability of electricity and gas, tariff rationalisation

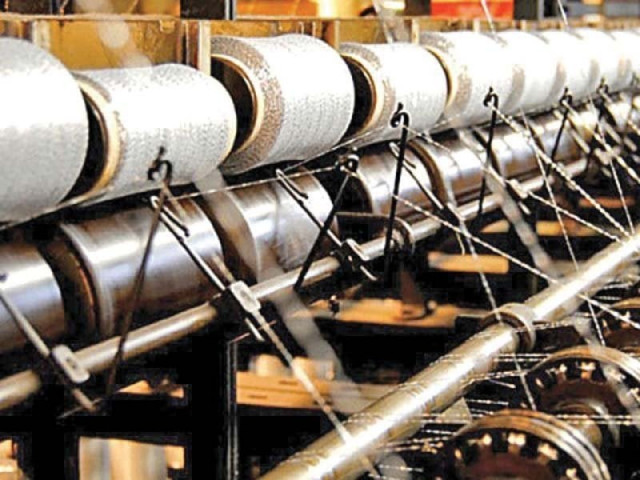

PHOTO: FILE

It said that it has conducted a series of studies and has identified appropriate areas and relevant measures that could provide impetus for achieving sustainable growth.

"The government needs to embark on a three-pronged strategy that includes availability of electricity and gas, tariff rationalisation of the textile value-chain and encouragement of new investment to create exportable surplus, said Aptma in a statement.

"Availability of energy at affordable cost could be a stepping stone for reducing the cost of doing business. Currently, electricity costs Rs11.40 per kWh, which is unrealistically high and inflated due to elements of cross subsidy and theft in the system.

"Removal of these loading factors will make electricity available at Rs7 per Kwh. This reduction obviously will incur no loss to the government, it will instead streamline generation and distribution of electricity. Punjab, which is the principal hub of the textile industry, is getting gas at Rs1,300 per mmbtu, whereas, for the rest of the country, the same is available at Rs600 per mmbtu. It will be in the fitness of things, if it is made available at the same rate in the whole country.

Aptma said that it is surprising that the Federal Board of Revenue is collecting taxes on raw materials used in the manufacture of man-made yarn and making yarn price unviable. "The government may take other measures to provide protection to local manufacturers of raw material rather than taxing raw material, which is contrary to the scheme of custom tariff."

Aptma said it is necessary to provide incentives to farmers in order to enhance cotton productivity. "Instead of imposing duty on import of cotton, the FBR should provide zero rate inputs of cotton like fertiliser and electricity. "The duty on cotton could only make a case if domestic cotton production was enough to meet local demand for cotton.

"The government is aware that the world is rapidly switching over to manmade fiber and to follow the global trend the government would have to create a space for reducing the cost of staple fiber through removing the custom duty, which is in excess of 10%. Similarly, the increasing trend in the import of synthetic yarn is adversely affecting its local production. Imposing 15% regulatory duty on its import will provide some breathing space for its local production.

"The rationale of zero rated sector means 'no tax'. It hardly makes sense to subject any of the zero-rated sectors to 1.25% turnover tax. This needs to be brought to zero as currently it is leading to recurring losses. As such, its maximum rate should be fixed at 25% in the forthcoming budget."

Published in The Express Tribune, April 7th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ