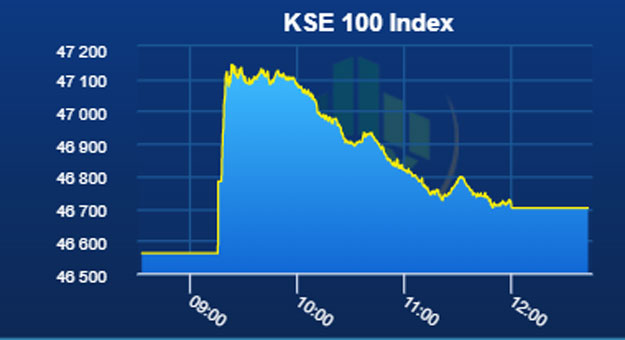

Cheering news of amnesty scheme, KSE-100 climbs over 580 points in intra-day trading

Settles with pared gains at mid-day break as analysts weigh in on massive tax incentives announced by PM

Settles with pared gains at mid-day break as analysts weigh in on massive tax incentives announced by PM. PHOTO: AFP

The index, a benchmark for market performance, powered past the 47,000-point level with ease, hitting an intra-day high of 583 points or 1.25% to touch 47,144 before profit-booking intervened to drag prices lower.

By noon, the index settled at the 46,701 level, still a 140-point or 0.3% increase over Thursday’s closing as euphoria over the amnesty scheme settled.

Market watch: KSE-100 gains 457 points, ends seventh successive session in green

Analysts and brokerage houses weighed in on the announcement of the tax amnesty scheme, which Prime Minister Shahid Khaqan Abbasi announced on Thursday during a press conference, calling it a positive for the economy but also issuing a note of caution on the development.

The scheme entails a three-month window for wealthy Pakistanis to whiten their hidden local and foreign assets at nominal rates from two per cent to five per cent. It also aims to increase the existing narrow tax base through incentives and tax cuts.

SOURCE: PSX WEBSITE

SOURCE: PSX WEBSITEThe scheme will now be implemented through a presidential ordinance that the government plans to issue before Sunday. It will then take its approval from the cabinet through circulation, said a government official.

“The tax amnesty announcement is a positive trigger for the equity market,” said Faisal Jawed, head of sales at IGI Securities. “The expectation of the announcement also caused share prices to rally on Thursday, and it was the same case in the morning today.”

Arif Habib Limited said the introduction of tax reforms is not only expected to bring new tax filers into the tax net but also reduce the share of undocumented classes in the overall economy.

Pakistan's salaried class wins huge tax exemptions

“With an overhaul of the taxation and valuation system governing real estate transactions, more money is expected to flow in the documented sector thereby resulting in an increase in corporatisation, higher savings rate and enhanced taxation,” said the brokerage house in a note to clients.

“In addition, these steps are expected to bring in precious foreign exchange worth $5 billion into the country, which is crucially needed as Pakistan’s current account deficit has widened $10.8 billion during 8MFY18.

“We believe the banking and automobile sectors are expected to benefit the most as new inflows are expected to boost the deposit base of banks while increase in disposable incomes will lift the demand for consumer durables and automobiles.

However, some analysts were wary of the development. “There is still a lot to be done before the scheme is implemented. The legal course for the government to have this amnesty approved could meet some hurdles,” said an analyst, speaking on condition of anonymity.

Another equity analyst also echoed the same sentiment. “Declaration of foreign assets and subsequently, the influx of flows depends on successful implementation of the scheme which is exposed to political obstruction.

“On a broader perspective, the policy will help to increase documentation in the economy, which will also widen the tax base.

“After reduction in taxes and resultant rise in disposable incomes, consumer demand will further spur. Rising incomes could also lead to higher savings, and that would boost liquidity in the capital markets and banking channels.”

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ