Pakistan's salaried class wins huge tax exemptions

Income tax exemption threshold increased to Rs1.2m

Photo: FILE

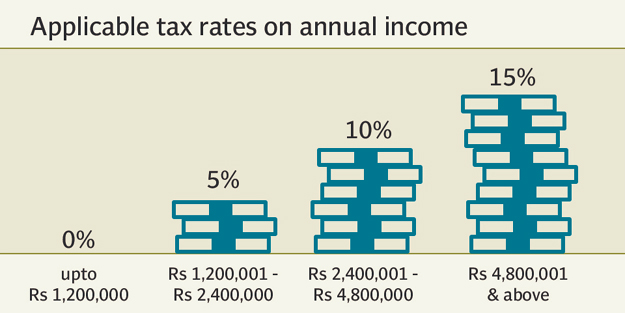

The decision to change the income tax rates for the salaried class will provide a relief of almost Rs100 billion before the upcoming general elections. The government has offered the simplest tax structure having only four income tax slabs with rates from 5% to 15%. These slabs would replace the seven existing income tax slabs that attracted income tax rates from 10% to 35% plus a fixed amount of tax.

The decision will take effect from July 1, said Prime Minister Abbasi while addressing a press conference at the PM’s Office.

Salaried class to benefit as govt mulls lower income tax rates

However, the decision to increase the income tax exemption slab from Rs400,000 to Rs1.2 million per annum will erode 521,597 income tax return filers from the current tax base, which is 42% of the existing tax base, according to calculations of the Federal Board of Revenue.

But the Prime Minister Abbasi said that irrespective of the fact whether there is a tax on income or not, the people will have to file their income tax returns, which will increase the tax base.

The three-fold increase in income tax exemption will also cut the FBR’s tax revenues by Rs35.2 billion, which the category of people earning from Rs400,001 to Rs1.2 million per annum contribute. The present rates for Rs400,001 to Rs1.2 million are in the range of 10% to 15%.

Out of 1.26 million people who have filed income tax returns, over 700,000 of them paid income tax, said PM Abbasi. The rest of the 500,000 people did not pay a penny but filed income tax returns, said the Prime Minister. “This is unsustainable situation and requires radical reforms”, said the Prime Minister.

From tax year 2013 to 2017: Except for salaried class, number of tax return filers shrinks

The PM said that it has been proposed to exempt the annual income of up to Rs1.2 million from the tax. “This is substantial reduction in the tax rate and there is now hope that the people will start paying taxes,” said the PM.

The Prime Minister said that the income tax rates for people earning from over Rs1.2 million to Rs2.4 million will be 5% from July 1. The existing rates for this category of the people are in the range of 10% to 17.5% in addition to a fixed amount of tax. In this category about 346,000 people paid Rs27.7 billion in income tax last year. The FBR will take a hit of about Rs20 billion in this category.

The PML-N government will announce fiscal year 2018-19’s budget on April 27 - almost five weeks before its five-year constitutional term comes to an end. The new income tax rates will be lowered through the Finance Bill that the government will table in the National Assembly on April 27.

Govt considering taxing ‘gifts’ among non-family members

The PM also announced that for the income category of Rs2.4 million to Rs4.8 million the income tax rate will be 10% only. At present, the tax rate for this category are in the range of 17.5% to 27.5% in addition to a fixed amount of tax. In this category about 186,000 paid Rs27 billion income tax last year.

Abbasi said for those who earn over Rs4.8 million annually, the income tax rate will be only 15%. The existing rate for these people is in the range of 27.5% to 35% plus Rs6 million tax for the highest slab. In this category, about 248,000 people paid Rs75 billion income tax to the FBR. At the revised rates, the FBR will take a hit of about Rs40 billion.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ