Weekly review : Bourse falls 1.5% amid selling

Osama’s killing and its aftermath lead to uncertainty in the market.

The week started off with the news that the world’s most wanted man Osama bin Laden was killed by US Special Forces, leading to uncertainty and selling at the Karachi bourse.

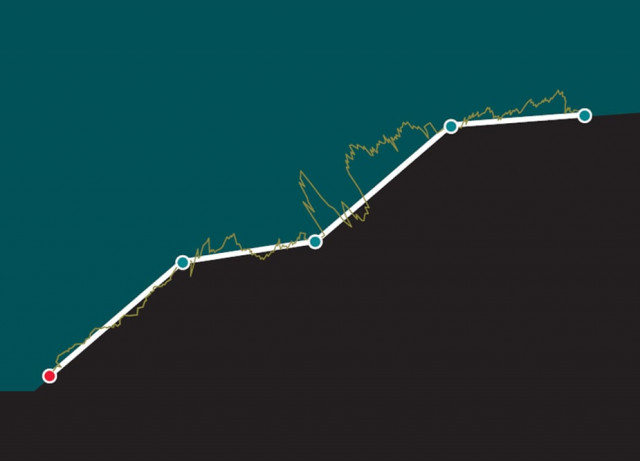

The KSE 100-share index shed 177 points or 1.47 per cent in the week ended May 6 to close at 11,880 points.

Uncertainty was further fuelled when International Monetary Fund, World Bank and Asian Development Bank officials cancelled their trips to the country due to security concerns.

Though the formation of the federal government alliance with Pakistan Muslim League-Quaid and Muttahida Qaumi Movement was taken positively, investor concerns remained in place due to rising circular debt and uncertainty after Osama bin Laden, said Arif Habib Investments Limited Director Ahsan Mehanti.

Even the much-awaited relief in the inter-corporate debt issue could not provide the expected thrust to the market. The finance ministry released around Rs120 billion to cut the swelling energy sector debt by more than 30 per cent.

Average daily volumes remained low at 68 million shares while foreigners turned net buyers of $18 million during the week, according to JS Global Capital.

After falling 385 points in the first three days of the week, positive activity was witnessed at the bourse following a neutral assessment by Moody’s ratings agency on Pakistan’s economy, which also maintained the country’s credit rating as well as outlook on foreign aid.

Yet this proved short-lived as a meltdown in global stocks and commodities caused its ripple effects in Friday’s trading session.

Oil prices went into free-fall on Thursday, diving more than 10 per cent to close below $100 a barrel, the biggest daily drop since the 2008 financial crisis.

Result season concludes

Fauji Fertiliser Company concluded the result season by announcing a profit growth of 51 per cent mainly on higher urea prices. Overall, corporate profitability for the January to March quarter registered an impressive growth of 19 per cent, with the manufacturing sector witnessing a jump of 80 per cent, followed by energy companies, up 16 per cent and services up eight per cent.

Monday, May 2

The stock market lacked any major enthusiasm on the first trading session of the week as trade remained range-bound due to absence of triggers.

Selling was witnessed after the announcement that Osama bin Laden, the alleged mastermind of the 9/11 attacks in the US, had been killed during a military operation in Abbottabad.

Tuesday, May 3

The stock market continued the downward trend amid serious tensions in Karachi. Protesters had set fire to at least 25 buses and trucks since Monday after a Muttahida Qaumi Movement (MQM) member was gunned down.

Wednesday, May 4

The stock market plummeted more than two per cent as concerns rose that US may cut aid to Pakistan after the death of Osama bin Laden. Anxiety within the market spread on fear of US Congress proposing suspension of aid to Pakistan.

Thursday, May 5

Renewed investor confidence spurred a rally at the stock market after assurance by US officials and Moody’s about no imminent foreign aid withdrawal. Remarks from Moody’s about no imminent foreign aid withdrawal and sovereign rating revision gave relief to investors.

Friday, May 6

The bourse witnessed a bearish spell along with its regional peers on the back of fall in international commodity prices.

Oil prices went into free-fall on Thursday, diving more than 10 percent to close below $100 a barrel, the biggest daily drop in price since the 2008 financial crisis.

Published in The Express Tribune, May 8th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ