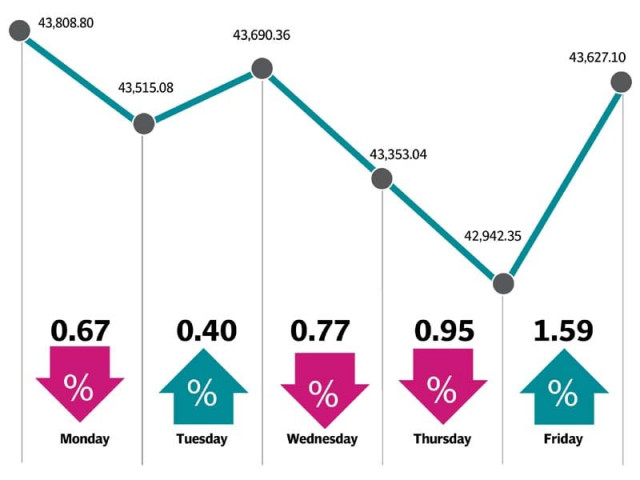

Weekly review: KSE-100 endures roller-coaster ride, ends 0.41% lower

Benchmark index decreases 182 points to settle at 43,627

Weekly review: KSE-100 endures roller-coaster ride, ends 0.41% lower

A plethora of macroeconomic and political news along with ongoing corporate results season contributed towards swinging sentiments at the bourse. Trading kicked-off on a negative note on Monday, as heavy selling by foreign investors dampened investors’ interest.

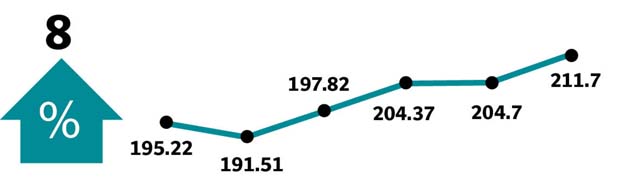

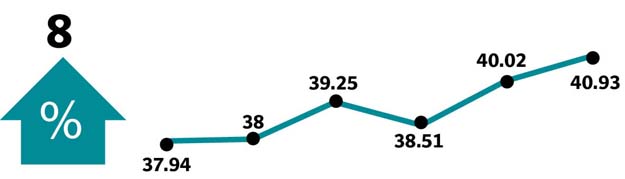

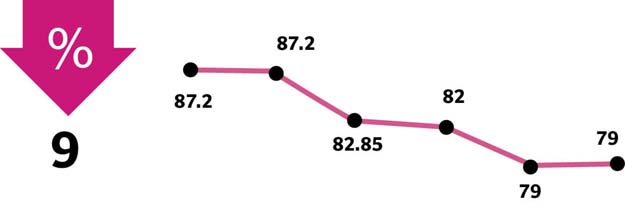

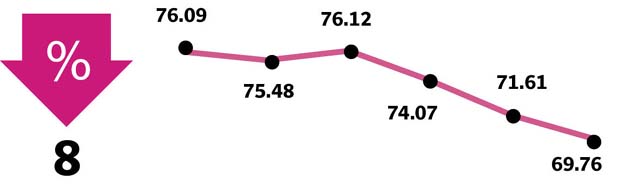

Week-On-Week: SPI drops 0.03%

Tuesday brought about a turn of events with the market getting a reprieve as the Supreme Court’s decision regarding banks’ pension case liability led the index into the green zone. However, the positive run was short-lived as the index fell back into the red in the following two sessions. Pertinently, uncertainty remained amid news of US potentially adding Pakistan’s name to the terrorist watch list, which caused panic amongst locals and foreign investors.

The week proved to be a roller-coaster ride for global equities as well. After last week’s global sell-off, US stocks rebounded sharply. The S&P 500 rose marginally on Friday to mark its biggest weekly increase in five years.

The positivity came after a global market correction that was sparked by inflation concerns in the US in February, raising fear that a nine-year bull market had ended, but data on consumer prices and retail sales this week left investors less worried, returning the stock market to its upward trajectory.

In-line with this trend, the KSE-100 Index finished the last trading of the week on a positive note. It shot up over 680 points as concerns evaporated. Participation was down this week as average daily volumes for the outgoing week decreased 19% to 199 million shares, whereas value traded increased significantly by 24% to $66 million.

Sectors that kept the index under stress were cements (168 points), oil and gas marketing companies (85 points), pharmaceuticals (60 points), fertiliser (56 points) and engineering (39 points). On the other hand, sectors that contributed positively to the index were commercial banks (380 points), oil and gas exploration companies (46 points) on the back of recovery in international oil price, and tobacco (11 points).

In terms of scrips, LUCK (down 67 points), DGKC (46 points), SNGP (42 points) and SEARL (35 points) took away points from the index, while major gainers of the week were HBL (up 251 points), UBL (73 points), PPL (42 points), BAHL (41 points) and HMB (29 points).

Meanwhile, foreigners offloaded stocks worth $16.1 million compared to $8.5 million in the last week. Major foreign divestment was witnessed in commercial banks ($10 million), and exploration & production ($7.4 million) while on the local front, major accumulation was reported by insurance companies ($16.8 million), companies ($9 million) and other organisations ($5.2 million).

Week-On-Week: SPI drops 0.29%

Among major highlights of the week were; rice exports crossed $1 billion mark in seven months, import of three-year used cars allowed, remittances climbed to $11.4 billion since July, foreign investment dipped 3% and government all set to unveil package to lift exports.

Winners of the week

Habib Bank

Habib Bank Ltd operates a commercial bank in Pakistan. The bank offers commercial, corporate, investment, retail and international group banking.

Habib Metropolitan Bank

Habib Metropolitan Bank Limited is a fully accredited commercial bank. The bank provides banking services to individual and corporate customers including personal loans, education loans, mobile banking, cash management services, short and long-term financing, international trade, and savings accounts.

Losers of the week

Jubilee General Insurance

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous.

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

Published in The Express Tribune, February 18th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ