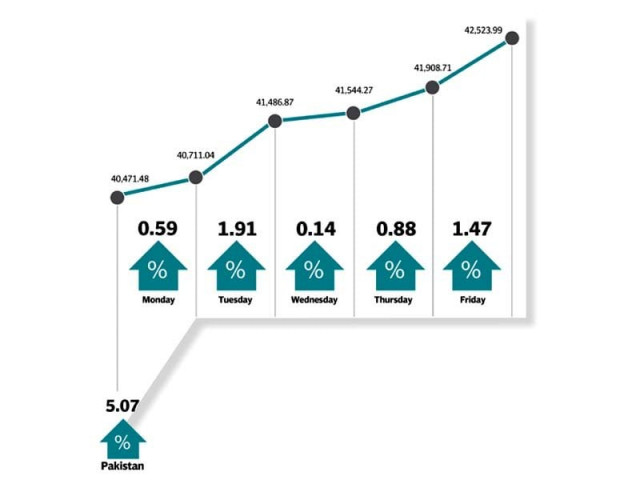

Weekly review: KSE-100 marches up 5.1% in 2018’s first week

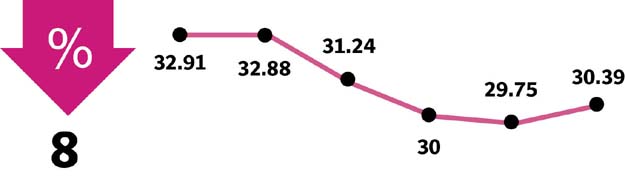

Traded volumes increase 10%, while traded value rises 9% in outgoing week

Despite strained relations between the US and Pakistan, over US President Donald Trump’s tweet and the subsequent announcement to withhold military assistance, the market saw a positive run.

The 12-day winning streak, which is currently ongoing, was supported by foreign and local institutional buying. Other factors that helped the market were rising oil prices and expectations of a hike in interest rate.

Market watch: After torrid ride, KSE-100 ends 2017 on positive note

Trading kicked off on Monday from the 40,400 level and continued to remain positive until the last trading day of the week. Buying interest was seen in stocks across the board.

Activity picked up during the last four days of the week where average traded volumes and average traded value grew by 10% week-on-week to 237 million and 9% week-on-week to $86 million.

Sectors that drove most of the activity were banks, cements, exploration & production (E&Ps) and fertilisers that contributed 787 points, 309 points, 253 points and 231 points to the index, respectively. On the other hand, tobacco and chemical cumulatively withheld 29 points

In terms of stocks, HBL (+2%), UBL (+3%), LUCK (+3%), FFC (+4%) and DAWH (+4%) added 238 points to the index. However, PPL (-1%), POL (-1%), MTL (-1%), KEL (-1%) and TRG (-2%) withheld 37 points.

Market watch: Stocks breach 41,000 barrier on healthy gains, activity

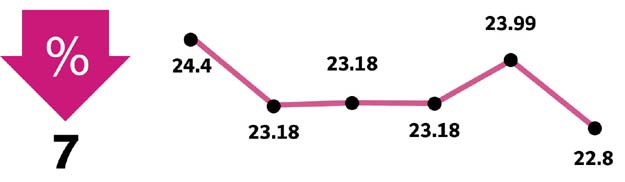

Foreign investors stood out as the largest category of buyers as they mopped up shares worth $23 million, up 1.6 times from the previous week. Most of their buying was concentrated in banking and cement stocks.

Mutual funds also bought shares worth $9 million, as they deployed fresh inflows into the market. Domestic companies, individuals and insurance companies, however, resorted to profit-taking during the week.

Key highlights of the week were; release of CPI inflation numbers (4.57% year-on-year in Dec 2017), release of cement dispatches numbers (up 4.94% year-on-year in Dec 2017), release of petroleum sales numbers (up 11% year-on-year in Dec 2017), export of 40,000 metric tons of urea to Sri Lanka by local manufacturers, and hydrocarbon discovery at Baratai block by OGDC.

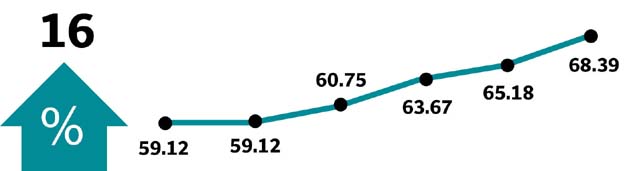

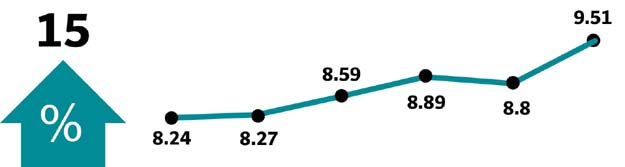

Winners of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

The Bank of Punjab

The Bank of Punjab operates under the status of a scheduled bank in Pakistan. The bank provides commercial banking services.

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

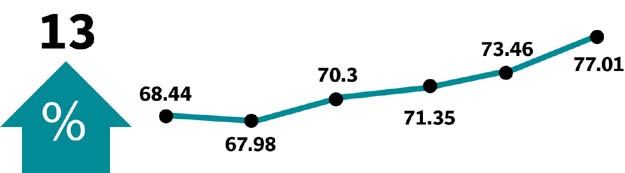

Losers of the week

Nishat Chunian Power

Nishat Chunian Power Limited is a Pakistan-based company. The principal business of the company is to build, own, operate and maintain a fuel-fired power station having gross capacity of 200MW and net capacity of 195.722MW for the generation, supply and transmission of electric power at Jamber Kalan, Tehsil Pattoki, District Kasur, Punjab. The company is a subsidiary of Nishat (Chunian) Limited.

Abbott Laboratories

Abbott Laboratories (Pakistan) Limited manufactures, imports, and markets research-based pharmaceutical, nutritional, diagnostic, hospital, and consumer products. The company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease and dental infections.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Published in The Express Tribune, January 7th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ