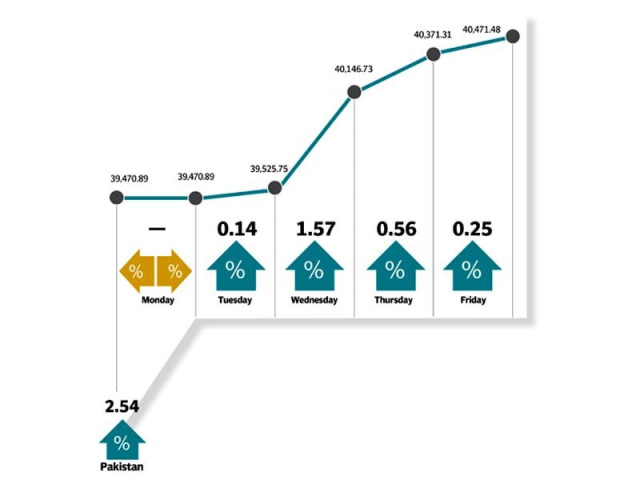

Weekly review: KSE-100’s relief rally continues

Index stays in green throughout the week, buoyed by encouraging political developments

The appointment of Miftah Ismail as Advisor to the Prime Minister on Finance calmed fears of the economy running without policy direction till the upcoming elections.

Positive sentiment generated by the passing of the delimitation bill in the senate also carried into the week with domestic institutions also window dressing their numbers as the year draws to a close.

The bourse kicked off the week on a positive note with the index crossing the 40,000 points barrier, supported by local investors and increased buying in oil and gas sector due to globally increased oil prices.

Market watch: Driven by blue chips, KSE-100 rises for sixth straight session

Later on, massive points were contributed by the bolstering cement and financial sectors, with the index remaining in green throughout the week.

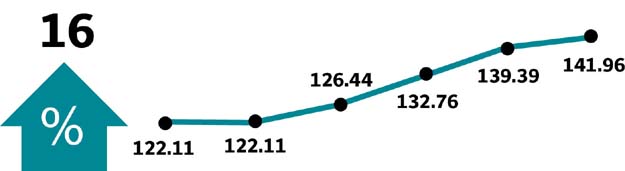

Market participation increased significantly with average daily traded volumes rising 55% week-on-week to 215 million shares while average daily traded value increased to $110 million.

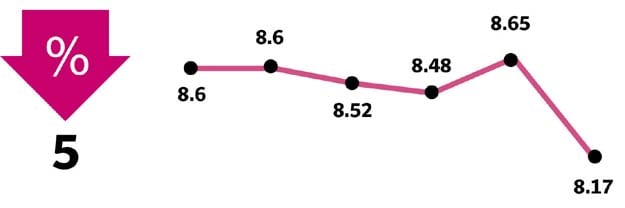

“Overall 2017 witnessed a stark decline in trading activity, with average daily volumes clocking at 236 million shares as compared to 281 million in the year before, marking a decline of 16%,” Elixir Securities said in its report, adding that the value traded remained flattish at $110 million against $112 million in 2016.

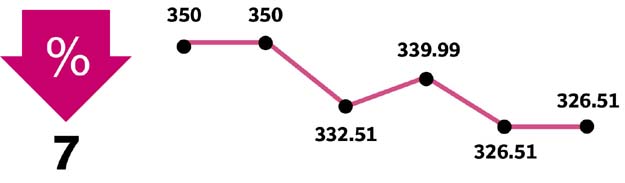

The highest week-on-week value buying was witnessed in heavyweight sectors including cements (295 points), commercial banks (164 points), oil and gas exploration companies (110 points) and engineering (66 points).

Sugars (-10 points) and transport (5 points), however, remained under pressure.

Trading was dominated by WorldCall Telecom (WTL: 85 million shares) and K-Electric (KEL: 40 million shares).

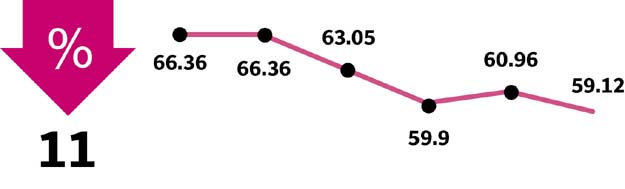

Insurance companies remained the biggest sellers during the week with $14.9 million while the same was absorbed by mutual funds and foreigners with net buying of $13.6 million and 8.9 million respectively.

Market watch: After torrid ride, KSE-100 ends 2017 on positive note

During 2017 foreigners continued to remain net sellers with outflows of $488 million in line with the trading activity in 2016, Elixir Securities said.

“The year marked a drastic decline of 96% in buying from NBFC at $10 million against $226 million in the year before while mutual funds continued to remain the top buyers, mopping shares worth $217 million.”

Sector-specific major highlights of the week were; Fitch Ratings says widening CA deficit raises medium-term risks (economy), import duties cut on raw materials (economy), Toyota cars get pricier by Rs60,000 (auto), Miftah Ismail becomes finance adviser (economy), CPEC power projects expected to up GDP by 2% (economy), profit repatriation by foreign firms jumps 29% (economy), questions raised over GE’s flagship power turbines in Pakistan (power), Pakistan has to repay $6 billion in foreign debt in six months (economy).

Winners of the week

Kohat Cement

Kohat Cement Company Limited manufactures and sells

grey cement.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Pioneer Cement

Pioneer Cement Limited produces ordinary portland cement and sulphate resistant cement.

Losers of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

JDW Sugar

JDW Sugar Mills Ltd produces and sells crystalline sugar. The company is located in District Rahim Yar Khan and formerly named United Sugar Mills Limited.

Hum Network

Hum Network, Ltd operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Published in The Express Tribune, December 31st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ