Imran escapes disqualification, Tareen ineligible for public office

Fawad Chaudhry says PTI will file review petition against Tareen's disqualification

A file photo of Imran Khan and Jahangir Tareen.

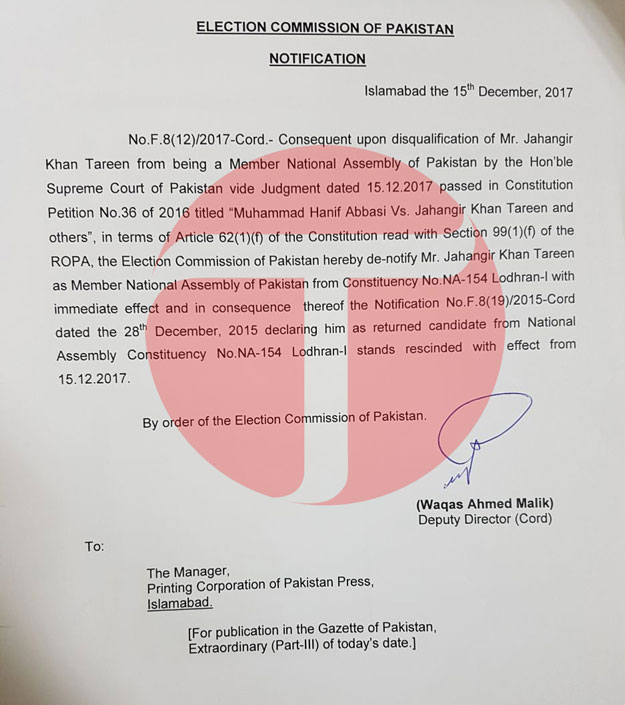

It was a day of mixed blessing for the Pakistan Tehreek-e-Insaf (PTI) as the Supreme Court found party chief Imran Khan to be honest, but disqualified general secretary Jahangir Tareen. Neither the PTI nor PML-N welcomed the top court’s judgment.

The three-judge bench, headed by Chief Justice of Pakistan Mian Saqib Nisar and comprising Justice Umar Ata Bandial and Justice Faisal Arab, on Friday announced two verdicts on the constitutional petitions filed by PML-N leader Hanif Abbasi seeking the disqualification of Imran and Tareen on various grounds.

The chief justice announced both judgments in courtroom No 1, which was packed with workers of both political parties. The court has accepted Imran’s stance on the purchase of Banigala land as well as the establishment of his offshore company. After the Panama Papers verdict, Naeem Bukhari has emerged victorious. Both judgments have been authored by the chief justice. Interestingly, the verdict has also strongly endorsed the majority verdict in the Panama case.

The bench disqualified Tareen on very similar grounds to those used by the larger bench to oust former prime minister Nawaz Sharif. The court did not pass any direction regarding allegations of corruption against Tareen.

Meanwhile, although the bench declared Imran ‘honest’, the PML-N lawyers are expressing concern why the court did not disqualify Imran on the basis of his offshore company, which was alive till 2015.

Overall, legal experts said it was a bad day for the PTI because the SC also gave relief to the Sharif family by rejecting NAB’s appeal for the reopening of the Hudabiya scam.

The court says that this case has been heard primarily because an international upheaval followed the disclosure of the Panama Papers in April 2016.

“Several leading political personalities including the heads of government, most notably, in Europe and Asia, stood exposed for directly or indirectly owning foreign undeclared assets through offshore trusts and companies established in tax haven jurisdictions of the world. These revelations implicated amongst others, the person and family of our former prime minister, Mian Muhammad Nawaz Sharif. The public outrage that followed in Pakistan was spearheaded by the respondent before us.”

[/fbvideo]

The order adds, “The current petition, based on the same genre of allegations, namely, concealment of ownership of foreign undeclared assets contrary to the election laws of the country, came up before us separately for hearing. The foregoing background of the case mandates that Imran as a public office holder should withstand the same rigour and test of scrutiny and accountability that he caused in the parallel proceedings on the same type of allegations.”

The bench dismissed the petition seeking Imran’s disqualification by observing that the PTI chief had no legal obligation to disclose his offshore company Niazi Service Limited (NSL) as an asset in his income tax returns or his statement of assets and liabilities filed with the Election Commission of Pakistan (ECP) along with his nomination papers or in his annual returns filed under Section 42A of the ROPA.

“NSL was established as a corporate vehicle for the legal ownership of the London flat, of which the Respondent (Imran Khan) was the beneficial owner. The Respondent was neither a shareholder nor a director of NSL which had a paid-up capital of £9/- and the London flat as its sole asset,” says the judgment authored by the chief justice.

The CJP in his 130-page verdict observed that the money trail for the purchase of the Banigala property by Imran had been duly established before the court, adding that the method adopted by the respondent for arranging timely funding for the sale consideration through his wife was a lawful arrangement.

“In any event, the funds that she contributed to the purchase of the Banigala property were duly returned by the respondent from a lawful source that was a duly declared property.

“The court finds that the purchase price of Rs43.5 million of the Banigala property was paid to the extent of Rs7.3 million by Imran and the balance amount of Rs36.2 million was paid with amounts converted from foreign currency remittances made by Imran’s ex-wife Jemima Khan.

“We find that during the period 8.4.2002 until 22.1.2003, Jemima Khan provided a total of US$665,340 – according to the exchange rate prevalent on 7.5.2003 – towards the purchase of the Banigala property. The respondent repaid on 7.5.2003 an amount of UK£562,415.54 to Jemima Khan from the sale proceeds of his London flat in order to settle the funding temporarily provided by her.”

The SC has endorsed Imran’s stance that the Banigala property is owned by him after it was orally gifted to him by his ex-wife Jemima Khan vide gift mutation No.10696 dated 29.10.2005 after their divorce became effective in June 2004. Prior to that, the Banigala property had been purchased by the respondent as a family home for his wife and children for which the financial provision extended by his wife was more than reimbursed by the Respondent on 07.05.2003.

The judgment says that Imran has declared his advanced payment made to 1-Constitution Avenue Tower, Islamabad in his statement of assets and liabilities filed with his income tax return in the tax year 2014.

“In the following year, the respondent was allotted the flat and declared the same both in his assets and liabilities statement filed with his income tax return for the tax year 2015 as well as his annual return under Section 42A of the ROPA filed with the ECP in 2015. Therefore, we hold that no misdeclaration of assets was committed by the Respondent in relation to the said property in his annual return filed with the ECP in the year 2014. There is no dishonesty in the omission made by him,” says the order.

The court also noted that the petitioner failed to bring forth any concrete evidence to establish a different purpose for NSL, and it had no hesitation in believing the respondent’s contention that NSL was created solely to own and hold the London flat in order to avoid capital gains tax.

Tareen decision

The same bench has declared that Shiny View Limited (SVL) – an offshore company established by Tareen and having the legal title of the 12-acre “Hyde House” property – is, in actuality, owned by Tareen.

The chief justice in his separate 81-page verdict observed that Tareen had sent around more than Rs500 million at the exchange rate prevalent at that time and claims that amount to have been utilised for the purposes of purchase and construction of “Hyde House”.

“SVL or Hyde House was never transferred to any trust by the respondent, thus, it is his asset which he has failed to declare in his nomination papers filed on 9.9.2015 according to the mandate of the law to contest the by-elections from NA-154 Lodhran and, therefore, he is not honest in terms of Article 62(1)(f) of the Constitution read with Section 99(1)(f) of ROPA,” says the verdict.

The court noted that in his concise statement, Tareen in unequivocal, clear and unambiguous terms stated that he has no beneficial interest in the trust arrangement which holds SVL and Hyde House, but the trust deed dated 5.5.2011, on which reliance has been placed by the respondent himself, he is the ‘discretionary lifetime beneficiary’ along with his spouse and, therefore, this is a blatant misstatement on the part of the respondent made before the highest judicial forum of the country which is not a trait of an honest person.

“Consequently, on both the counts mentioned above, the respondent is declared not to be an honest person in terms of the constitutional provisions and the provisions of ROPA, therefore, he ceases to be the member of the Parliament having incurred the disqualification,” says the verdict.

The court added that it failed to find when or how SVL was transferred to HSBC. It noted that Tareen had also not shown the court if Hyde House was subsequently transferred to the trustee named in the settlement.

The bench was of the “firm opinion” that neither SVL nor Hyde House were trust property under any document on the record. “Moreover, from the money trail provided, it is the case of the respondent that the entire amount for the purchase and construction of Hyde House was sent by the respondent in a legal way through proper banking channels… once the veil of incorporation of SVL is lifted, the respondent’s face is clearly seen behind it as the true and actual owner of Hyde House.”

The court noted that perhaps SVL was created as a repository to hide his tax paid money, sent through banking channels and shown to have been spent on the creation of SVL and the purchase of Hyde House, but this was done in a clandestine and dubious manner. “The object behind this exercise was to hide and stash the said money, SVL and the property from the tax authorities and from the public eyes; by a person who has even in the past been a holder of a public office and presently occupies such an office.”

It further said that Tareen had not placed any proof on the record that the amounts he transferred to his personal bank account abroad were utilised for the purchase of Hyde House and those were ever transferred to SVL for this purpose.

The court also noted that there was another interesting aspect, as the money Tareen sent for the purchase and construction of Hyde House was never declared in his own tax returns, but rather as gifts to his four children, without there being any actual gift because no crossed cheques were brought on the record envisaging the gift of the said amount in favour of the children. “This all seems rather farcical,” it adds.

As regard Tareen’s agriculture land issue, the court said that they are not persuaded to make any declaration against the respondent in this context “because the matter whether inaccurate declaration has been made by the respondent, either in respect of agricultural income tax before the concerned department under the Act of 1997 or before the FBR, is a matter which is sub-judice before different forums in the income tax hierarchy and even before this court”.

On loans, the order said, “We are not convinced and persuaded on the proposition that the respondent has got any loans written off from various banks and thus, has incurred disqualification under Article 63(1)(n) of the Constitution because such loans have been written off with regard to FPML and was prior to the year 2010, whereas the respondent at that time was not the shareholder or director of the said company.”

About the issue of his involvement in insider trading, the court has decided not to adjudicate the matter as section 15-B of the Ordinance, 1969 and thus, for all intents and purposes this is a past and closed transaction.

“We are also not persuaded to hold that the provisions of Section 15-A and 15-B of the Ordinance, 1969 in the facts and circumstances of the case and because of subsequent enactment of the Act, 2015 are ultra vires of the Constitution”.

[poll id="1538"]

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ