Trade results of the first five months have made this year’s $25.7-billion annual trade deficit target irrelevant, but the finance ministry is still not in the mood to portray the real picture of the external sector to the IMF.

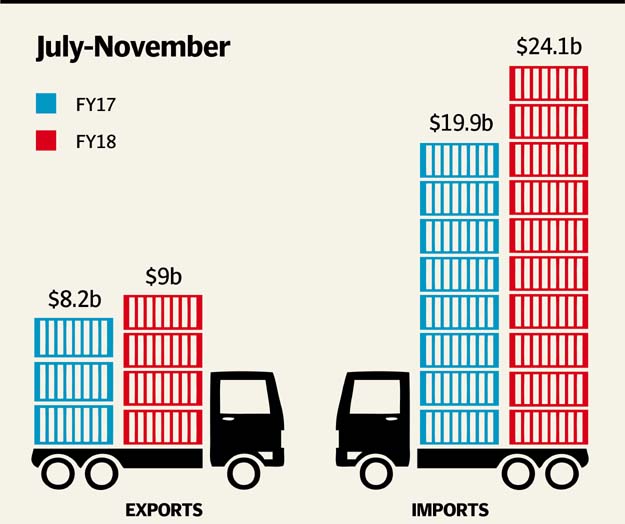

The value of goods imported exceeded the value of those exported by $15.03 billion in July-November, reported the Pakistan Bureau of Statistics on Monday. Trade deficit during the first five months of the fiscal year was $3.33 billion or 28.6% higher than the same period of last year, said the national statistics agency.

After debt repayments in coming months, SBP’s own net reserves will be a mere $4.5 billion

Exports in July-November period increased by 10.5% to over $9 billion but these were only equal to 39% of the annual export target of $23.1 billion. In absolute terms, export receipts were up by $857 million during the first five months.

The value of imports stood at $24.1 billon, which was 21.12% or $4.2 billion higher than the import bill booked during the first five months of last fiscal year. The five-month import bill was nearly half of the annual target.

Export receipts were 266% less than the import bill in the first five months. The higher trade deficit is on an already higher base, as Pakistan had closed the last fiscal year at a record $32.4-billion deficit.

The trade deficit in the first five months was equal to 58.5% of the government’s annual target of $25.7 billion, indicating that this year the current account deficit would remain far higher than official projections of $9 billion.

A higher-than-officially projected current account deficit will have a direct bearing on the official foreign currency reserves, which are on the sliding path. Excluding its short-term obligations, the central bank’s net reserves are not more than $5 billion, although gross official reserves stand at $15.1 billion. The latest trade figures also affirm apprehensions of the IMF which were expressed during the ongoing Post Programme Monitoring talks.

The talks began last week and would continue for next couple of days aimed at assessing Pakistan’s ability to return the $6.1-billion IMF loan.

During the talks, the IMF showed serious reservations over the health of the country’s external sector, said sources in the finance ministry. They said that the IMF was sceptical about the government’s claim that the financing gap was around $6 billion. The finance ministry is claiming that the imports would grow in single digit but the IMF believes that the growth would be in double-digits, said the sources.

Independent economists say that Pakistan will require about $20 billion to $25 billion in the current fiscal year to meet its external financing needs, although the finance ministry has lately put the figure at $18 billion including debt repayment obligations.

The IMF also disapproved of the government’s policy to keep the rupee overvalued, which finally led to the depreciation of the Pak-rupee against the US dollar. The rupee traded over Rs110 to a dollar in the interbank market on Monday.

Prime Minister Shahid Khaqan Abbasi has decided to depreciate the rupee, asking the central bank to let it settle around Rs110 to Rs111 to a dollar, said the officials. The IMF termed the first-day depreciation of 1.4% too little too late, said the officials.

In order to curb the growing import bill, the federal government had taken few measures in October but these have proven insufficient to curb the imports. It had introduced heavy regulatory duties on scores of items in addition to erecting non-tariff barriers.

For the new fiscal year 2017-18, the federal government has a target to increase the exports to $23.1 billion, which requires 13.2% growth over the last year’s total exports of $20.5 billion. The government is aiming to curtail the import bill at $48.8 billion, which seems impossible.

It is highly unlikely that the government will achieve $23 billion export target, as five-month cumulative growth in export was only 10.5%.

Pakistan borrows $2.5b from global capital markets

Annualised data

On a year-on-year basis, Pakistan’s exports grew to $1.97 billion in November over the same month of the last fiscal year, according to the PBS. The exports were higher by 12.4% or $217 million over the receipts of November 2017. The imports grew at a pace of 16.5% and the country booked $4.9 billion import bill in November. The import bill was $693 million more than that of November 2016.

Consequently, the trade deficit widened 19.44% or $2.9 billion in November over the same month of the previous year. In absolute terms, the deficit was higher by $476 million.

Monthly results

On a month-on-month basis, exports in November increased only 4.6% to $1.97 billion over October. Exports were $88 million higher than the receipts in the preceding month. Imports in November marginally decreased over October, standing at $4.9 billion. The month-on-month trade deficit was down by only 3.4% or $117 million.

Published in The Express Tribune, December 12th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1724760612-0/Untitled-design-(12)1724760612-0-405x300.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ