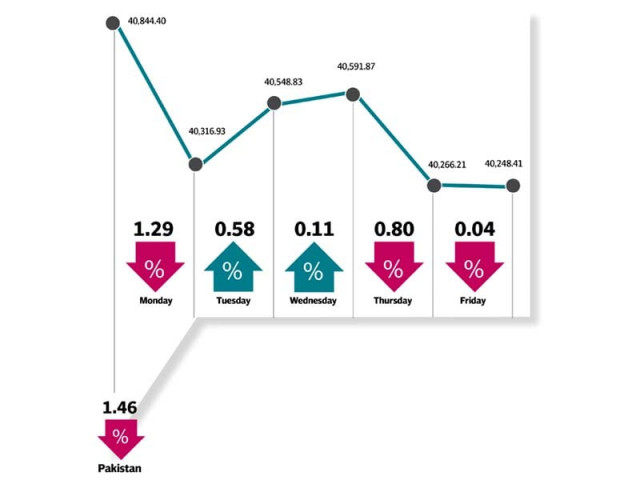

Weekly review: KSE-100 Index endures another tough ride

Benchmark index declines 1.5% as political jitters shake things up

The prime minister finally accepted Finance Minister Ishaq Dar’s ‘leave for absence’ and relieved him of his duties. The ongoing sit-in in the federal capital also continued to create an environment of instability, thus keeping investors away.

Matters were further aggravated when the government announced its decision to close high cost furnace oil based power plants and switch to newly commissioned RLNG and coal-based power projects. This in turn created pressure on the energy chain, which dragged the index down.

Weekly review: Volatile KSE-100 ends nearly flat

Concerns were raised on the future outlook of oil based IPP’s, oil marketers, refineries, and explorers who would all be affected when furnace oil based power generation is phased out completely in the long run.

Stocks plummeted on Monday and the index saw a negative start of the week owing to thin volumes and lack of positive triggers. Things took a turn on Tuesday, where the market gained 231 points to finish in the green. Although this was followed by another positive session, the two-day win streak did not add much to the index as gains were minimal. The remaining two sessions, once again saw a bearish run with the index dropping to finish at the 40,248-point level.

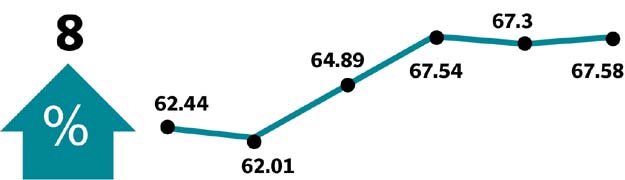

Trading activity remained dull as average daily traded volumes remained low at 112 million shares (up 6% week-on-week) while average daily traded value plummeted 8% to $47 million.

In terms of sectors, OMCs (down 4.1% week-on-week) and refineries (down 2.7%) wiped out 218 points from the index. As a result, across the board pressure was seen in other sectors as well such as fertilisers (down 1.3%) and cements (down 1.5%). Commercial banks also pulled the index down by 122 points.

Stocks that negatively contributed to the index include NESTLE (-72pts), PSO (-55pts) in anticipation of demand of furnace oil to go down significantly, ENGRO (-53pts) attributable to downgrade from the MSCI mid cap to small cap, UBL (-50pts), HBL (-48pts) and HUBC (-38pts).

On the flip side, stocks in the green were PAKT (54 points), KEL (36 points) on the expectation of materialisation of Shanghai Electric deal and review on the determination of multi-year tariff by Nepra, and OGDC (31 points).

Market watch: KSE-100 touches new peak with handsome gain

Foreigners remained net sellers of $6.3 million during the week compared to a net buying of $1.1 million in the previous week.

Major selling was witnessed in commercial banks and cements of $4.3 million and $3.7 million, respectively. On the other hand, major buying was witnessed in E&P ($4 million), OMC ($1.1 million) and telecom ($0.9 million).

On the local front, companies remained the major buyer of $3.9 million followed by other organisations with net buy of $3.5 million.

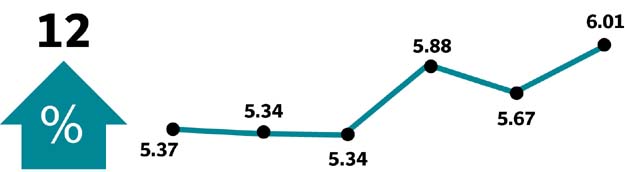

Among other major news of the week were; monetary policy was announced, the JCC approved the long-term CPEC plan, current account deficit numbers were released at ($5b recorded in 4MFY18), start of Pak-IMF meetings under Post Monitoring Program and textile exports were up 8% in 4 months.

Winners of the week

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

K-Electric Limited

K-Electric is a Pakistani vertically integrated electric-energy corporation involved in generating, transmitting, and distributing electrical power to over 23 million inhabitants of Karachi.

Ghani Glass

Ghani Glass Limited manufactures and sells glass containers. The company manufactures international glass containers for pharma, food and beverage. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

Losers of the week

Nestle Pakistan

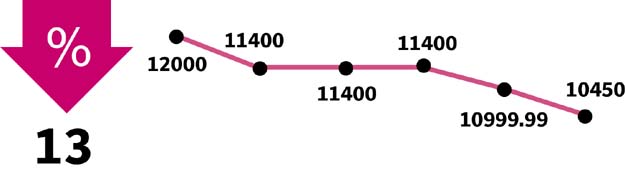

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Nishat Power

Nishat Power Ltd is an independent power producer that supplies electricity to the national grid in Pakistan.

Nishat Chunian Power

Nishat Chunian Power Limited is a Pakistan-based company. The principal business of the company is to build, own, operate and maintain a fuel-fired power station having gross capacity of 200MW and net capacity of 195.722MW for the generation, supply and transmission of electric power at Jamber Kalan, Tehsil Pattoki, District Kasur, Punjab. The company is a subsidiary of Nishat (Chunian) Limited.

Published in The Express Tribune, November 26th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ