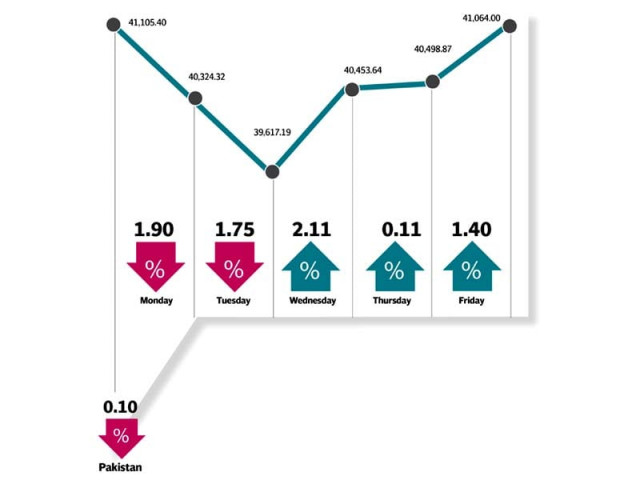

Weekly review: Volatile KSE-100 ends nearly flat

Benchmark 100-share index drops 0.1% to settle at 41,064 points

During the week, investors’ anxiety peaked after the issuing of bailable arrest warrants for ex-PM Nawaz Sharif and his family. Accelerated selling by foreign investors at the start of the week also meant local institutional and retail investors sat on the sidelines in anticipation of positive news.

In this bleak scenario, positivity was generated by external factors including a rise in global oil prices which stimulated buying in oil marketing and production companies. To top it off, the government also announced an increase in the prices of all petroleum products.

Market watch: KSE-100 touches new peak with handsome gain

This, coupled with reduction in political noise and a slowdown in foreign selling, allowed the market to gain 1,447 points during the last three days of the week.

That said, average volumes during the week were 117 million shares, down by 13% week-on-week, whereas the average traded value increased by 3% to $68 million. Pak Elektron dominated the volumes following a decision on its multi-year tariff.

Sectors that dragged the index down included cements (-133 points), commercial banks (-128 points), power generation and distribution (-50 points), technology and communication and cable and electrical goods.

Stock-wise, the top five laggards were UBL, Lucky Cement, Dawood Hercules, Bank Al Habib and SNGPL, that wiped 231 points off the market.

During the week, foreigners sold stocks worth $31 million. Major offloading by foreign investors was concentrated in commercial banks ($6.0 million), oil and gas exploration and production companies ($4.7 million) and fertilisers ($4.4 million).

On the local front, selling was countersigned in mutual funds ($9.99 million) and companies ($6.1 million).

Arif Habib Research said “the week saw volumetric offtake data releases for select industries where the overall growth strengthened the market sentiments on real economic growth”.

“Cement dispatches for the outgoing month experienced growth of 18% year-on-year while oil marketing companies’ energy sales increased 5% against the same period last year. Domestic urea offtakes for the month of Oct-17 also experienced 4% YoY increase,” it added.

Among major highlights of the week were; petrol price goes up by Rs2.49/litre, October CPI inflation remains at 3.8% year-on-year, foreign reserves decline by $59.3 million, PPL gets $54.8 million in overdue payments from Canadian oil firm, and Circular debt reaches Rs450 billion.

Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

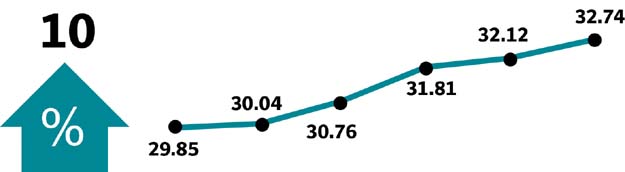

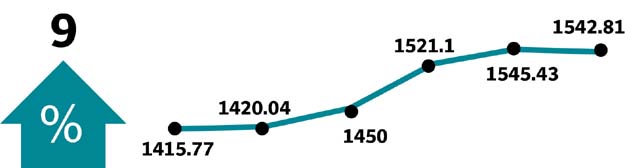

Winners of the week

Fatima Fertiliser

Fatima Fertiliser Co Ltd produces fertilisers. The company is developing a fully integrated fertiliser complex, capable of producing Ammonia, Nitric Acid, Nitro Phosphate, Nitrogen Phosphorous Potassium and Calcium Ammonium Nitrate.

Mari Petroleum

MPCL is one of the leading exploration and production companies in Pakistan. It manages and operates the country’s largest gas reservoir (in terms of current reserves) at Mari field, Ghotki district, Sindh.

Millat Tractors

Pakistan Petroleum Ltd specialises in the exploration and production of crude oil and natural gas. The company also sells liquefied petroleum gas and condensates.

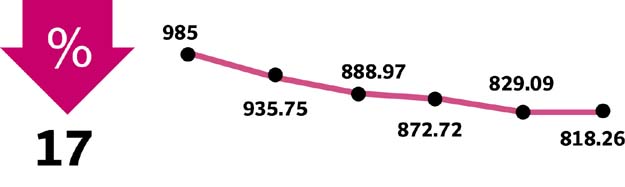

Losers of the week

Service Industries

Service Industries Limited specialises in manufacturing tyres and tubes for motorcycles, bicycles, rickshaws and trollies. The company also produces footwear.

Feroze1888

Feroze1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Pak Elektron

Pak Elektron Limited manufactures and sells a variety of electrical products and domestic appliances. The group’s power products include transformers, energy meters and switchgears. Their appliances consist of a range of deep freezers and air conditioners. The group also has an agreement with Sony Pakistan (Pvt) Ltd for which Pak Elektron will manufacture Sony brand televisions.

Published in The Express Tribune, November 5th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ