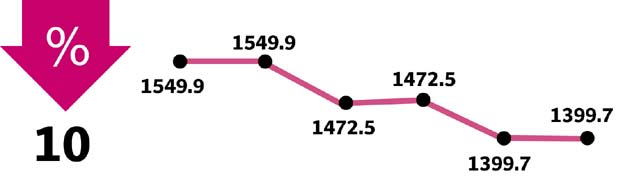

Weekly review: KSE-100 gains 5.62% as stocks stage massive recovery

Benchmark index rises 2,241 points, settles at 42,087.89

The recovery comes after a long period of bloodbath that saw the index drop to its lowest point of the year.

Improvement in investor sentiment was mainly driven by government intervention after Prime Minister Shahid Khaqan Abbasi’s meeting with leading stockbrokers to discuss setting up a Rs20 billion fund under the National Investment Trust to revive the confidence of market participants.

Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

Attractive valuations and higher international crude oil prices also generated significant interest among investors, sidelining political noise due to Ex-PM Nawaz Sharif’s indictment by an accountability court on corruption charges.

Positive sentiment started to creep in from Monday due to reports of a bailout package and a perceived mending of civil-military relations, with the market gaining 944.61 points during the trading session.

Tuesday witnessed a minor glitch due to profit-taking in the latter half of the day; however, the negativity was short-lived as the index again ended in green on Wednesday.

For the last three days of the week, decisive political movement coupled with announcement of impressive financial results by notable index names kept investor interest high enabling the positive momentum to continue.

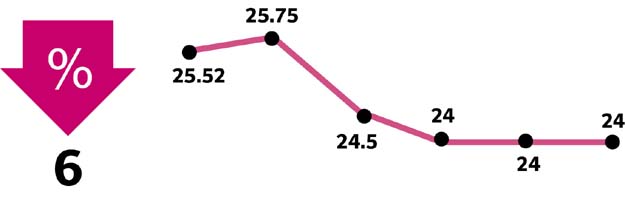

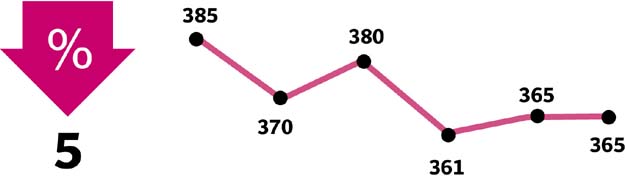

Average trading volumes during the week also rose to 185 million shares, up by 6% week-on-week, with the average traded value increasing 48% to $59.25 million, indicating that major activity was generated by sideboard items. Engro Polymer dominated the volumes.

Cement (477 points), oil and gas exploration (338) and fertiliser (315) sectors made a strong comeback, with banking (252) and oil and gas marketing (209) also contributing positively. Impressive quarterly results and increased production levels and capacities propelled cement and oil and gas exploration stocks upward.

Internationally, high crude oil prices also supported growth of oil and gas marketing companies.

Stock-wise, the top five laggards were Pakistan Tobacco, Kot Addu Power, Nestle Pakistan, JDW Sugar and National Bank of Pakistan, cumulatively wiping 80 points off the market.

Market watch: KSE-100 touches new peak with handsome gain

During the week, foreigners sold stocks worth $7.4 million despite buying heavily during the previous week. On the domestic front, mutual funds and individual investors also continued with their selling streak by cumulatively offloading $9.5 million during the week. Banks and insurance companies, however, provided buying support to the market, mopping up shares worth $9.2 million and $3.6 million, respectively.

Major news during the week included; imposition of regulatory duty on 201 new items to contain current account deficit, EU expanded the list of Pakistani products eligible for tax concessions, cotton exports reached 145,886 bales in Oct 2017, FDI jumped up by 56% in Jul-Sep 2017, and Pakistan’s total liquid foreign exchange reserves rose to $20 billion.

Winners of the week

Ghani Glass

Ghani Glass Limited manufactures and sells glass containers. The company manufactures international glass containers for pharma, food and beverage. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

Sui Southern Gas

Sui Southern Gas Company Limited transmits and distributes natural gas and constructs high-pressure transmission and low-pressure distribution systems. The company’s transmission system extends from Sui in Balochistan to Karachi in Sindh.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Losers of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Standard Chartered Bank

Standard Chartered Bank Pakistan Limited is an international bank that provides consumer and wholesale banking.

JDW Sugar

JDW Sugar Mills Ltd produces and sells crystalline sugar. The company is located in Rahim Yar Khan district and formerly named United Sugar Mills Limited.

Published in The Express Tribune, October 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ